Bitcoin Has Entered the Guinness Book of World Records – Market Overview (21.10 – 3.11)

Over the past two weeks, the total market capitalisation exceeded EUR 1.03 trillion. The increase in market capitalisation over a 14-day period is 9.57%. The price of Bitcoin has risen by 6.15 % over the last 14 days to a current value of over €20,700. Bitcoin’s dominance is currently around 38,6 %.

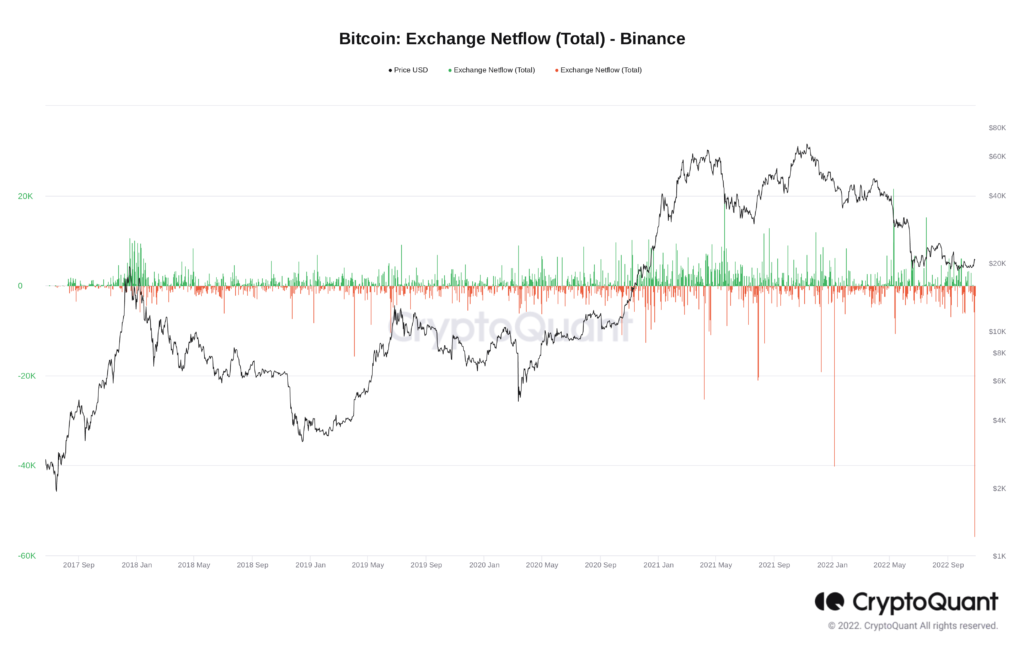

Investors Continue to Drain BTC From Exchanges

At the end of October, the price of Bitcoin climbed back above $20,000 for the first time in weeks. Trading volumes in the BTC/USD currency pair also increased significantly, with investors continuing to accumulate Bitcoin in massive numbers.

The accumulation of BTC by investors is also associated with the outflow of Bitcoins from exchanges. Investors typically move Bitcoins from exchanges to their private wallets because of their intended long-term holding in a safer place.

According to data from CryptoQuant, an astronomical 55,000 BTC left Binance, the largest crypto exchange, in a single day. This is the highest Bitcoin outflow from the exchange in its history, surpassing the massive outflow from January 2022, when nearly 40,000 BTC left the exchange in a single day.

We also informed you about the massive outflows of BTC from exchanges in our last market overview, when a huge amount of BTC left several exchange wallets. Increased outflows from exchanges are seen as positive among investors, as with less BTC available on exchanges, the pressure to sell Bitcoins is lower. Source

Britain Has a New Prime Minister. What Does This Mean for Cryptocurrencies?

Following the resignation of the previous Prime Minister, Liz Truss, on 20 October, the ruling Conservative Party in Britain has begun the process of electing a new leader and Prime Minister. Truss, who took over from Boris Johnson on 5 September, was pressured to resign after only 44 days in office. Her economic “mini-budget” plans, which included substantial tax breaks for top earners, drew heavy criticism from both the general public and members of her own cabinet.

Rishi Sunak, who previously served as UK Chancellor of the Exchequer, became the new Prime Minister in Britain after Penny Mordaunt and Boris Johnson dropped out of the Conservative Party leadership election.

The new British Prime Minister will not have it easy leading the country. The difficult macroeconomic situation and high inflation continue to plague the whole of the United Kingdom. The country’s consumer price index rose by 10.1% year on year in September, and high inflation will continue for some time to come. The energy supply problems caused by the Russian invasion of Ukraine have exacerbated the country’s economic problems, leading to household energy bills rising by up to 80% in early October.

However, the attitude of the new UK Prime Minister towards cryptocurrencies seems to be very positive. Sunak, who served as Chancellor of the Exchequer in April 2021, has proposed that the Treasury and the Bank of England form a working group to explore the creation of a central bank digital currency, known as CBDC. The CBDC survey was in line with the Treasury’s proposal to help fintech companies expand and ensure the UK remains at the cutting edge of digital financial innovation.

Furthermore, in April 2022, Sunak revealed plans to make the UK a global hub for crypto technology. At the forefront of these plans, for example, was a call for the recognition of stablecoins as a legal form of payment, a move that could significantly boost the UK crypto industry. On top of that, the Treasury, led by Sunaka, has been working with the Royal Mint, where together they have been exploring ways to make the UK tax system more competitive in order to encourage the further development of cryptocurrencies.

Under Sunak’s leadership at the Treasury, the UK government’s stance has been pro-crypto. However, when Sunak left his chair ahead of Boris Johnson’s resignation, it somewhat called into question the UK’s pro-crypto approach. After all, there was no guarantee that the next government would continue to support innovation in the form of cryptocurrencies.

However, the crypto public now sees Sunaka’s ascension to the Prime Minister’s seat as very positive. The new Prime Minister will have the opportunity to put people in important positions who share his positive views and initiatives on cryptocurrencies, further supporting the technological potential of cryptocurrencies in Britain. However, Sunak will need to demonstrate that he can handle the job, which he will need to convince not only members of parliament but especially the general public. Source

Bitcoin Whitepaper Celebrated Its 14th Birthday

On the last day of October, Bitcoin Whitepaper celebrated its 14th birthday. On this day in 2008, Satoshi Nakamoto released a nine-page paper that launched a new financial revolution and practically laid the foundation for the entire crypto ecosystem as we know it today.

On 31 October 2008, Satoshi Nakamoto published a whitepaper about Bitcoin to a crypto mailing list called Metzdow. Metzdow was a mailing list run by a group of cypherpunks that was full of ideas and thoughts on creating a new form of digital currency. Satoshi shared his whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” which outlined the main features of a new financial system without central authorities.

At the time, the pseudonymous creator of bitcoin revealed that he was working on a new electronic cash system that uses a consensual Proof-of-Work (PoW) algorithm that requires no trusted third-party interaction. Although the paper was initially met with mixed reactions, his idea has created a revolution in the field of digital currencies.

Two months later, on 3 January 2009, the Bitcoin network was launched, and the first block in the Bitcoin network was mined. Eight days later, one of the developers, Hal Finney, accepted the first transaction of 10 BTC from Satoshi Nakamoto.

The identity of the mysterious creator of Bitcoin remains unknown to this day. Although there are a number of adepts who could be behind the creation of this digital innovation, all of the possible adepts deny that they were behind the birth of Bitcoin.

In just 14 years, Bitcoin has achieved far more than anyone could have imagined at the outset. Bitcoin has been accepted by merchants around the world, world-renowned institutions have begun investing in it, and it has even become legal tender in two countries. Bitcoin has a great future ahead of it, and thanks to Fumbi, you can be a part of it too. Source

El Salvador Opens Bitcoin Embassy in Switzerland

It is widely known that El Salvador and Switzerland are among the countries favouring cryptocurrencies and their technological potential. El Salvador has invested in Bitcoin several times and adopted it as its legal tender, while one of Switzerland’s cities, Lugano, wants to become a major crypto hub in Europe.

Last Friday, El Salvador signed a memorandum of understanding with the city of Lugano in Switzerland that aims to expand the adoption of bitcoin across the European continent. The Central American state has also reportedly opened a “bitcoin office” in Lugano.

During Tether’s inaugural forum in Lugano, El Salvador’s ambassador to the United States, Milena Mayorga, said the office will be staffed by a new honorary consul dedicated to bitcoin advocacy across Europe.

“My fellow Salvadorans and I are very excited by the promise of Bitcoin, and I look forward to seeing how this initiative will help increase access to economic security and economic freedom for all,” Milena Mayorga said about the opening of the Bitcoin Embassy. Source

Elon Musk Bought Twitter

Last week, the world’s richest man, Elon Musk, completed the acquisition of the social network Twitter for a total of $44 billion. So, after months of controversy and legal wrangling, the Twitter buyout saga appears to be over.

Immediately after the acquisition was completed, Musk published a post on his Twitter account with the caption, “the bird is free”. A bird because the Twitter logo is a little blue bird.

A few days later, Musk announced the dismissal of the company’s top executives, including chief executive Parag Agrawal. According to US media reports, CFO Ned Segal and head of legal Vijaya Gadde are leaving along with Agrawal.

Elon Musk’s takeover of Twitter, however, raises many questions. Musk, who has described himself as a “free speech absolutist”, has long criticised some of Twitter’s restrictions on posts and people. Musk has even declared that he will lift bans for some suspended users, which may include former US President Donald Trump, who had his account deactivated after the Capitol Hill riots. Experts say there are fears that a more lenient free speech policy would mean that people blocked for hate speech, misinformation or denying COVID-19 or may be given space on Twitter again.

In response to Musk’s call, Thierry Breton, the EU’s internal market commissioner, published a post in which he wrote that “in Europe, the bird will fly by our rules”, suggesting that regulators would take a tough stance against any relaxation of Twitter policy.

Following the acquisition announcement, the prices of several assets, including Bitcoin, rose. Musk-backed Dogecoin responded to the news with a huge rise, rising over 100% in a matter of days. Source

Bitcoin Has Entered the Guinness Book of World Records

Bitcoin, the most popular cryptocurrency, has received several entries in the Guinness Book of World Records.

Bitcoin has been listed in the record books as the most valuable cryptocurrency of our time while also earning an entry for being the world’s first decentralised cryptocurrency. “Bitcoin was developed as a solution to the challenge of regulating a digital currency without any centralised organisation, or ‘trusted third party’, to oversee transactions,” the online Guinness Book of World Records says. The Guinness Book also recorded the first commercial bitcoin transaction, in which Laszlo Hanyecz paid 10,000 BTC for a $25 pizza order.

In addition, the OG NFT CryptoPunks project also made the Guinness Book of World Records as the “most expensive NFT collectables” after entrepreneur Deepak Thapliyal purchased CryptoPunk #5822 for $23.7 million in the first half of February.

El Salvador was also added to the record books, as the first country to adopt bitcoins as legal tender in June last year.

The recognition of cryptocurrencies and their inclusion in the Guinness Book of World Records indicates that cryptocurrencies are slowly but surely becoming mainstream. Blockchain and digital assets have been some of the topics that have significantly touched the public around the world over the past few years. Source

US GDP Grew in the Third Quarter

After two consecutive quarters of contraction, the US economy grew in the third quarter – a sign that the US economy remains strong despite the Federal Reserve’s aggressive push this year to raise interest rates to curb high inflation.

According to a Commerce Department report, US gross domestic product increased by 2.6% between July and September. Such growth is a big positive after a 1.6% decline in the first quarter and a 0.6% drop in the second quarter, which has also injected optimism into financial markets, including the cryptocurrency one.

In response to the positive GDP news, Bitcoin rose nearly 5% as GDP growth with higher interest rates could dampen the Fed’s interest rate hikes. The Bank of Canada’s recent move to raise rates less sharply than expected also gave investors hope that the U.S. central bank could respond similarly at its meeting in early November. Source

3 min •

3 min •