Ethereum ETF Officially Launched – Market Info

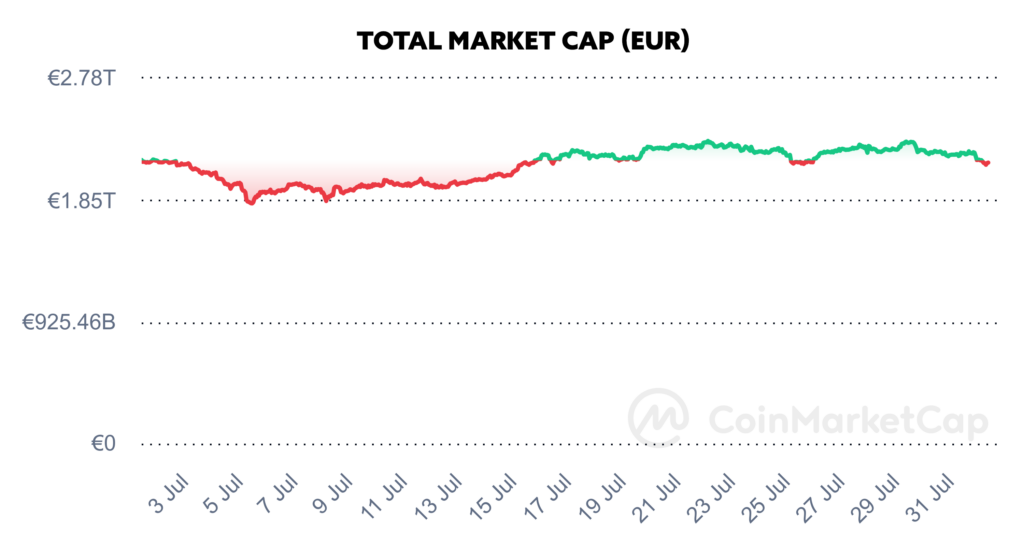

Over the past two weeks, the total market capitalisation exceeded €2.14 trillion. The decrease in market capitalisation over a 14-day period is 2.28%. The price of Bitcoin has risen by 1.08% over the last 14 days to a current value of over €59,750. Bitcoin’s dominance is currently around 56.17%.

Source: Coinmarketcap

Ethereum ETF Officially Launched

Early last week, spot Ethereum ETFs began trading on the U.S. market, marking a significant milestone for the entire crypto industry. However, the approval of the S-1 forms and the subsequent launch of these funds followed a long and challenging approval process, during which the SEC repeatedly postponed its decision, ultimately deciding at the last possible moment.

Bitcoin ETFs, which were approved in January of this year, played a crucial role in the approval of Ethereum ETFs, confirming that the SEC is no longer as strongly opposed to cryptocurrency ETFs as it once was.

Ethereum ETFs offer investors several advantages, including the ability to invest in the cryptocurrency Ethereum through a regulated instrument. This allows new investors, including institutions that had previously hesitated to invest in cryptocurrencies due to concerns about unregulated instruments, to hop on the crypto bandwagon. During the first few trading days, we saw inflows of tens of millions of dollars into the newly launched spot Ethereum ETFs.

Companies that have launched their Ethereum funds include BlackRock, Fidelity, and VanEck, the main difference among these funds being their fee structures. Fees in Ethereum-focused funds typically range from 0.15% to 0.3%, with the only exception being Grayscale’s converted fund, which set its fee at 2.5%.

The launch of Bitcoin ETFs earlier this year had a significant impact on the asset’s price, driving it to a new all-time high of $73,000 within a few months. However, it’s important to note that investing in ETFs is more of a “long-term game” rather than short-term speculation—so while the price may fluctuate in the short term, the benefits of ETFs should prove positive in the long run. Source

Trump Wants the U.S. to Be a Crypto Hub

Former President and current presidential candidate Donald Trump outlined his plans to support Bitcoin if elected in the upcoming presidential election during a Bitcoin conference in Nashville on Saturday. Speaking before thousands of attendees, Trump declared his intention to make the U.S. a “Bitcoin superpower” under his leadership.

In his keynote speech at the Bitcoin conference, the Republican presidential candidate also promised to turn the United States into the “crypto capital of the world” and to establish a strategic Bitcoin reserve. Trump further pledged to immediately remove current SEC Chairman Gary Gensler if elected and to create a new advisory board for crypto assets, even asking the crowd if anyone was interested in joining it.

Throughout his nearly 50-minute speech, Trump repeatedly contrasted his support for cryptocurrencies with the Biden administration’s efforts to regulate the industry, telling the audience that the federal government is blocking the path to cryptocurrencies. He also expressed a desire for Bitcoin mining to take place in the United States.

Trump’s address at the Bitcoin 2024 conference highlighted how radically his stance on cryptocurrencies has shifted over time. As recently as 2019, Trump tweeted that the value of cryptocurrencies was highly volatile and that he wouldn’t support them. However, in the past two years, he has released several of his own NFT collections and even begun accepting cryptocurrencies as donations for his presidential campaign. Source

Ethereum Celebrated 9 Years

On Tuesday, July 30, 2024, Ethereum, currently the second-largest blockchain network by market capitalization, celebrated its ninth birthday.

“Happy 9th birthday, Ethereum,” wrote Vitalik Buterin on the social media platform X, commemorating what is also known as Launch Day. “Looking forward to seeing what the next decade brings,” added Buterin, the founder of the Ethereum network, in his post.

Blockchains traditionally celebrate two significant milestones—the release of the whitepaper and the official network launch date—which can sometimes be confusing to people. However, July 30 marks the date when the Ethereum network officially launched in 2015, with its first block being mined. On this day nine years ago, some of the co-founders and supporters, including Gavin Wood, Vlad Zamfir, and Lefteris Karapetsas, gathered in a small office in Berlin to witness the mining of the first block together.

Source: The Social Network X

Happy Birthday, Ethereum!

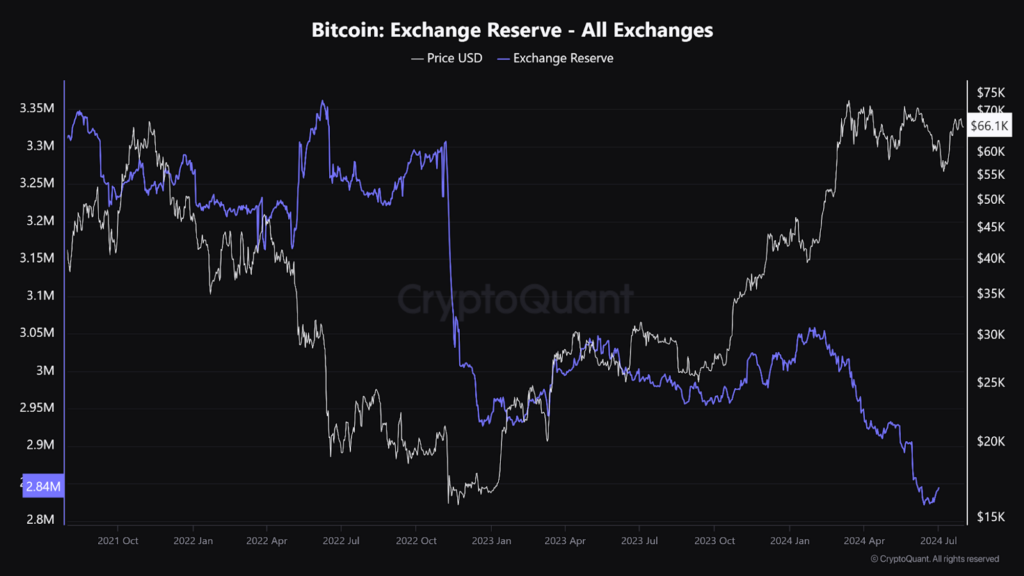

The Number of Bitcoins on Exchanges Is Constantly Falling

The number of Bitcoins held on exchanges has dropped to approximately 2.8 million, according to the latest data, reaching its lowest level in several years. This sharp decline in the amount of Bitcoin on exchanges comes at a time when Bitcoin recently retested the $70,000 price level just a few days ago.

The trend of gradually decreasing Bitcoins held on exchanges began in early 2022, but it has significantly accelerated over the past year. However, the graph also shows a slight reversal in this trend during June, potentially indicating a short-term shift in investor behaviour as well as increased trading activity.

Source: CryptoQuant

According to analysts, the increase in Bitcoins on exchanges in June correlates with recent uncertainty surrounding the liquidation of Bitcoins by the German government, as well as movements of Bitcoins associated with the Mt. Gox exchange, which is currently redistributing some of the Bitcoins it managed to recover from the 2014 hack.

The divergence between the rising price and decreasing Bitcoin reserves on exchanges has caught the attention of market analysts and investors. Analysts from Bitfinex told Decrypt that the decreasing amount of Bitcoins on exchanges could have positive long-term effects for Bitcoin, as BTC held on exchanges is often considered available for trading or selling. Conversely, an increase in assets held in private wallets signals that investors plan to hold their assets.

Generally, the amount of crypto assets stored on exchanges has an inverse relationship with the price. As one rises, the other is likely to fall, and vice versa, noted Adam Berker, Chief Legal Officer at Mercuryo. The current situation contrasts sharply with the end of 2022, when the amount of Bitcoins on exchange wallets surged dramatically, leading to sell-offs and a significant price drop. Source

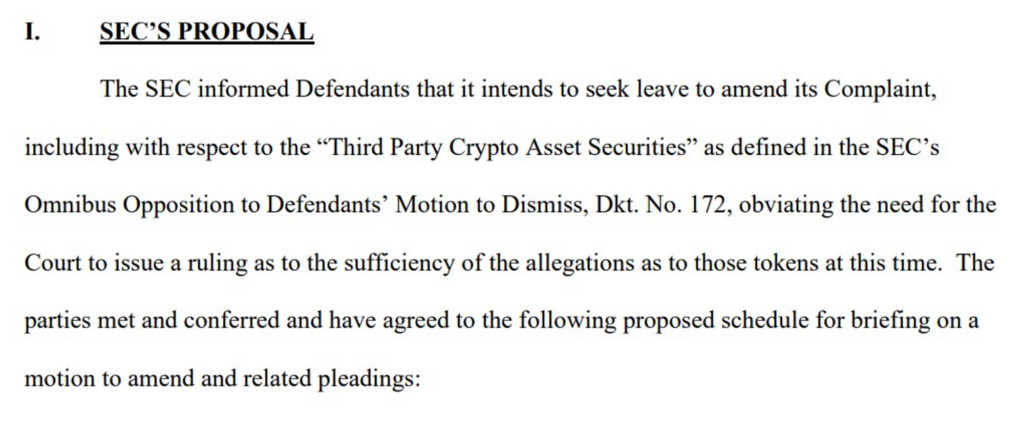

SEC Drops Charges Against Several Altcoins

The U.S. Securities and Exchange Commission (SEC) has withdrawn its request for a court ruling to classify certain altcoins, including BNB, SOL, MATIC, ADA, and ATOM, as securities. On Tuesday, July 30, the SEC filed a notice in its lawsuit, stating that it wishes to amend its complaint concerning the “third-party crypto assets” defined in the case.

Source: Cointelegraph

According to the SEC’s motion, the agency is requesting to remove the need for a court decision on the sufficiency of allegations regarding these tokens at this time. This means that the government agency is no longer asking the court to determine whether the affected tokens are securities.

In June 2023, the SEC charged Binance with several violations, including allowing the trading of tokens that the SEC considers to be securities. The SEC identified a total of 68 tokens that it deemed to be securities, with notable examples including BNB, Solana, Matic, and ATOM.

Over time, the SEC’s stance on cryptocurrencies has evolved, partly due to the ongoing presidential campaign, during which candidates are seeking to appeal to pro-crypto American voters. This includes not only Donald Trump, who recently spoke at a Bitcoin conference but also members of the Democratic Party in the House of Representatives, who last Friday signed a letter urging the Democratic Party to adopt a “forward-looking approach” to blockchain and digital assets. Source

Jersey City to Invest a Portion of Its Pension Fund in Bitcoin ETFs

The mayor of Jersey City, an American city with a population of approximately 250,000, recently revealed plans to invest a portion of the city’s pension fund into Bitcoin ETFs, marking a significant step towards integrating cryptocurrencies into municipal financial strategies.

Steven Fulop announced that the second-largest city in New Jersey is already working on updating its documentation with the U.S. Securities and Exchange Commission (SEC) to include the option to invest in Bitcoin ETFs as part of its pension funds. This move follows a similar decision by the Wisconsin pension fund, which allocated 2% of its total $156 billion assets into Bitcoin ETFs in the second quarter.

The mayor, who has been in office since 2013, emphasized his long-standing belief in cryptocurrencies and blockchain technology. Fulop stated that the question of whether Bitcoin will survive is largely settled, asserting that crypto and Bitcoin have prevailed. He also highlighted the potential of blockchain technology, ranking it among the most significant technological innovations since the advent of the Internet.

The shift towards cryptocurrency investments in public pension funds reflects a broader trend of institutional acceptance. As more cities and states consider diversifying their portfolios with digital assets, it could potentially influence wider adoption of cryptocurrencies in the traditional financial sector. However, it is worth noting that Fulop did not mention any plans to invest in other cryptocurrencies or assets, nor did he address Ethereum ETFs, which began trading earlier last week. Source

Invest with Fumbi today

Harness the potential of cryptocurrencies simply, safely and effectively. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in the Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. If you want to build your own crypto portfolios, choose the Advanced Portfolios product, where you will have access to more than 80 cryptocurrencies and templates created by our team, focusing on various areas within the crypto world.

INVEST WITH FUMBIHave you come across a term in the text that you don’t understand? Never mind, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •