Bitcoin Whitepaper Celebrated Its 15th Birthday – Market Info

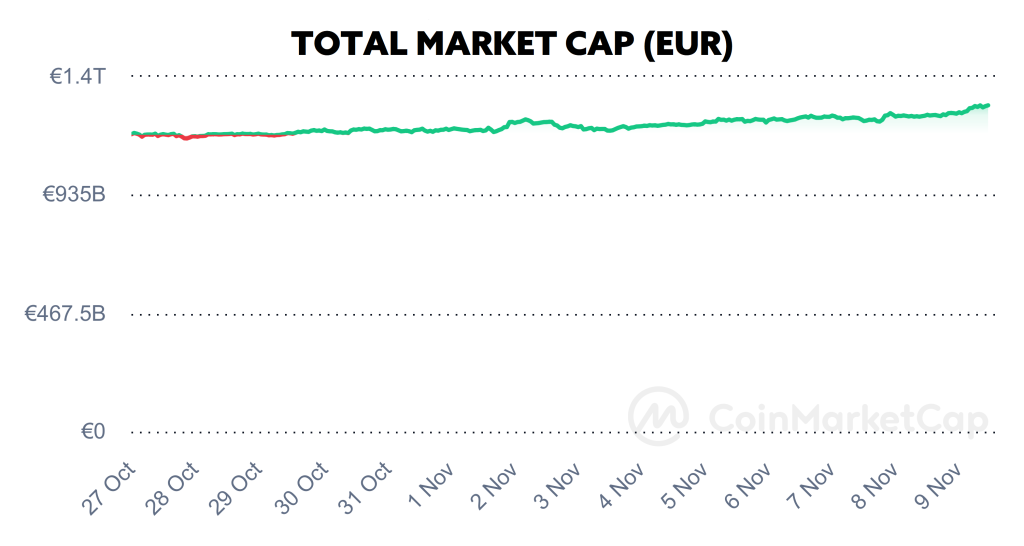

Over the past two weeks, the total market capitalisation exceeded €1.28 trillion. The increase in market capitalisation over a 14-day period is 6.66%. The price of Bitcoin has risen by 5.6% over the last 14 days to a current value of over €34,320. Bitcoin’s dominance is currently around 52.1%.

Source: Coinmarketcap

Bitcoin Whitepaper Celebrated Its 15th Birthday

On the last day of October, Bitcoin, the most popular and well-known cryptocurrency, celebrated its 15th anniversary since the publication of the initial document, also referred to as the Bitcoin Whitepaper.

In his Bitcoin Whitepaper, the anonymous creator (or creators) of Bitcoin, who went by the pseudonym Satoshi Nakamoto, described a decentralised system that could facilitate peer-to-peer transactions and that would solve the double-spending problem that has been frequently mentioned in previous attempts to create a digital currency.

Satoshi proposed to solve this problem through a network of nodes to verify and record transactions through a consensus mechanism known as proof-of-work, which was put into real operation just two months later, on January 3, 2009.

The Bitcoin whitepaper, officially titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” appeared on the Internet after the global financial crisis of 2008, and many believe it was the answer to that crisis and the failure of traditional banking. Nakamoto’s vision was clear – to create a currency that was independent of the state, resistant to censorship, and available to anyone, anywhere in the world.

Since 2008 and the launch of the Bitcoin network in early 2009, Bitcoin has grown to become a global phenomenon and the most powerful asset. Bitcoin has become the foundation for a new wave of innovation within the cryptocurrency sector, inspiring many other developers to create other programmable blockchains designed for specific needs. Source

SEC Struggles to Hire Crypto Experts

The U.S. Securities and Exchange Commission (SEC), one of the main federal regulators in the United States that is currently deciding whether or not to approve the Bitcoin Spot ETF Fund, is having trouble hiring cryptocurrency professionals, according to a report released from the agency’s inspector general.

The Office of Inspector General in the US functions as an independent body that reviews and oversees the operations of federal agencies such as the SEC, the Federal Trade Commission and the Social Security Administration. Last week, the SEC’s Division of Enforcement released a report on October’s governance and performance challenges that showed one major interesting fact tied directly to cryptocurrencies.

According to the document, the SEC faces enormous challenges in recruiting crypto asset specialists, which the Office of Inspector General sees as key to strengthening the SEC’s ability to examine new and pre-existing challenges in the cryptocurrency market. The agency is reportedly having difficulty recruiting specialists because the pool of qualified experts in this area is still low and often times these experts are directed to private sector firms that will offer them much more enticing terms.

Furthermore, the report goes on to describe that one of the significant problems in recruiting crypto experts to the SEC is the rules that prohibit employees from possessing cryptocurrencies. In practice, this means that if a crypto professional wanted to be employed at the SEC and owned cryptocurrencies, they would have to sell off all of their assets. According to the inspector this prohibition is detrimental to recruiting because, in most cases, the candidates are unwilling to give up their cryptoassets to work for the SEC. In fact, the federal agency has complex ethics rules in place that prohibit employees who own equity in a company, for example, from making decisions on any matters involving that company.

The SEC is currently deciding whether to approve a number of spot BTC ETFs from companies such as BlackRock and Fidelity. It is the lack of qualified crypto experts that may be one of the reasons why the SEC has so far deferred all of its decisions regarding these applications. Source

The UK Is Considering Introducing Stablecoins Into the Real Economy

According to the latest information published in the Financial Times, the UK central bank, the Bank of England, and the UK regulator, the FCA, have put forward a proposal to ensure the implementation of stablecoins into the real economy by using stablecoins as a payment option for goods and services.

The regulatory proposal put forward by the central bank and the FCA seeks to harness the potential benefits that stablecoins could provide to UK consumers and retailers. They see one of the main benefits as being that payments to retailers by consumers could be faster and cheaper.

The proposal aims, among other things, to regulate stablecoins to increase consumer protection, prevent money laundering through a strong set of rules and protect financial stability.

“Stablecoins have the potential to make payments faster and cheaper for all, and that’s why we want to offer firms the ability to utilise this innovation safely and securely. Getting views from others is essential for creating proportionate rules that benefit consumers and firms and also meet our objectives,” said Sheldon Mills, FCA’s executive director of consumer and competition. His idea was backed by Sarah Breeden, deputy governor for financial stability from the Bank of England, who said that “stablecoins can enhance digital retail payments in the UK.” Source

Hong Kong Moves Towards Launching a Spot ETF

The Securities and Futures Commission (SFC), which acts as Hong Kong’s securities regulator, is reportedly considering launching a spot BTC ETF for retail investors. According to Julie Leung, director general of the Hong Kong Securities and Exchange Commission, the agency is considering allowing the issuance of this type of product given that the risks are currently adequately managed.

Hong Kong already permits trading of crypto ETFs based on Futures, but also only in a limited mode. According to information, there are only three crypto ETF companies operating in the market, with roughly $65 million under management. However, according to experts, this number is far beyond its potential and also beyond the overall size of the local ETF market.

Hong Kong’s potential entry into spot crypto ETFs could be a significant boost in the context of the economic confrontation between the U.S. and China, according to BitMEX crypto exchange founder Arthur Hayes. According to him, the launch of a spot ETF in Hong Kong would lead to increased competition between the two economies, stressing that this competitive struggle would ultimately be beneficial for Bitcoin itself.

Hong Kong’s open stance on spot ETFs contrasts with that of regulators in the U.S., which have long delayed the approval of a spot BTC ETF in the United States. However, the launch of funds of this kind in Hong Kong could be a catalyst for the United States, which would certainly not want to be left behind in this area. Source

SBF Guilty on All Counts

Sam Bankman-Fried (SBF), the founder of the bankrupt crypto exchange FTX, was found guilty on all counts of the indictment last Thursday in a trial related to the collapse of the crypto exchange FTX. A 12-member federal jury convicted Bankman-Fried of seven felony counts related to the unexpected collapse of one of the largest crypto exchanges, which managed billions of dollars in capital.

Prosecutors produced numerous reports showing that Bankman-Fried lied to investors about FTX’s financial health and used customer funds to enter into unauthorized and excessively risky trading positions through Alameda Research.

The verdict came after a month-long trial in federal court in Manhattan. Prosecutors portrayed the 30-year-old former billionaire as a lying fraudster who stole billions of dollars of his customers’ funds to hide losses at an affiliated hedge fund, Alameda Research.

Bankman-Fried was found guilty of felony counts of fraud, securities fraud, conspiracy or money laundering. He faces up to 110 years in prison at sentencing, which is scheduled for March 2024. The jury deliberated only two days before reaching a unanimous verdict on all counts. Bankman-Fried stared straight ahead as the verdict was read and showed virtually no reaction. Source

The Fed Did Not Raise Interest Rates

The Federal Reserve (Fed) did not raise interest rates during last week’s meeting and kept them in the range of 5.25% to 5.50%. With this move, monetary policymakers in the U.S. are trying to determine whether current interest rates are tight enough to be able to push inflation to the desired level.

Fed Chairman Jerome Powell said during a subsequent press conference that the current situation is a slight conundrum for them, but that they would be willing to raise interest rates again if inflation persists and continues to rise. However, Powell also expressed concern that rising interest rates may begin to put pressure on the economy and economic growth. Therefore, the Fed decided not to raise rates at the moment, preferring to wait for the labour market data and the year-on-year inflation data, the outcome of which will be reflected at the Fed’s next meeting in December.

U.S. equities along with cryptocurrencies reacted higher following the news, while the U.S. dollar along with yields on Treasury bonds saw a minor decline. However, investors are increasingly starting to lean towards the Fed having already reached a ceiling on interest rate hikes and could start gradually cutting rates from next year. The rate cuts are a positive signal for risk assets, which include cryptocurrencies and equities. Source

INVEST WITH FUMBI

START INVESTING

3 min •

3 min •