Events responsible for the LUNA cryptocurrency crash

In recent days, the cryptocurrency ecosystem has become a target of a ruthless but well-thought-out attack.

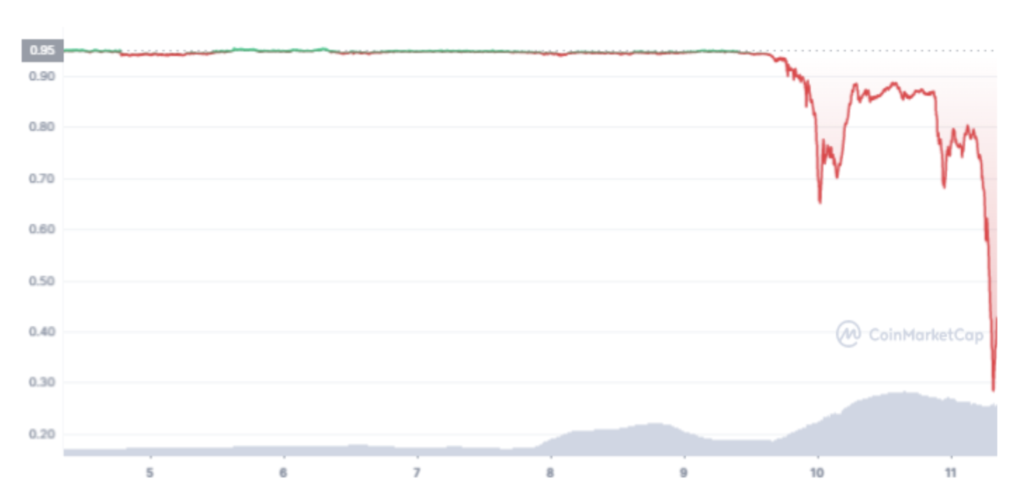

According to guesswork and speculations, the popular algorithm stablecoin TerraUSD (UST) has fallen victim to a coordinated attack in which an attacker instantly sold UST stablecoin worth several hundred million dollars on the Binance and Curve platforms. This caused the UST to deviate from the peg to the US dollar, which in turn caused a huge panic in the entire cryptocurrency market. But let’s take a closer look at the whole problem.

TerraUSD (UST) is the best known and most powerful stablecoin built on the Terra blockchain. Following its successful launch, UST issuance began in September 2020. The UST stablecoin is value-linked to the US dollar at a 1:1 ratio. There is no particular entity or firm behind its issuance as the UST’s monetary stock is controlled algorithmically. The stablecoin market supply is determined based on the issuance or burning of the LUNA token.

The system relies on traders who burn or create tokens to make a profit to maintain its peg to the US dollar. This process works by pairing UST with sister cryptocurrency Luna. Each time a UST token is issued, the equivalent of $1 in Luna tokens is burned and vice versa. So when the UST price drops below $1, traders are asked to burn the UST, for which they will receive the Luna token at a discounted price. As the UST supply falls, the price should theoretically return to $1 while maintaining a fix.

However, this did not happen in the current situation. According to speculation, the attacker’s plan was well thought out and coordinated.

About 10 minutes after the LFG (Luna Foundation Guard), a non-profit organization dedicated to supporting the Terra ecosystem and the UST stablecoin withdrew part of the $150 million liquidity from Curve Finance in preparation for 4pool (a pool consisting of USDT, USDC, FRAX and UST on Curve Finance), the attacker immediately took action.

The attacker initially accumulated $3 billion in bitcoin through the so-called OTC trades and exchanged $1 billion in bitcoin for stablecoin $UST. In this way, he paved the way for the liquidation of the UST on Curve Finance and, at the same time, for the shortening of bitcoins, knowing that the LFG would sell its bitcoins to protect the stability of the stablecoin. The attack was ready for launch.

The attacker withdrew all available UST liquidity from Curve Finance, for which he needed about $350 million. He then began massively selling the accumulated $UST on the Binance Stock Exchange, creating a modest bid shock, resulting in a small deviation of $UST from the value of one dollar. The Internet and social networks began to spread information almost immediately that one entity had withdrawn all available liquidity from the UST pool on Curve Finance, which provoked a rapid negative reaction from traders. A huge number of shorts (short sales) began on the network’s native token LUNA within a few minutes.

Additionally, the massive FUD (fear, uncertainty, and doubt) and rapid dissemination of information have caused many investors to immediately sell their LUNA tokens at a market price. Consequently, as the price of LUNA fell, UST destabilized and began to loosen.

Initially, the price of $UST dropped to only $0.98. Platform’s founder, Terra Do Kwon, already noticed that something was off and announced the deployment of $1.5 billion ($0.75 billion in BTC and $0.75 billion in UST) capital to stabilize UST. Still, according to available information, he did not intend to dispose of these BTCs.

However, when the price of BTC began to fall rapidly, LFG completely emptied its Bitcoin wallet. According to btcinfocharts.com, the LUNA-LFG bitcoin wallet currently has zero bitcoins on its balance. According to on-chain data, LFG has withdrawn its entire bitcoin reserves of BTC 42,530.82, worth nearly $1.3 billion at a loss. LFG accumulated bitcoins at an average price of over $40,000 and liquidated its reserves at $30,237.

However, the fact that the LFG sold its bitcoin reserves to stabilize the UST played the attackers perfectly into their cards. The attackers had already opened short positions on Bitcoin, on which they began to profit almost immediately. Furthermore, they used the remaining $650 million $UST for massive $UST sales on the Binance Stock Exchange, causing the price of stablecoin to fluctuate significantly.

The more BTCs were sold, the more the panic grew in the market, causing an awkward situation in which investors wanted to get rid of their $UST as soon as possible. However, the sale of BTC reserves failed to stabilize the price of $UST per dollar, bringing even greater uncertainty to the market.

After several hours, market panic over the $UST and $LUNA problems caused some centralized exchanges, including Binance, to suspend LUNA and UST withdrawals.

Depeg of the $UST stablecoin also influenced the largest decentralized protocol on the Terra platform called Anchor Protocol. The total locked asset value in this protocol fell from over $ 6 billion to over $ 600 million in two days, down 90%.

Carrying out this attack would probably not be economically possible once the 4pool was already active on Curve Finance (a pool consisting of USDT, USDC, FRAX and UST). It is estimated that draining liquidity from this pool would require up to $4 billion. It leads to the conclusion that the timing of the attack was not accidental.

Stablecoin $ UST is still in trouble. Its value is currently about $ 0.40, while the value of $LUNA has fallen from $ 80 to about 20 cents. However, the value of $UST is likely to return to its equilibrium value over time through Terra modules and arbitrage trades, but its credibility is already severely compromised.

INVEST WITH FUMBIDid you come across a term you didn’t understand? Don’t worry. All essential terms regarding cryptocurrencies are in our Fumbi Dictionary.

3 min •

3 min •