Quarterly Cryptocurrency Market Overview – Q1/2022

The year 2022 began in a sign of relatively high volatility. At first, traditionally in the world of cryptocurrencies, but later, unfortunately, also in other economic sectors. The Russian invasion of Ukraine drove the prices of several raw materials and energy to new highs, but the subsequent correction depicted an unprecedented instability on their price chart. The stock markets were in a similar situation, only that the price curve fell first. Following crypto investors, the rest of the world is also getting used to uncertainty.

In the background of the military conflict in Ukraine, Bitcoin has successfully demonstrated its importance in the geopolitical struggle. Russia’s proposal to accept Bitcoin as part of its gas payments can be considered the first sign of a new trend. Bitcoin is becoming a global neutral means of trade in the international market. In war, the currency is often just another of the weapons that powers use to assert their influence and demonstrate power. Bitcoin’s adoption in this area makes sense mainly because it is apolitical and does not tilt the scales to any party involved.

The topic of inflation has dominated the last month, not only in the EU but also in the USA. The rise in the price level does not seem to be as temporary as many politicians have promised. For this reason, many investors resort to traditional anti-inflation medicine – gold. However, more and more people are discovering the magic of Bitcoin, which is still in its infancy but on its way to becoming a digital version of this popular asset. The events of recent weeks only indicate that such an asset can be very useful in the future.

Download the full report from this link – Fumbi Network Q1 Report

Bitcoin in Q1

Source: Messari

Bitcoin opened the new calendar year with a valuation of $46,187. With small deviations, the entire first quarter was marked by fluctuations in the price range between $35,000 and $45,000. However, Bitcoin broke out of this zone at the end of March and closed the first quarter at $45,537, with a loss of -1.7% compared to the opening price on January 1, 2022. The best day in the first quarter for Bitcoin was February 28, when its value rose by 14.59% in a single day.

Highlights

- The first quarter was mostly marked by accumulation, during which Bitcoin probably found its local minimum. The cryptocurrency market capitalization climbed back to two trillion dollars at the end of March.

- The majority of the top 10 altcoins were in the red in the first quarter, Terra surprised.

- The Russian invasion of Ukraine has caused a wave of uncertainty across the global economy and financial markets. The cryptocurrency market has been no exception. However, it quickly became apparent that bitcoin could serve as a safe, quickly transferable and stable alternative to traditional money.

- The proposal to ban Proof-of-Work cryptocurrencies in the European Union has not passed. In the voting process of the European Parliament’s Committee on Economic and Monetary Affairs (ECON), 32 MEPs were in favor of rejecting the proposal, while only 24 were in favor of approving it.

- The Canadian branch of KPMG, part of a global network of financial audit, tax and advisory firms, has announced the purchase of cryptocurrencies Bitcoin and Ethereum. KPMG is a member of the Big Four accounting organizations – the world’s four largest professional services networks.

- On-chain data shows that the number of retail-owned addresses is steadily growing. In addition, there has been a significant drop in the 1 Year Active Supply in the past quarter, which means investors are not willing to sell bitcoins at current prices.

- In recent months, TVL has been consolidating between $73 and $85 billion, indicating steady investor interest in interacting with DeFi apps. Ethereum continues to be the most popular smart contract platform, with alternative platforms such as Terra, Binance Smart or Avalanche remaining at the forefront.

Download the full report from this link – Fumbi Network Q1 Report

BTC – Addresses with Balance Greater than 0.001 BTC

Source: Messari

The metric of addresses with balance greater than 0.001 BTC tracks the sum count of unique addresses holding at least 0.001 native units as of the end of the reference period, worth about $45. The number of such addresses has increased by nearly 3.7% in the last three months, signaling an inflow and continuously growing investors interest in bitcoin. The main motives behind the bitcoin accumulation by retail investors are likely to be yield, hedge against inflation and speculations.

ETH – Address Count

Source: Messari

The total number of addresses on the Ethereum network continues to grow at a rapid pace. During the first three months of the new calendar year, the number of addresses on the Ethereum network grew by 8.57% to 78,376,564 addresses. The significant growth in addresses signals users’ unabated interest in interacting with decentralized applications and NFT collections. In addition, the ETH 2.0 upgrade is gaining attention from many investors who are accumulating Ethereum as an investment asset over the long term horizont.

ETH – Average Transaction Fees

Source: Messari

Every time an operation occurs on Ethereum’s network, a transaction fee is incurred. Based on the complexity of the transaction and how quickly the user wants the transaction settled, the gas fee changes. During the first quarter, there was a significant decrease in the average transaction fee in the Ethereum network. The main reasons for the decline in transaction fees on the Ethereum network include the growing popularity of alternative blockchain platforms focused on DeFi, as well as the growing interest in using Layer 2 (L2) solutions on the Ethereum blockchain.

Download the full report from this link – Fumbi Network Q1 Report

DeFi

Source: DefiPulse

The beginning of the year was marked by a decline in TVL, which correlated with price fluctuations of BTC and other cryptocurrencies. The entire DeFi sector declined significantly, but the protocols on the Ethereum network proved to be more stable during the market downturn compared to other less commonly used networks. However, there were exceptions that did well during the fall of the market, such as Terra.

In recent months, TVL has consolidated between $ 73 billion and $ 85 billion, indicating stable interest. This is influenced by several factors, a significant factor that pulls TVL down is the uncertainty regarding the regulation of the entire DeFi sector, which is awaited not only by the companies creating these protocols, but also by investors and ordinary users.

On the positive side, however, institutions are beginning to take an interest in DeFi and would like to take part in these activities, as DeFi offers new opportunities for risk management, arbitration and trading. Higher risk also means higher yields compared to traditional bonds, stocks or forex trading.

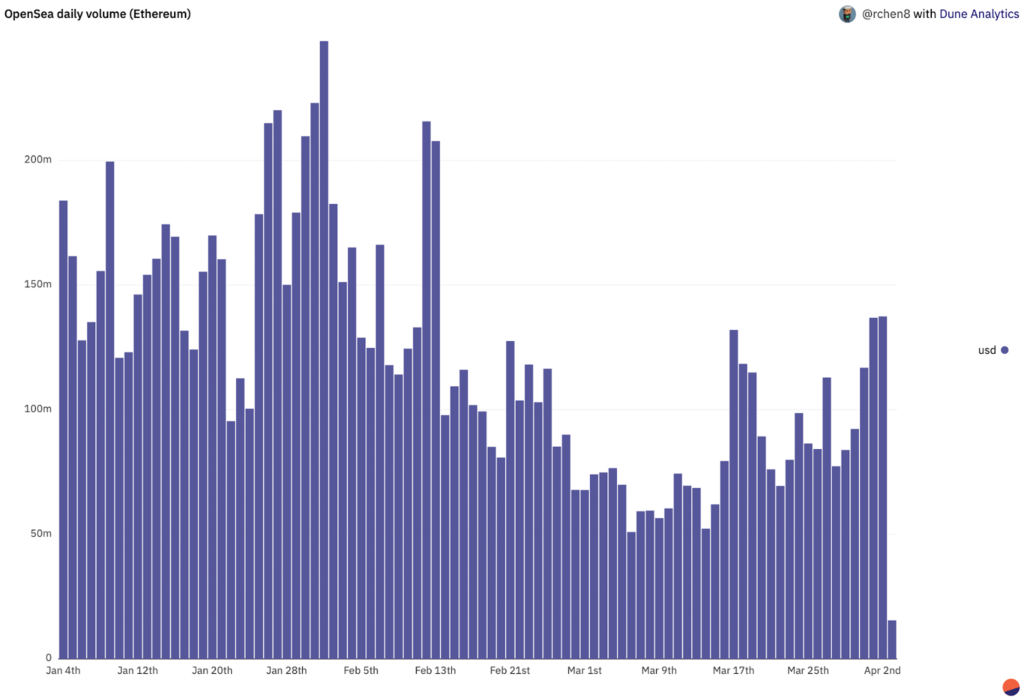

NFT & Metaverse

Source: Dune Analytics

NFTs are still a popular topic and one could say that the craze we experienced in 2021 continues. Interest in NFTs and trading volumes correlate to some extent with the price movements of bitcoin and other cryptocurrencies. If there is uncertainty in the market and cryptocurrency prices are moving down, we can expect to see less interest in NFTs. Once the price of BTC stabilized in March, volumes and enthusiasm for speculating in NFTs increased again.

New collections of NFTs are appearing daily on popular NFT marketplaces such as OpenSea, Rarible and LooksRare, and while some end up as worthless JPEGs after a short time, others hit the road to success and can bring in big returns. What sets blue chip NFT collections like Bored Ape Yatcht Club or Akuki apart is a supportive community, a packed roadmap, various creative opportunities for using NFTs (e.g. selling merch with NFTs), events or collaborations with artists and celebrities.

Invest with Fumbi

Invest in the fast-growing cryptocurrency industry simply, safely and efficiently with our products. You can start at €50

EASY REGISTRATION

3 min •

3 min •