Bitcoin Drops by 60% From Its All-Time High – Crypto Weekly Update

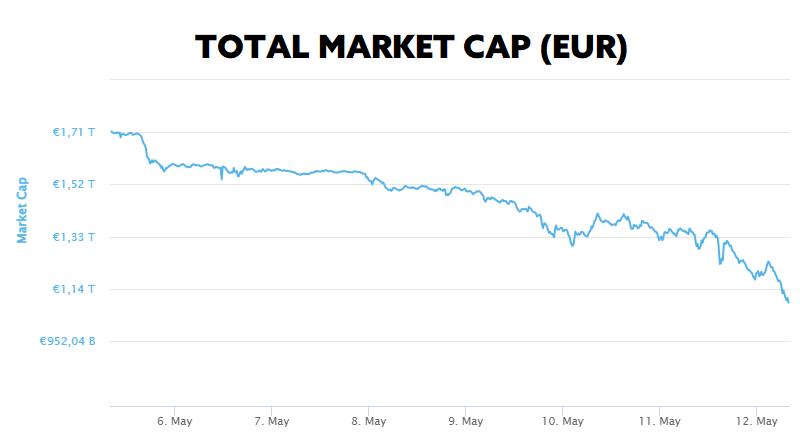

This week, the total market capitalization exceeded 1.08 trillion EUR. The decrease at the 7-day interval is 36%. Bitcoin decreased by 33% during the week to a current value of over 25,700 EUR. Bitcoin dominance is 44.7%.

Bitcoin Drops by 60% From its All-Time High

The dynamics of risk markets, which undoubtedly include the cryptocurrency market, are very high and often unpredictable.

The Fed’s base rate hike brought a momentary positive sentiment to the market last week, as experts focused on financial markets expected this step. Bitcoin tried to test the $40,000 resistance level after the news was announced but unfortunately failed to hold it.

The short-term optimism in the market quickly turned into uncertainty, which caused a huge capital outflow from the crypto market.

Bitcoin, a well-known and the most popular cryptocurrency, is currently trading for just $27,000, its lowest value since July 2021. Bitcoin’s spot price is currently down by 60% from its all-time high of $68,789 reached in November.

There are several events responsible for capital outflows from the market. First and foremost is investors’ delayed and more mature reaction to a base rate hike, given that inflation in the US is at 40-year highs and investors remain concerned about whether the US Federal Reserve can reduce inflationary pressures without driving the US economy into an outright recession.

Furthermore, a base rate hike makes money inherently more expensive. Bank loans and mortgages are more expensive and less available, which, on the one hand, helps to slow down inflation, but, on the other hand, it weakens consumer demand and slows down economic growth.

10 Year Treasury Rate has also reacted to the current situation, reaching its highest level since 2018. When government bond rates rise, investors are motivated to invest their capital in “almost risk-free” assets, which in turn causes capital to flow out of risk markets.

The mood in the cryptocurrency market has not been helped by the recent unpleasantness related to the likely coordinated attack on the stablecoin UST, whose price has lost its peg to the US dollar.

Although market sentiment does not look favourable, for investors, it is the period of fear and uncertainty that is the best opportunity to expand their investment portfolios. Source

El Salvador buys the dip

El Salvador’s President Nayib Bukele announced on Monday via Twitter that the country under his leadership has decided to take advantage of the current slump in the cryptocurrency market and has purchased an additional 500 bitcoins worth $15.3 million.

“El Salvador just bought the dip!” Bukele tweeted, adding that his government purchased at an average price of $30,744.

El Salvador is historically the first country to ever adopt Bitcoin as its legal tender. Although Bitcoin enthusiasts rejoiced at the news, the public and the International Monetary Fund had rather mixed feelings about Bitcoin’s adoption. Source

Terra Blockchain Platform in Trouble

TerraUSD (UST), until recently the third-largest stablecoin, is in huge trouble. An elaborate and well-coordinated attack on this algorithmic stablecoin caused the price of UST to plummet from its dollar value to a whopping 22 cents.

TerraUSD (UST) is the best known and most popular stablecoin built on the Terra blockchain. After a successful launch, UST issuance started back in September 2020. The UST stablecoin is pegged in value to the US dollar at a 1:1 ratio. There is no specific entity or company behind its issuance, as the monetary supply of UST is algorithmically controlled. The market supply of the UST stablecoin is determined by the issuance or burning of the LUNA token.

About 10 minutes after LFG (Luna Foundation Guard), a non-profit organization focused on supporting the Terra ecosystem and the UST stablecoin, pulled out $150 million worth of liquidity from Curve Finance’s decentralized protocol in preparation for the so-called 4pool (a pool consisting of USDT, USDC, FRAX, and UST on Curve Finance), an attacker decided to take advantage of the situation.

The attacker initially accumulated $3 billion in bitcoin through so-called OTC trades, exchanging one billion bitcoins for $UST stablecoin. In this way, he set the stage to liquidate the UST on Curve Finance while simultaneously shorting bitcoins, knowing that the LFG organization would sell its bitcoins to protect the stablecoin peg. The action could have begun.

The attacker first withdrew all UST liquidity from Curve Finance and then sold the accumulated USTs on Binance. The supply shock caused the price of stablecoin to deviate slightly from one dollar, causing a slight panic in the market. However, that was just the beginning.

The fact that the LFG organization began selling its bitcoin reserves to maintain the UST peg was grist for the mill for the attackers. In fact, the attackers had likely already opened short positions on Bitcoin in advance and immediately began profiting from them. In addition, they used the remaining 650 million raised from the OTC to massively sell off $UST, which started the price of the stablecoin to fluctuate significantly.

The more BTC was sold, the more panic grew in the market, causing an uncomfortable situation during which investors wanted to get rid of their $UST as soon as possible. The sell-off of BTC reserves failed to stabilize and bring the price of $UST back to one dollar, which in turn brought even more uncertainty to the market.

The panic in the market about the problems of $UST and $LUNA caused some centralized exchanges, including Binance, to suspend withdrawals of LUNA and UST tokens after a few hours.

Stablecoin $UST is currently still in huge problems. Its value is currently around $0.40, while the value of $LUNA has dropped from $80 to around $0.2. The value of $UST is likely to return to its equilibrium value over time through Terra Modules and arbitrage trades, but its credibility is already very significantly eroded. Source

Microstrategy Has no Plans to Sell Bitcoins

Microstrategy CEO Michael Saylor took to Twitter on Tuesday morning aimed to alleviate fears that Microstrategy would face liquidation risks in its bitcoin-backed loans if the price of Bitcoin continues to fall.

“MicroStrategy has a $205 million term loan and needs to maintain $410 million as collateral,” Saylor said, linking to his company’s Q1 2022 investor presentation.

Although MicroStrategy owns 129,218 BTC, 115,109 BTC are unencumbered and available to be put as additional collateral if needed. With a $410 million collateral requirement in its loan, this amount of bitcoin would be enough to avoid a margin call if the bitcoin price sustained above $3,562. However, Saylor added that the company wouldn’t sell even if that level got breached.

Microstrategy acquired its bitcoins at an average price of $30,700, meaning that at the current price of $31,800 per bitcoin, the company is still roughly $142 million in profit. Source

Australia Will Have Crypto Spot ETFs

Crypto enthusiasts from Australia will soon have three new crypto ETFs.

The latest update came late on Monday as Cboe Australia issued a round of market notices that three funds previously delayed are expected to begin trading on May 12. They include a Bitcoin ETF from Cosmos Asset Management, plus BTC and Ether spot ETFs from 21Shares.

The ETFs were originally scheduled to launch on April 26, but the CBOE Australia exchange postponed the launch due to a lack of approvals.

The spot ETFs will offer retail and institutional investors in Australia an easy opportunity to invest in Bitcoin and Ethereum cryptocurrencies at favorable fees and without having to worry about custody.

Spot ETFs are already operating in several countries, including Canada and Brazil, but government authorities in the United States continue to reject this type of ETF. Source

Instagram Plans to Implement NFTs

Mark Zuckerberg, CEO of Meta (formerly known as Facebook), announced that the company would begin testing non-fungible tokens (NFTs) on its social network Instagram as early as this week.

In an interview with Impact Theory’s Tom Bilyeu published to Facebook on Monday, Zuckerberg said the move to test digital collectibles on Instagram was the first step toward allowing creators and collectors to display NFTs on other apps under Meta’s control, including WhatsApp or Facebook Messenger.

With this move, Instagram follows social network Twitter, which announced and later launched the NFT profile photos feature in September last year.

Although it is not yet clear how NFTs will be implemented in Instagram, it is expected that Instagram’s NFT model will be built on a similar principle to how Twitter works. That is, users will be able to use their NFTs as profile photos, which is possible on Twitter through the paid TwitterBlue app. At the same time, it seems that Meta will start implementing NFTs only for verified people at first- so mostly influencers. Source

Start investing safely in cryptocurrencies now.

START INVESTING

5 min •

5 min •