Morgan Stanley Expands in Cryptocurrencies – Market Info

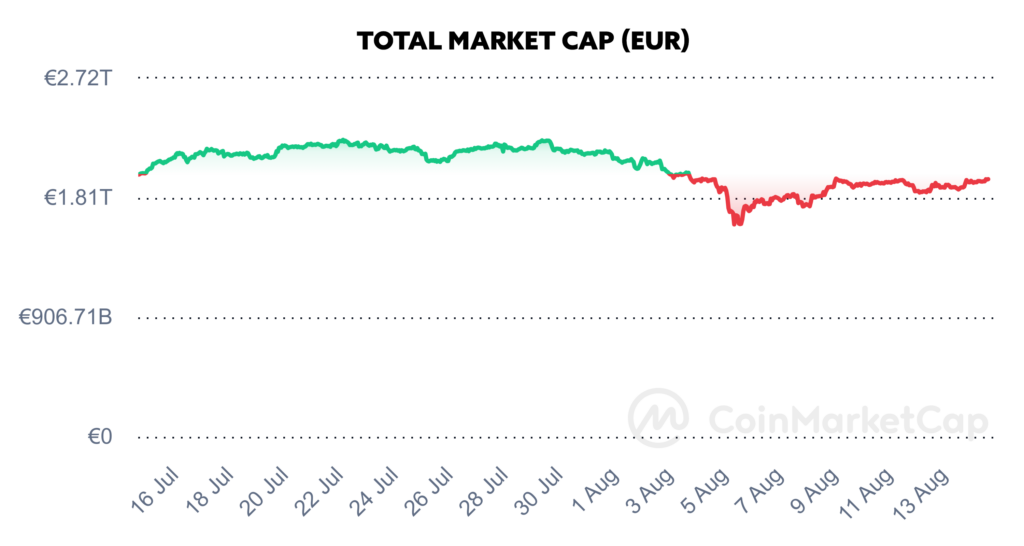

Over the past two weeks, the total market capitalisation exceeded €1.94 trillion. The decrease in market capitalisation over a 14-day period is 9.3%. The price of Bitcoin has fallen by 7.11% over the last 14 days to a current value of over €55,500. Bitcoin’s dominance is currently around 57.3%.

Source: Coinmarketcap

Morgan Stanley Expands in Cryptocurrencies

Morgan Stanley, the world’s fourth-largest investment bank, has reportedly instructed its 15,000 financial advisers in the United States to start recommending bitcoin ETFs to their clients.

A person close to the bank, who was not authorized to speak publicly about the matter, also commented to Cointelegraph magazine. The source confirmed that Morgan Stanley has been running a pilot project with financial advisors since August 7, with the bank’s financial advisors currently recommending only two bitcoin funds: the BlackRock iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC).

The involvement of financial advisors in the U.S. cryptocurrency world is a significant milestone for the entire crypto sector. Morgan Stanley has one of the strongest and largest advisory networks in the U.S., with Morgan Stanley’s advisory network reportedly managing up to $3.75 trillion, including $1 trillion in self-directed client accounts.

Roxanna Islam, head of sector and industry research at VettaFi, said funds from Blackrock and Fidelity appear to be so-called “blue chips” among spot bitcoin ETFs. Most institutions and banks invest in Bitcoin through these funds, and a significant number of independent financial advisors also recommend investing in Bitcoin through one of these two funds in most cases, according to VettaFi’s research.

The involvement of financial advisors and advisory platforms in the world of cryptocurrencies could spur an influx of new capital into Bitcoin ETFs and a sharp rise in the price of Bitcoin, according to Matthew Sigel, head of digital asset research at VanEck. What’s more, other investment banks are expected to join Morgan Stanley in the coming months, not wanting to miss out on this opportunity and not wanting to let Morgan Stanley alone cover the entire field. Source

Ripple Succeeded in Dispute With SEC

The long-running dispute between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs is slowly but surely coming to an end. Over the past week, a U.S. court decision was issued that moved the dispute between the SEC and Ripple Labs a big step forward.

According to the court’s decision, Ripple Labs is to pay a fine of $125 million and will be barred from certain activities that led to violations of the U.S. Securities Act. The $125 million fine in this case is significantly higher than expected – as the SEC had asked for a $2 billion fine. This is almost 94% less than the SEC was asking for, and also half what Ripple was willing to pay in an out-of-court settlement at the beginning of the litigation.

In its decision, the court acknowledged for the second time that the XRP token itself is not a security, but fined Ripple Labs for selling it directly to institutional investors such as hedge funds.

Ripple Labs CEO Brad Garlinghouse said in a post on the social network X shortly after the ruling that it was a victory for Ripple, the entire crypto industry and the rule of law. Ripple Labs co-founder Chris Larsen commented that the SEC’s incredibly long campaign against Ripple is finally over. Larsen also added that he believes this will also be the end of the current administration’s war on cryptocurrencies.

In response to the news, the value of the XRP token rose by more than 25% in a matter of minutes. At the same time, a number of members of the XRP community started joking on the social network X that this price movement caused Ripple to make enough money to pay off the entire fine within 5 minutes by increasing the value of the token. Source

Celsius Sued Tether

Celsius Network has filed a lawsuit against Tether seeking $2.4 billion in Bitcoin damages. The dispute arose out of an agreement under which Celsius borrowed USDT and used Bitcoin as collateral. The price of Bitcoin fell, allegedly leading to Celsius’ failure to meet its obligation to provide additional collateral, with the subsequent liquidation of the positions and collateral in accordance with the agreement.

Tether’s defence is that the action is without merit and describes it as an attempt at “blackmail” by Celsius, which is attempting to cover up its own financial failure in this way. To reassure USDT holders, Tether refers to its equity of $12 billion to assure them that the lawsuit will have no effect on them. Tether CEO Paolo Ardoino said that the company followed the contract to the letter and that the lawsuit misinterprets basic risk management principles.

Celsius only recently emerged from bankruptcy, distributing more than $3 billion to creditors as part of its restructuring plan. As part of that plan, Celsius’ creditors acquired shares in a new Bitcoin mining company, Ionic Digital. As of February, this company has mined more than 1,300 BTC and currently holds more than 1,800 BTC. Source

Grayscale Ethereum Trust for the First Time Without Outflows

The Grayscale Ethereum Trust reached a significant milestone on Monday as it saw no outflows for the first time since its conversion to a spot ETF. As of Monday, August 12, ethereum ETFs saw total inflows of $4.9 million, indicating growing interest in the products. ETF trading volume increased significantly, reaching $286 million on August 12, up from $166.9 million on Friday.

The Fidelity Ethereum Fund led inflows of $3.98 million. It was followed by Bitwise Ethereum ETF with $2.86 million and Franklin Ethereum Trust with $1.01 million. On the other hand, the VanEck Ethereum Trust saw net outflows of $2.92 million, its first-ever outflows since July 23. Some funds, such as

Grayscale Ethereum Mini Trust and Invesco Galaxy Ethereum ETF, saw no activity in inflows or outflows on Monday. iShares Ethereum Trust from BlackRock, despite not seeing any inflows on Monday, still leads the market with inflows of more than $901 million since its launch. Despite the recent downturn in the market, Ethereum-based products have attracted $155 million in the past week. Source

Goldman Sachs Unveils Investment in Bitcoin ETFs

Goldman Sachs, the world’s second-largest investment bank, a few days ago revealed information that it owns a stake in bitcoin ETF funds amounting to $418 million, highlighting the bank’s investment in digital assets. The largest part of this investment was in BlackRock’s iShares Bitcoin Trust, in which the bank invested $238.6 million worth of capital, bringing the total to 6,991,248 shares in the fund. In addition, Goldman holds $79.5 million in the Fidelity Bitcoin ETF and $35.1 million in the Grayscale Bitcoin Trust.

The move is part of a broader trend of increasing institutional adoption of bitcoin ETFs in 2024, driven by rapid growth in the sector. The iShares Bitcoin ETF has seen explosive growth, with net inflows of $20.5 billion in 2024 alone. In comparison, a fund from Fidelity has seen net inflows of $10.76 billion so far, and a fund from Ark & 21Shares has seen inflows of $2.8 billion.

Goldman Sachs’ diversified portfolio also includes smaller positions in bitcoin ETFs from Invesco Galaxy, Bitwise, WisdomTree and ARK 21Shares. This allocation signals a shift in the industry where digital assets are being integrated into mainstream financial products. Among the top Bitcoin ETFs launched in 2024, iShares, Fidelity, ARK 21Shares and Bitwise emerged as market leaders. Source

Will Bitcoin ETFs Outperform Satoshi Nakamoto?

U.S. spot Bitcoin ETFs are rapidly accumulating large amounts of Bitcoin and are currently slowly but surely approaching the 1 million BTC mark in total holdings. This rapid growth in Bitcoin accumulation began after their launch in January, and these funds have seen tremendous success, attracting billions of dollars from investors who were previously afraid or hesitant to enter the crypto market. The largest of these funds is BlackRock’s iShares Bitcoin Trust, which currently holds more than 347,994 BTC. Grayscale follows right behind with 232,542 BTC, with both funds contributing significantly to the total holdings, which surpassed 906,000 BTC on Tuesday.

These ETFs are expected to soon surpass the estimated 1.1 million BTC attributed to Bitcoin’s creator, Satoshi Nakamoto. This threshold could be crossed as early as October at the current rate of accumulation, which would mark a historic milestone in Bitcoin’s integration into the financial system.

Although Grayscale has faced several significant withdrawals from its investors due to high fees, which has increased overall outflows from spot ETFs, current projections suggest that the BlackRock fund will become the largest holder of Bitcoin by the end of 2025. The growth of these ETFs signals the growing acceptance and legitimization of Bitcoin as an investment asset. These ETFs provide a safe and regulated approach for investors to gain exposure to Bitcoin, attracting investors who were previously hesitant to enter the crypto market. Source

Invest with Fumbi today

Harness the potential of cryptocurrencies simply, safely and effectively. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in the Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. If you want to build your own crypto portfolios, choose the Advanced Portfolios product, where you will have access to more than 80 cryptocurrencies and templates created by our team, focusing on various areas within the crypto world.

INVEST WITH FUMBIHave you come across a term in the text that you don’t understand? Never mind, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •