Halving in Just Nine Days – Market Info

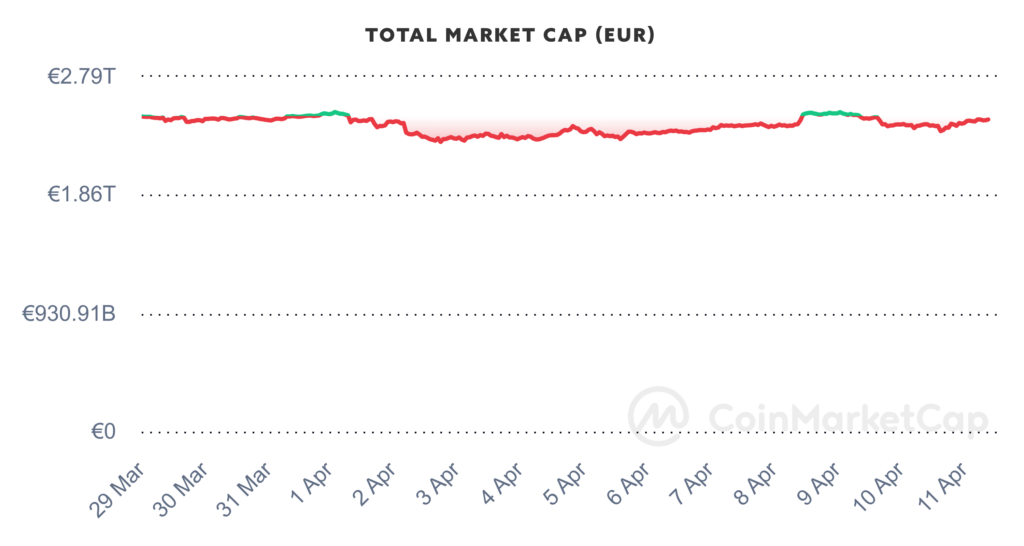

Over the past two weeks, the total market capitalisation exceeded €2.41 trillion. The decrease in market capitalisation over a 14-day period is 2.43%. The price of Bitcoin has risen by 0.91% over the last 14 days to a current value of over €66,100. Bitcoin’s dominance is currently around 54.4%.

Source: Coinmarketcap

Halving in Just Nine Days

It’s almost here! The long-awaited event in the Bitcoin network, known as halving, is less than nine days away. As early as next week, the amount of newly mined bitcoins in each block will be reduced from 6.25 BTC per block to 3.125 BTC, further reinforcing the scarcity and scarcity of Bitcoin.

In their latest report, analysts at Bitfinex predict that the price of Bitcoin could rise by roughly 160% in the 14 months following halving, reaching the peak of the market cycle around the $150,000 price level. “Using a straightforward regression model, we predict a 160% post-halving price surge in the next 14 months, taking the price to between $150,000 – $169,000.” the published report states.

However, the analysts also note that at the current price level, there is still high selling pressure compared to previous market cycles, as bitcoin has reached a new price high for the first time in its history before halving. Spot ETFs in particular have had a big impact on the price rise in recent months.

And while the massive rise in bitcoin’s price by both institutions and retail is a strong sign of confidence, analysts say it could also bring significant selling pressure, as many as 1.87 million BTC, representing roughly 9.5% of the total circulating stock, have been purchased above the $60,000 per BTC threshold, according to the data. This, according to them, underscores the active involvement of short-term holders, who may realize their profits in the near term after halving.

Halving will also significantly affect miners. According to CryptoQuant CEO Ki Young Ju, the current cost of mining using Antminer S19 XP mining equipment will increase from US$40,000 to US$80,000 after halving. Halving thus greatly affects the behaviour of miners, as the cost of mining will always double in order to earn the same amount of BTC.

After the halving in May 2020, the miners’ cost per BTC mined increased to USD 30,000 on average, but the price of BTC rose to USD 69 thousand during the last cycle, making mining profitable for miners. Historically, BTC prices have seen multiple price increases usually within 18 months after halving has taken place on the Bitcoin network. For example, after halving in 2012, the price of Bitcoin increased by approximately 9,000% to reach $1,162. After the 2016 halving, Bitcoin increased by 4,200%, and after the 2020 halving, the price of Bitcoin increased by nearly 683% to reach $69,000.

After each halving, there usually comes a period when the price of BTC remains below the miner’s profitable price. This period is often marked by uncertainty and increased sales of mining rigs, especially associated with many small and lone miners who have to shut down due to higher costs. Historically, however, it has been shown that when demand increases due to declining supply in the market, the price rises, and often rises much higher than the average cost of extraction for the extractors. Source

Chinese Asset Managers Explore Spot ETFs

A number of China-based asset management companies have expressed interest in recent weeks in offering bitcoin spot exchange-traded funds (ETFs) through their Hong Kong offices. Harvest Fund and Southern Fund, two prominent firms managing assets in excess of US$400 billion, are reportedly actively exploring the possibility of introducing such ETFs.

The move is a result of strict restrictions on cryptocurrency trading and mining in China, which prevent asset managers from offering ETFs within the country. However, this is not the case in the Hong Kong administrative region, where Harvest Fund already submitted an application for a spot bitcoin ETF in January. Southern Fund, which currently offers bitcoin futures ETFs and ether futures ETFs in Hong Kong, is also reportedly considering creating its own spot ETF.

Harvest Fund currently has total assets under management of more than $230 billion, while Southern Fund has more than $280 billion in assets under management. The approval of spot ETFs from these influential institutions could significantly boost the view of Bitcoin in the eyes of both Chinese regulators and investors.

By leveraging Hong Kong subsidiaries, large funds in China can gain exposure to Bitcoin in compliance with legislative rules. Operating subsidiaries in the Hong Kong administrative region provides a legal loophole for Chinese companies to actively engage in the cryptocurrency world. According to analysts, the first Hong Kong spot ETFs could potentially be launched as early as the second quarter of this year. Source

Asian “Microstrategy” Shocked Investors

Metaplanet, a little-known investment firm trading on the Tokyo Stock Exchange, announced plans a few days ago to adopt Bitcoin (BTC) as its main treasury reserve asset – a move that nearly doubled the company’s stock price.

In a post on social network X on Monday, the company confirmed that it had already invested JPY1 billion (roughly $6.56 million) in the asset, which at the time represented nearly half of its total market capitalisation. Following the announcement, Metaplanet’s stock rose more than 90% from JPY19 per share at Monday’s market close to JPY36 per share at Tuesday’s close. According to data from the Tokyo Stock Exchange, as many as 69 million shares of the company were traded on Tuesday, a meteoric jump from the average of 928 thousand shares traded daily.

“This strategic key is not just about embracing digital assets, but also about pioneering a future where finance meets innovation at its core,” the company said in a post on its social network X.

The relatively unknown investment firm is now considered by the Japanese but also the wider crypto community to be Japan’s Microstrategy. Microstrategy, led by Michael Saylor, switched to the Bitcoin standard back in August 2020, and since then, the company’s shares have risen nearly 1,000% from $146 to more than $1,400 today. Source

Decentralised Applications Are Trending Again

DappRadar’s latest report, “State of the Dapp Industry Q1 2024,” which focuses on analyzing decentralised applications built on various blockchains, revealed that the number of daily active unique addresses in the Web3 space reached 7 million addresses in the first quarter of 2024. This represents a 77% increase compared to Q4/2023, with notable growth of up to 9% in the decentralised social networking sector, which is powered by decentralised applications.

According to the report, Layer 2 (L2) blockchains in particular have seen a surge in activity in recent months. According to analysts, the surge in activity on second-layer blockchains is directly related to the latest update in the Ethereum network called Dencun, which significantly reduced fees on blockchains built on top of the Ethereum network. This made transactions cheaper for users, which contributed to an increase in activity on these platforms.

The NFTs sector also saw a rebound in the first quarter of this year, according to the data, with nearly 1 million daily active addresses in the sector and nearly $4 billion in transaction volume in the first quarter. This is an increase of more than 50% compared to the previous quarter, with the sector continuing to be dominated by NFT marketplace Blur, which accounted for almost 50% of the trades with a total volume of $1.9 billion.

The blockchain gaming industry saw as many as 2.1 million daily active unique addresses during the first quarter, a 59% increase over the previous quarter. The synergy between games and NFTs is evident as together they are driving the growth of the digital sphere, with game-related NFT collections recording the highest sales of all NFTs this quarter. Source

SEC Launches Comment Phase on Ethereum ETF

The U.S. Securities and Exchange Commission has opened the floor for comments and comments on three proposals to launch a spot ETF for the cryptocurrency Ethereum.

According to an announcement by the U.S. Securities and Exchange Commission (SEC), efforts by Grayscale, Fidelity and Bitwise to launch the first spot ETFs on the cryptocurrency Ethereum will be the subject of a comment period over the next three weeks, during which the SEC is seeking comments from interested parties on the proposed funds.

Despite the opening of the comment phase, SEC Chairman Gary Gensler said back in January that bitcoin’s approval should signal nothing about the commission’s views on the status of other crypto assets under federal securities laws.

Analysts, however, are far less sanguine about the approval of a spot ETF for Ethereum than they were about a bitcoin ETF. Bloomberg Intelligence senior analyst Eric Balchunas lowered his Ethereum ETF approval prediction to just 25% on the grounds that the SEC is much less active in this case than it has been in approving Bitcoin ETFs. However, officials at investment bank JPMorgan believe that failure to approve a spot Ethereum ETF in May will result in the start of new lawsuits. According to Nikolaos Panigirtzoglou, managing director and global market strategist at JPMorgan, the SEC might not succeed in these lawsuits, which could lead to the approval of an Ethereum ETF at a later date. Source

Three AI Projects Are Considering Token Mergers

A few days ago, three prominent artificial intelligence (AI)-focused protocols, SingularityNet, Fetch.ai, and Ocean Protocol, opened discussions about the possible merger of their tokens into one common token, AltSignals (ASI), which would have a market capitalisation of $7.5 billion.

According to information available from the Cointelegraph website, the three platforms will continue to operate as separate entities, but the new agreement would promote their collaboration under a newly formed group called Superintelligence, to be led by Ben Goertzel, founder and CEO of SingularityNet. The three protocols share a common goal of developing decentralised, blockchain-based AI protocols that cannot be controlled by centralised entities or large corporations.

Currently, there is a community vote on each protocol in which the community can decide whether or not the three tokens will be merged. The vote will run until April 16, and we at Fumbi will be actively monitoring the whole situation. We’ll keep you posted in case of any news in this area. Source

Invest With Fumbi Today

Capitalise on the potential of cryptocurrencies simply, securely and efficiently. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in the Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. Meanwhile, if you want to get a weekly reward from investing, choose the Staking Portfolio with an expected annual reward of 5-7% and no entry or annual fees.

TAKE ADVANTAGE OF CRYPTO’S POTENTIALDid you come across a term in the text that you do not understand? Don’t worry, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •