Brazil Passes Important Crypto Law- Cryptocurrency Market Overview (16.12.-29.12.)

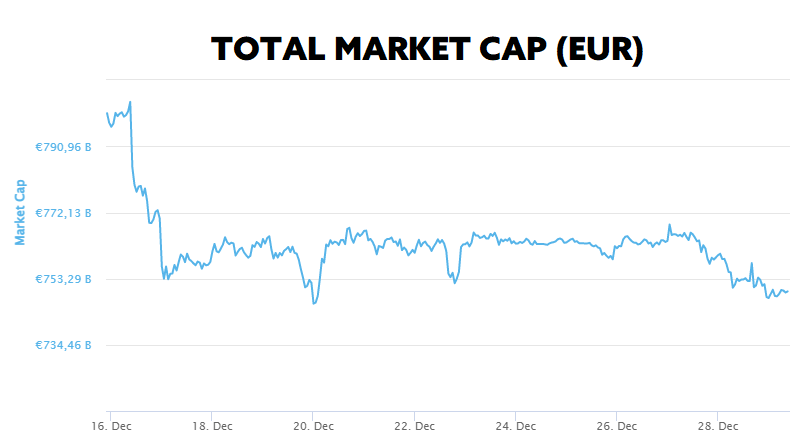

Over the past two weeks, the total market capitalisation exceeded €747 billion. The decrease in market capitalisation over a 14-day period is 7.66%. The price of Bitcoin has fallen by 6.4 % over the last 14 days to a current value of over €15,550. Bitcoin’s dominance is currently around 40.1 %.

Brazil Passes Important Crypto Law

Brazil’s President Jair Bolsonaro has signed a bill to legalise using crypto as a payment method within the country.

The official journal of the Brazilian federal government from 22 December states that Bolsonaro signed law no. 14,478 after its approval by the country’s Chamber of Deputies. The signing of the approved law was the final step towards its adoption as well as the adoption of crypto payments in the country.

According to the bill, Brazilians will not use Bitcoin as legal tender in the country, as is the case in El Salvador or the Central African Republic. However, the newly passed law includes many digital currencies under the definition of legal payment methods in Brazil. It also establishes a licensing regime for virtual asset service providers and sets penalties for fraud using digital assets.

The adopted and signed Cryptocurrency Law will take effect in 180 days. By then, however, President Jair Bolsonaro will no longer be serving as President of Brazil, having lost the presidential election to his biggest rival, Luiz Inácio Lula da Silva, in October. Da Silva served as the country’s president from 2003 to 2010, and his view on cryptocurrencies and blockchain technology was very positive. Source

American Billionaire Wants to Buy Bitcoin

American billionaire and owner of the NBA basketball club Dallas Mavericks Mark Cuban, said in his latest interview with American host and comedian Bill Maher that he is considering buying more Bitcoins.

Cuban, who was a guest on the Club Random podcast, further stated that he prefers bitcoin to gold, which is traditionally considered a hedge against fiat currency inflation. Cuban also commented on the FTX crash, saying that “these explosions were not cryptocurrency explosions, they were crypto bank explosions.” The billionaire sees irresponsible lending of client funds, mispricing of collateral, and overly risky trades as the main reasons for FTX’s collapse.

Cuban also stated that he believes the price of Bitcoin will drop some more so that he can buy as many of them as possible in the future. Source

Bankman-Fried Released on Bail

The founder of the bankrupt FTX, Sam Bankman-Fried, managed to get out of jail before Christmas. A federal judge agreed to release him on bail after he was extradited from the Bahamas to the United States and appeared in a US federal court in New York. Bail for his release was set at $250 million.

Bankman-Fried’s release was conditional on the payment of a deposit of 10% of the total bail. The defendant must also stay with his parents in Palo Alto, California, and in addition to this condition, a long list of requirements was created under which he can be prosecuted at large. He’s not allowed to make financial transactions of more than $1,000, can’t open new lines of credit, can’t leave the house except to exercise and must go through substance abuse and mental health treatment, according to the agreement.

The former FTX CEO arrived at the first hearing in New York wearing a wrinkled jacket and was considerably intimidated. When asked if he agreed to the terms of his release, he nodded that he agreed to abide by all conditions. Source

Miners Have Had a Tough Year

Publicly listed Bitcoin mining companies have sold almost all of the bitcoins they mined during 2022. This may have created selling pressure and led to significant price declines during 2022.

Analyst Tom Dunleavy from Messari shared data on Twitter regarding BTC sales by miners. According to the tweet, as many as 40,300 of the 40,700 BTC mined by Core Scientific, Riot, Bitfarms, Cleans Park, Marathon, Hut8, HIVE, Iris Energy, Argo and Bit Digital were sold between January and November 30 this year. Dunleavy believes that the miners who are constantly selling newly mined bitcoins are creating selling pressure and pushing the price of BTC down.

During this year, there has also been a significant drop in the reserves of mining companies, which decreased significantly especially during November, when the crypto industry got into trouble due to the FTX crash. During December, after the situation calmed down, miners’ reserves rose by around 1%. The slight increase in reserves is likely a result of the calming of the crypto market situation as well as the drop in energy prices in the United States. Source

Bitcoin Volatility at Record Lows

On-chain analysis suggests that bitcoin market volatility is at an all-time low. Multiple crypto analysts are analysing bitcoin blockchain data at the end of the year, including volatility, which is a big scare for many investors.

The last time Bitcoin’s volatility approached its current level was back in late 2018. At that time, the cryptocurrency market was in a bear market phase, during which asset prices dropped significantly. Cryptocurrencies are in a similar phase of the market cycle now.

Bitcoin has traded between $15,700 and $18,700 over the past six weeks. With most of the world currently celebrating Christmas and the arrival of the New Year, market volatility is unlikely to increase in any significant way in the coming days. Source

Russian Ex-President Predicts Global Transition to Cryptocurrencies

Dmitry Medvedev – a Russian politician who was president of the Russian Federation from 2008 to 2012 – thinks that the International Monetary Fund (IMF) and the World Bank may collapse in 2023. He suggested that such an event could significantly weaken the euro and the dollar and significantly increase the adoption of cryptocurrencies.

His assertion was backed by Tron cryptocurrency founder Justin Sun, who called the statement “remarkable” while adding that global adoption of cryptocurrencies is steadily increasing and the best is yet to come. According to Sun, cryptocurrencies are the future of money and have the potential to create a “revolution in the field of global reserve currencies.” Source

Start investing safely in cryptocurrencies now.

INVEST WITH FUMBI

3 min •

3 min •