Bitcoin Has Reached its New Low for This Year

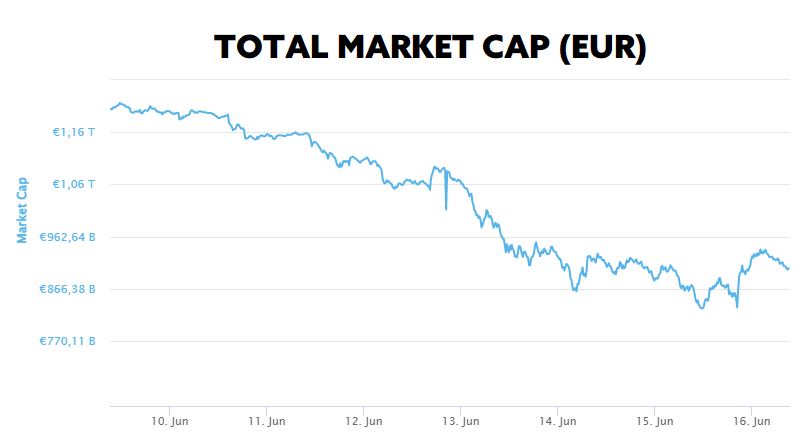

This week, the total market capitalization exceeded 902 billion EUR. The decrease at the 7-day interval is 22.41%. Bitcoin decreased by 29.3% during the week to a current value of over 20,100 EUR. Bitcoin dominance is 44.4%.

Bitcoin Has Reached its New Low for This Year

The cryptocurrency market plunged into a massive sell-off earlier this week. Tensions in global financial markets as well as macroeconomic uncertainty wiped several hundred billion dollars of wealth from the market in the past 72 hours.

Bitcoin, the most popular cryptocurrency, has seen a loss of -24% in the last three days, and its value has plummeted to $20,100, its lowest price since December 2020. The sell-off has not escaped the market number two Ethereum, which has plunged as much as 29% in the last three days and is slowly approaching the psychologically important price support at $1,000.

The trigger for the sell-off not only in the cryptocurrency market, but also in the stock market, was negative news and ongoing concerns about rising inflation. Based on last week’s data, the Consumer Price Index in the United States accelerated to 8.6% YOY in May from 8.3% in April, while experts were expecting inflation to be around 8.3%. Investors are now worried that belt-tightening in the form of anti-inflationary policy by the Fed may be even more aggressive, which does not play into the hands of risk assets.

Investors have less and less appetite for risk in uncertainty and are therefore shifting their capital into safer forms of investment, such as bonds. This has been reflected in recent days, for example, in the rise in yield on 10-year Treasury rate, which has risen from 3.04% to 3.40% over the past five days.

In the current situation in the cryptocurrency market, the market can be expected to be volatile for some time to come and volatility will be higher than it has been in recent weeks. However, the downturns in the financial markets offer investors a unique opportunity to create or expand their investment portfolio. Source

Celsius in Troubles

The current difficult situation on the cryptocurrency market was not helped by the latest news regarding the lending platform Celsius, which suspended all withdrawals from its platform last Sunday.

Celsius Network is a centralized platform that offers returns on various cryptocurrencies including Bitcoin, Ethereum or many other crypto assets. In a way, the platform resembles a kind of “crypto bank” but functions more like a hedge fund.

The whole system of the platform works very simply. Users deposit their crypto assets on the platform, and based on their assets, they can earn interest of up to 10% APY. The platform on-lends the assets it receives to other entities and institutions at a higher interest rate.

The suspension of withdrawals immediately triggered speculation as to whether Celsius was sufficiently liquid and able to meet its obligations to clients. The power of blockchain technology lies precisely in its transparency, which allows companies’ clients to directly monitor open positions.

Members of the crypto community immediately drew attention to one of Celsius’ open positions on the Oasis platform, where Celsius borrowed a huge amount of DAI stablecoin in exchange for crypto collateral. With the price of Bitcoin falling, the position was fast approaching liquidation, which would mean that the company’s collateral could be “liquidated” when the Bitcoin price fell even further.

Fortunately, over the past two days, Celsius has repeatedly added collateral to the WBTC-A vault 25977 position, moving its liquidation price from the original $22,000 to the current $14,000. Thus, Celsius continues to keep its position open, allowing it to gradually pay back its DAI loan and increase their Collateralization Ratio.

How the situation will develop further is still questionable. However, Celsius has significantly damaged its reputation by suspending withdrawals, and if withdrawals are resumed, a huge outflow of capital from the platform to users’ private wallets can be expected. Source

Ethereum Launches Proof-of-Stake on Testnet

On Wednesday, June 8, a long-awaited transition from the Proof-of-Work algorithm to a new model called Proof-of-Stake was made in an Ethereum testnet called Ropsten.

The Ropsten testnet is considered to be the oldest and most popular testnet on the Ethereum blockchain, allowing developers to test and optimize the blockchain before putting various improvements on the mainnet. Ropsten is almost identical to the mainnet, with the key difference that no “real” funds are at risk if any technical issues occur.

Several leading decentralized applications responded immediately to the launch of the new consensus algorithm on the testnet and decided to deploy their applications on the Ropsten, in order to support development and also to test the performance of their applications on the new PoS model.

Ethereum network developers are also planning to transition PoS to two other public test networks, Sepolia and Goerli, in the near future for optimization and testing before putting Proof-of-Stake on the main network. Source

Survey: 90% of Americans Plan to Buy Crypto in 2022

Despite several bearish signals in the cryptocurrency market, the majority of people remain positive and see the downturns in the cryptocurrency market as the new opportunity.

The latest survey from Bank of America, the largest commercial bank in the US in terms of deposits and one of the largest companies of its kind in the world, showed that the majority of retail investors plan to buy cryptocurrencies later this year.

The survey, conducted in early June on a sample of 1,000 respondents, found that 90% of respondents were preparing to buy cryptocurrencies within the next six months. The survey further noted that the number of users who owned cryptocurrencies was similar to the number who wanted to buy.

According to Bank of America, 30% of respondents said they had no intentions of selling their cryptocurrencies during the next six months despite the massive decline that the crypto market has suffered.

Another interesting statistic is that 39% of respondents noted that they used cryptocurrencies as a means of payment for online purchases. This number is a positive surprise, as most investors see cryptocurrencies as just an investment or speculation tool. However, the survey shows that the popularity of crypto-to-fiat products continues to grow. Source

Gary Gensler Worries About New Crypto Bill

In last week’s market overview, we informed you about a bipartisan bill that was introduced in the Senate of the United States, aimed to create a regulatory framework for cryptocurrencies in the US.

One of the requirements in the bill was that priority oversight of the cryptocurrency market would no longer be conducted by the US Securities and Exchange Commission (SEC), but that oversight of the cryptocurrency market would fall under the US Commodity Futures Trading Commission (CFTC).

However, SEC chairman, Gary Gensler, is not very enthusiastic about this proposal. Gensler is concerned that the bill could weaken investor protections in traditional financial markets.

At Tuesday’s CFO Network Summit, The Wall Street Journal asked Gensler what he thought of the new bill. „We don’t want to undermine the protections we have in a $100 trillion capital market. We don’t want our current stock exchanges, mutual funds, or public companies to, sort of inadvertently by a stroke of a pen, say ‘you know what, I want to be non-compliant as well, I want to be outside of this regime that I think has been quite a benefit to investors and economic growth over the last 90 years,“ said Gensler.

At the summit, Gensler said the SEC wasn’t looking to extend its jurisdiction and that some cryptocurrencies are already under the jurisdiction of the agency since they qualify as being a security. Senators mostly agreed with Gensler’s view that some altcoins would likely be considered securities, while Bitcoin and Ethereum should be classified as commodities. Source

Interesting Fact: Microstrategy and Tesla at a Loss

The two largest companies, Microstrategy and Tesla, which have added Bitcoin to their balance sheets over the past few years, are in unrealized loss at current price levels.

According to data from Bitcointreasuries.net, Microstrategy, led by Michael Saylor, spent a total of $3,965,863,658 to purchase 129,218 BTC. Although the company has been in profit most of the time on its bitcoin investments, recent events and price corrections in the cryptocurrency market have caused the value of bitcoins under Microstrategy’s management to currently stand at just $2,689,427,156, which means that the company is at an unrealized loss of nearly $1.3 billion on its investments. However, Michael Saylor has declared that his company will continue to pursue its bitcoin policy.

Tesla is in a similar position, having surprised the general public with its purchase of 43,200 bitcoins worth $1.5 billion in February 2021. However, the current value of bitcoins under Tesla’s management is only $899 million, 5which means Tesla is at an unrealized loss of $600 million on its investment. Source

Start investing safely in cryptocurrencies now.

START INVESTING

5 min •

5 min •