Crypto in Price Correction – Market Info

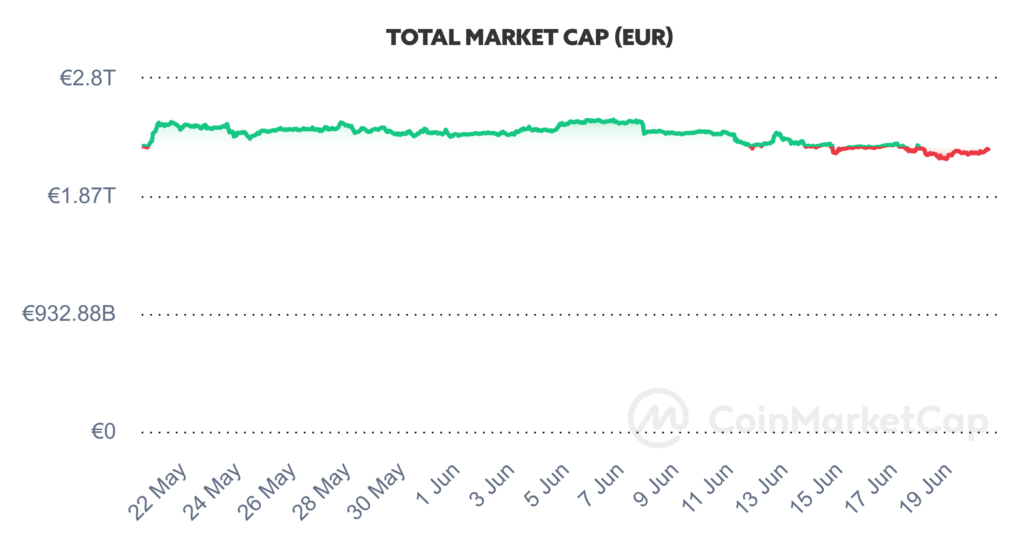

Over the past two weeks, the total market capitalisation exceeded €2.23 trillion. The decrease in market capitalisation over a 14-day period is 7.85%. The price of Bitcoin has fallen by 5.9% over the last 14 days to a current value of over €61,300. Bitcoin’s dominance is currently around 55.3%.

Source: Coinmarketcap

Crypto in Price Correction

Bitcoin and the entire cryptocurrency market have plunged into a market correction phase in recent days, during which Bitcoin has fallen by more than 3.5% in the last 7 days. Bitcoin lost key support at $65,000 on Tuesday and reached its lowest value in 30 days at $64,060.

However, the altcoins fared worse, being much more vulnerable to this correction. According to the data, the market capitalization of altcoins (excluding BTC, ETH, and stablecoins) has fallen by over 8.2% in the last 7 days, indicating a sell-off by investors as well as a great opportunity to buy them at a discount. The decline in the price of Bitcoin as well as altcoins has led to a drop in the market capitalization of the cryptocurrency market, which has fallen by 6% since the beginning of this June and currently stands at $2.13 trillion.

Bitcoin’s drop below $65,000 has led to massive liquidations across the crypto market. According to data from Coinglass, more than $300 million worth of long positions were liquidated on Tuesday alone, indicating a strong cleanup of overly leveraged long positions.

Despite this price correction and lower momentum across the entire crypto sector, analysts are still optimistic about Bitcoin and altcoins’ recovery in the coming weeks. Analysts at K33 Research said in their latest report that Bitcoin remains in a stable price range and has risen over 50% since the beginning of the year despite the correction.

Analysts from Rekt Capital also stated that Bitcoin has been in a continuous downtrend so far during June, adding that price corrections are very important for assets. However, Bitcoin will need to break out of this downtrend and initiate a price reversal.

Price corrections are nothing new or surprising in the cryptocurrency market. Corrections are considered a tool for “cleaning” the market from overly leveraged positions as well as short-term holders who buy cryptocurrencies mainly for speculative purposes. Source

SEC to Drop Investigation Into Ethereum

According to the latest information, the U.S. Securities and Exchange Commission (SEC) has dropped its investigation regarding the classification of the cryptocurrency Ethereum (ETH) as a security.

According to available information, the SEC’s Enforcement Division informed Ethereum developers Consensys on Wednesday that it is closing the investigation into Ethereum 2.0. This means that the SEC will not further investigate or impose fines for considering ETH as a security. Representatives of Consensys described this decision as a major victory for Ethereum developers, technology providers, and all participants in the entire crypto world.

In its statement, Consensys also mentioned that the SEC’s decision came after the company sent a letter to the agency on June 7th, asking whether it plans to end the investigation of Ethereum after the SEC approved a spot ETF for this asset. Consensys’ lead legal counsel, Laura Brookover, also published an excerpt from the SEC’s letter, in which the agency states that it has no intention of enforcing any measures.

Consensys sued the SEC in April shortly after receiving a notice from the agency known as a Wells notice, indicating that the crypto wallet Metamask could be violating securities laws. The lawsuit stated that the SEC and its chairman, Gary Gensler, believed that ETH had been a security at least since the beginning of 2023. Source

Spot Ethereum ETFs May Begin Trading by July

According to leading Bloomberg analyst Eric Balchunas, spot Ethereum ETFs could potentially start trading in the United States as early as July 2nd.

On June 13th, Balchunas published a post on the social network X, stating that the launch of trading spot ETFs for the cryptocurrency Ethereum could come as early as July 2nd, noting that staff at the U.S. Securities and Exchange Commission (SEC) are currently reviewing and commenting on individual S-1 applications. According to available information, the applications from individual firms were “clear and straightforward,” which could expedite the entire approval process.

According to Balchunas, there is a decent chance that the SEC is working to declare these applications effective next week, which would allow the SEC to dispose of these applications before Independence Day, which falls on July 4th in the USA.

SEC Chairman Gary Gensler provided a broader timeframe in a recent interview, indicating when spot ETH ETFs could start trading. Gensler mentioned in the interview that ETH ETFs could begin trading sometime during the summer but did not specify an exact date. He added that the speed of approval for S-1 applications would depend on how quickly issuers respond to comments from the SEC. Source

Deutsche Telekom Plans to Mine Bitcoin

A few days ago, T-Mobile Deutsche Telekom announced that as part of its expansion into the cryptocurrency world, it plans to start mining Bitcoin in the future.

The telecommunications company has been operating a Bitcoin node since 2023 and currently operates Bitcoin nodes on the layer-two network created over Bitcoin called the Lightning Network. Dirk Röder, Head of Web3 Infrastructure and Solutions at Deutsche Telekom, stated during his speech at the BTC Prague conference that the company will soon engage in “digital currency photosynthesis” – which is understood to mean the company’s involvement in Bitcoin mining.

The company is not a newcomer to the crypto world. It is actively involved in Web3 activities, such as operating its node in the Polygon network. The company is one of the hundred validators that participate in verifying transactions and blocks on the Polygon network, thus supporting the overall security of this network.

Additionally, in February, Deutsche Telekom partnered with the crypto AI project Fetch.ai to create a new kind of enterprise artificial intelligence. In this case, Deutsche Telekom operates as a blockchain validator for Fetch.ai and contributes to its development. Source

Microstrategy Can’t Get Enough of Bitcoin

Microstrategy simply cannot get enough of Bitcoin. This is how the company’s latest initiative in Bitcoin acquisition could be defined, as it plans to issue additional unsecured convertible debt securities worth $700 million to purchase more BTC for its reserves.

In its announcement on Friday, the company stated that by issuing new debt securities, it could raise up to $786 million and spend it on buying BTC and for general corporate purposes. Microstrategy, founded by well-known Bitcoin maximalist Michael Saylor, is currently the largest institutional holder of Bitcoin.

According to available information, the bonds will bear an interest rate of 2.25% per year, payable semi-annually on June 15 and December 15, starting this December. They will mature in June 2032, unless previously repurchased, redeemed, or converted.

Before the Friday announcement, the company held a total of 214,400 BTC – equivalent to approximately $13.9 billion. Microstrategy currently owns up to 1% of the total Bitcoin supply, which is capped at 21 million BTC, with just over 19.7 million BTC currently in circulation. Source

The Fed Left Interest Rates Unchanged

The Federal Reserve, during its meeting last week, left the key interest rate unchanged and indicated that it expects only one interest rate cut by the end of the year.

Policymakers of the Federal Open Market Committee (FOMC) lowered their interest rate expectations after a two-day meeting, as they previously indicated at the last meeting that there would likely be two rate cuts this year. The Committee also stated that interest rates will likely remain higher in the long term than initially anticipated.

New forecasts released after this week’s two-day meeting suggested mild optimism regarding inflation, which, according to last Tuesday’s data, rose by 3.3% year-on-year, better than analysts’ expectations of 3.4%. Inflation is thus closer to the Fed’s 2% target, which will allow some monetary policy easing in the second half of this year.

The Committee also indicated a more aggressive path of interest rate cuts in 2025 than initially expected, predicting a reduction of up to one basis point, whereas they previously estimated a 0.75 basis point cut. If these projections materialize, the reference interest rate could be around 4.1% by the end of next year. Source

Invest with Fumbi today

Harness the potential of cryptocurrencies simply, safely and effectively. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. And if you want to earn a weekly reward from investing, choose the Staking Portfolio with an expected annual reward of 5-7% and no entry or annual fees.

INVEST WITH FUMBIHave you come across a term in the text that you don’t understand? Never mind, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •