Are We Due for an Interest Rate Cut in the U.S.? – Market Info

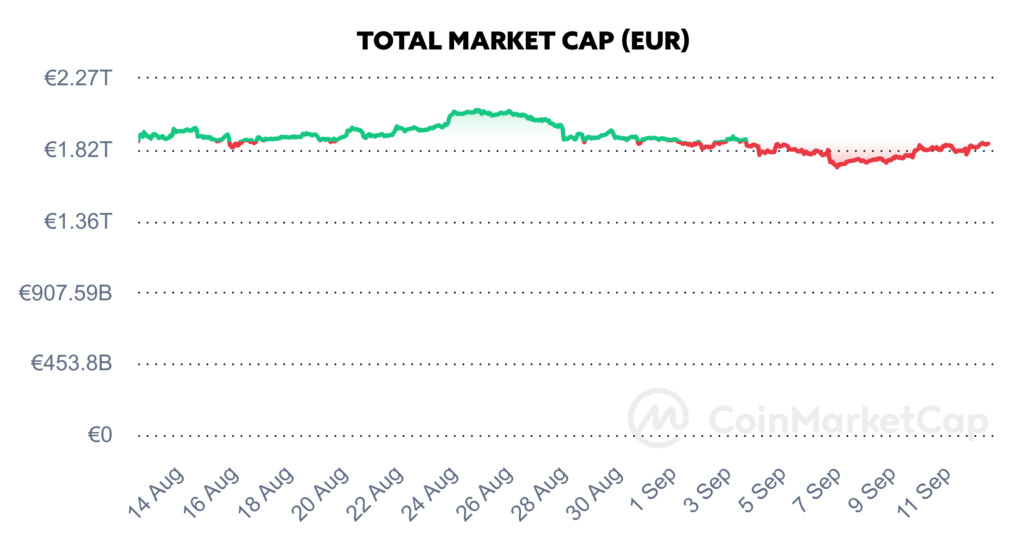

Over the past two weeks, the total market capitalisation exceeded €1.85 trillion. The decrease in market capitalisation over a 14-day period is 1.06%. The price of Bitcoin has fallen by 2.04% over the last 14 days to a current value of over €52,700. Bitcoin’s dominance is currently around 57.5%.

Source: Coinmarketcap

Are We Due for an Interest Rate Cut in the U.S.?

Friday’s U.S. jobs report brought new hope that the Federal Reserve (Fed) could move to cut key interest rates at its upcoming meeting. It is expected that a cut could come as early as next week, with increasing talk of a “more significant” rate cut of up to 50 basis points. A basis point represents 1/100th of a percentage point, with central banks usually opting for changes of 25 basis points, but in the case of an emergency, changes can be more significant.

According to 10x Research, the bullish liquidity easing cycle may start on an uncomfortable note for risk assets such as cryptocurrencies or equities. Indeed, a 50 basis point drop could signal economic concerns and lead investors to limit exposure to risky assets, such as in 2022 when the Fed sought to control inflation by raising rates by 50 and 75 basis points multiple times, sparking risk aversion in financial markets. The Fed is under pressure at the moment because some experts believe it is behind the curve. For example, Markus Thielen of 10x Research suggests that the Fed may have overlooked signs of a weakening labor market and therefore a more significant rate cut could be in response to lingering economic concerns. Similarly, Craig Shapiro, a macroeconomic strategist, argues that the Fed does not want to panic and therefore is unlikely to start with such a large rate cut.

The Fed’s next meeting is scheduled for 17-18 September, and at the end of that meeting (Wednesday evening) the Committee will also release information regarding changes in interest rates. Zdroj

Mixed Signals in Bitcoin ETF Trading

There are mixed signals in Bitcoin ETF trading, as this week’s Tuesday trading day in particular showed. Total capital inflows reached $177 million on Tuesday, but only three funds saw inflows, while the others showed zero activity.

Fidelity’s FBTC ETF saw the most significant inflows on Tuesday at $63.2 million, while Ark’s ARKB ETF saw inflows of $12.7 million. Grayscale’s Mini Bitcoin ETF saw inflows of $41.1 million. Other bitcoin funds, such as Grayscale’s GBTC, BlackRock’s IBIT and Invesco’s BTCO, saw no inflows or outflows of capital. Such movements do point to a steady but uneven interest among institutional investors in Bitcoin ETFs. At the same time, Monday and Tuesday saw positive capital inflows for the first time in more than 9 trading days.

Source: Farside Investors

For Ethereum ETFs, daily inflows were significantly lower, with nine ETH funds seeing capital inflows of just $11.4 million. A fund from Fidelity saw inflows of $7.1 million, followed by a fund from BlackRock, which saw capital inflows of $4.3 million.

Source: Farside Investors

Other funds, including Grayscale’s ETH funds, have reported virtually no activity related to ETH purchases or divestitures. At the same time, the low activity and low capital inflows into Ethereum ETFs indicate high caution on the part of institutional investors. Source

Solo Miner Mined BTC Block

On Tuesday, September 10, 2024, an individual Bitcoin miner managed to beat out the big mining companies and pools and mine block with serial number 860749, earning a reward of 3,169 BTC, which translates to about $181,000. Mining Bitcoin blocks is mostly the domain of mining groups that pool computing power to maximize their chances of mining a block and getting a block reward. The current reward per mined block is 3.125 BTC, which was halved after April’s Bitcoin halving. Transaction fees from transactions that have been included in a given block are by default added to the reward for a mined block.

Although solo miners usually have low computing power and their chances of extracting a block are really low, recently various new platforms have appeared on the market that offer mining machines for solo miners with relatively high performance compared to the machines that have been sold so far. This gives individuals a better chance of mining a block. The success of this solo miner is comparable to winning the lottery, as the hash rate and grid difficulty are at all-time highs, with the block being primarily sought by large mining companies and mining pools, which have a much larger hash rate than individual miners.

Julio Moreno, head of research at CryptoQuant, said that although it is a rare event, solo miners are finding blocks more and more frequently, thanks to the rise in popularity of smaller ASIC devices designed for home mining. Still, mining is dominated by mining pools, such as Foundry USA or Antpool, which together account for up to 53% of the Bitcoin network’s total hash rate. Source

Swiss Bank Started Offering Crypto Services

Zurich Cantonal Bank, the fourth largest bank in Switzerland, has officially entered the crypto market. The bank has launched cryptocurrency trading and custody services, expanding its financial footprint. As a result, clients can now trade Bitcoin and Ethereum cryptocurrencies and use cryptocurrency custody services. These new services are fully integrated into the bank’s existing digital platforms, such as ZKB eBanking and ZKB Mobile Banking.

In cooperation with Crypto Finance AG, a subsidiary of Deutsche Börse Group, the bank arranges the purchase and sale of cryptocurrencies without the need for clients to have their own crypto wallets. The move is not only aimed at ZKB clients but also offers business-to-business (B2B) solutions that enable other Swiss banks to provide cryptocurrency-related services. According to a press release, Thurgauer Kantonalbank, a Swiss cantonal bank, has become the first partner bank to integrate this business-to-business solution.

The move is part of a broader effort by Swiss banks to expand their crypto-services offerings. ZKB has previously explored the use of blockchain technology, including the possibility of issuing digital bonds on the SIX exchange and central bank digital currency projects in cooperation with the Swiss National Bank. Source

Siemens Issued a Bond via Blockchain

German technology giant Siemens has announced the issuance of its second digital bond worth €300 million, issued via blockchain in accordance with the German Electronic Securities Act. The move is part of the company’s efforts to strengthen its presence in the blockchain market.

The bond with a one-year maturity was issued on the private blockchain SWIAT and backed by the Bundesbank Trigger Solution. Siemens said the entire transaction was fully automated and took place in a matter of minutes.

“With the issuance of another digital bond, we are once again demonstrating our commitment to innovation and strengthening digital solutions for financial markets,” said Ralf P. Thomas, CFO of Siemens.

DekaBank served as bond registrar, with BayernLB, DZ BANK, Helaba and LBBW participating as investors in the issue. Germany’s largest bank, Deutsche Bank, in turn brokered the central bank’s cash settlement.

The move is part of Siemens’ broader strategy, which includes research into new technologies. In 2024, Siemens plans to explore the metaverse in collaboration with Sony, with an emphasis on industrial applications, including the development of a new mixed-reality headset to boost productivity using artificial intelligence. Source

How Has the Price of iPhones Changed Over Time Compared to Bitcoin?

Apple unveiled its latest iPhone 16 model on September 9 with a price starting at $799, which is approximately 0.014 Bitcoin (BTC). This way of expressing the price of the iPhone in BTC serves as a benchmark to measure the purchasing power of Bitcoin over the years.

In 2023, CoinGecko analyzed how much each new iPhone was worth in Bitcoins at its launch. For the record, the iPhone 15 cost as much as 0.031 BTC in 2022, which is more than double the price of the iPhone 16 in BTC, although its dollar price remained the same.

In 2022, the most affordable version of the iPhone 14 cost up to 0.042 BTC, which is almost three times more than what is expected for the iPhone 16 in 2024 if we were buying it with Bitcoin. During 2021, the iPhone 13 cost just 0.018 BTC, but it should be added that during this period the cryptocurrency market was in complete euphoria, and by the end of 2021 Bitcoin was reaching record highs.

The price of other iPhone 16 models, such as the iPhone 16 Plus ($899), iPhone 16 Pro ($999) and iPhone 16 Pro Max ($1,199), are also listed in Bitcoin: 0.0157 BTC, 0.0175 BTC and 0.021 BTC, respectively. Interestingly, someone who has held Bitcoins since 2022 could now buy two iPhone 16 Pro Max for the same amount of BTC as the simpler version of the iPhone 14 cost back then.

Source: CoinGecko

Since 2011, this trend has been repeated, with the price of iPhones in BTC dropping significantly as the value of the cryptocurrency increased. For example, the iPhone 4S cost as much as 162 BTC at its launch, while the current value of 162 BTC is approximately $9.23 million. Source

Invest With Fumbi Today

Harness the potential of cryptocurrencies simply, securely and efficiently. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in the Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. If you want to build your own crypto portfolios, choose the Advanced Portfolios product, where you will have access to over 80 cryptocurrencies and templates created by our team that focus on different areas within the crypto universe.

INVEST WITH FUMBIHave you come across a term in the text that you don’t understand? Never mind, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •