Ethereum Celebrates Its 8th Anniversary – Market Info

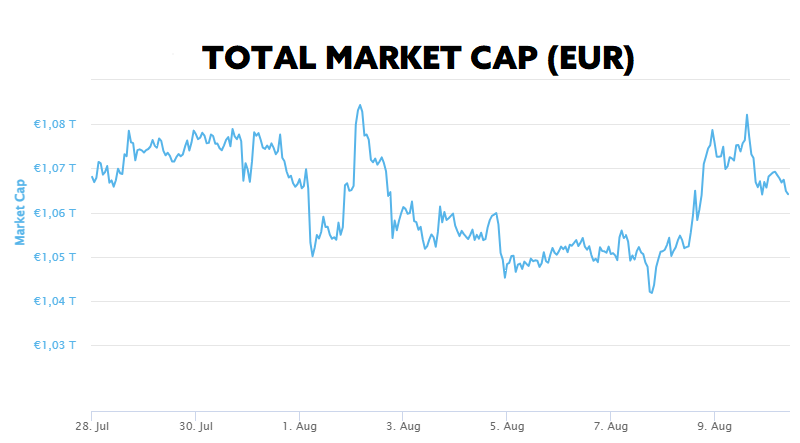

Over the past two weeks, the total market capitalisation exceeded €1.06 trillion. The decrease in market capitalisation over a 14-day period is -0.93%. The price of Bitcoin has risen by 1.13% over the last 14 days to a current value of over €26,750. Bitcoin’s dominance is currently around 48.8%.

Source: Coinmarketcap

Ethereum Celebrates Its 8th Anniversary

On July 30, the crypto community around the world came together to celebrate a momentous occasion – the 8th birthday of Ethereum, the most popular smart-contract platform. This momentous anniversary is linked to the moment eight years ago when the vision of an alternative decentralized world built on the blockchain was first born.

On July 30, 2015, former Ethereum Foundation CCO Stephan Tual wrote a blog post announcing that the Ethereum network was officially launched. “The vision of a censorship-proof ‘world computer’ that anyone can program, paying exclusively for what they use and nothing more, is now a reality,” he wrote.

With the advent and growth of the Ethereum network, the vision of a global system that is decentralized and resistant to censorship has become a reality. Eight years after the network’s launch, Ethereum is the largest cryptocurrency of its kind on the market, with a market capitalization of more than $223 billion and more than 1,900 active developers per month.

The significance and importance of ETH is evidenced by data posted on Twitter by crypto investor Ryan Sean Adams, who noted that Ethereum boasts a secured value of up to $400 billion, an annual profit of $3.6 billion, and the verification of more than 17.8 million blocks.

The first-ever block in the Ethereum network, designated “Block 0,” was mined on July 30, 2015, at 17:26 CET (Central European Time). It contained a total of 8,893 transactions, with these transactions consisting of the redistribution of ETH coins to investors who participated in the so-called initial coin offering (ICO). The size of this block was 540 bytes, and the reward for its mining was 5 ETH.

The founder of the Ethereum network, Vitalik Buterin, has become one of the most well-known and respected figures in the field of cryptocurrencies over the years. His vision of a “world computer” has become a reality, thanks to the hard work, dedication and passion of the entire community. Source

Spot ETFs in 6 Months?

Investors and the entire crypto community are eagerly awaiting any news regarding the launch of a spot ETF in the United States, which could bring a huge amount of new capital to the market.

With positive news on this front, Galaxy Digital CEO Mike Novogratz surprised the market on Tuesday evening, stating that the first spot ETF in the US could be approved sometime before February next year. In doing so, Novogratz cited internal sources from BlackRock and Invesco, which have also filed applications to launch their own ETFs.

“It’s a big, big deal. It’s a big deal because both our contacts, from the Invesco side and from the BlackRock side, get you to think that this is a question of when, not if,” Novogratz told shareholders during Galaxy Digital’s August conference call.

However, Novogratz believes that once approved, spot bitcoin ETF issuers like BlackRock and Invesco will fight tooth and nail for market share. Galaxy Digital president Chris Ferraro also added that he would not be surprised if the SEC eventually approves a potential spot BTC ETF, just to avoid being perceived as “obstructionist” by the public.

A spot ETF would allow investors to incorporate into the crypto market through traditional financial instruments, which could attract new investors, including major institutions, and increase market liquidity. The overall turn of events and the potential approval of a spot ETF gives investors hope that the connection between the traditional financial sector and the world of cryptocurrencies may bring new opportunities and, greater legitimacy for cryptocurrencies as part of the modern financial ecosystem. Source

Paypal Launches Its Own Stablecoin

Payment giant Paypal is expanding its presence in the world of cryptocurrencies. Earlier this week, the company launched its own stablecoin called PayPalUSD (PYUSD), which is reportedly fully backed by deposits in US dollars. Stablecoin can be bought and sold directly in the PayPal app or on the website, with a 1:1 exchange rate between the dollar and PayPalUSD.

Through the new stablecoin, users can make peer-to-peer payments, pay with it in stores, and transfer it between PayPal accounts and other external wallets. PayPal will also allow conversion between PYUSD and other cryptocurrencies supported by the platform, such as Bitcoin or Litecoin.

Stablecoin PYUSD is built on the Ethereum blockchain and is issued by Paxos Trust Company, a New York-based firm that provides regulated blockchain infrastructure to clients. Paxos is the issuer of a number of well-known assets, such as Binance’s stablecoin BUSD or the cryptocurrency PaxGold, which is backed by real gold.

PayPal’s decision to create its own stablecoin is not a surprise, as the company joined the crypto world back in 2020. Back then, the company allowed users to buy, transfer and sell cryptocurrencies Bitcoin, Bitcoin Cash, Ethereum and Litecoin directly in its app. Last year, the company acquired a New York BitLicense, which allows customers in the state to buy and sell cryptocurrencies. Source

Revolut Closes Its Crypto Operations in the US

Digital bank Revolut is shutting down its crypto platform in the United States due to an uncertain regulatory environment.

According to the news, the US clients of this bank will not be able to buy crypto through Revolut as of September 2, but they will have another 30 days to sell their assets. The letter sent out by the bank to local clients also states that access to the platform will be completely blocked after the divestment period expires.

The Revolut platform went on to say that it had made a “very difficult decision” with its local banking partner to halt operations due to “uncertainties around the crypto market” in the US regulatory authorities, led by the Securities and Exchange Commission, which has been increasingly negatively impacting crypto companies as well as crypto projects directly.

“This decision has not been taken lightly, and we understand the disappointment this may cause. This suspension does not affect Revolut users outside of the U.S. in any way, and impacts less than 1% of Revolut’s crypto customers globally. Revolut customers in all other markets can continue to sign up and enjoy using our crypto services,” a Revolut spokesperson said in an email to news portal CoinDesk.

However, according to the bank spokesperson, Revolut will actively explore alternative ways to provide cryptocurrency services, and the company hopes to offer crypto services in the U.S. again in the future. Source

KPMG Published a Report on Bitcoin

KPMG, a global network of audit, tax and advisory services firms that is one of the so-called “Big 4” largest advisory firms in the world, published a report last week on how Bitcoin can positively contribute to the three pillars of the ESG investment framework.

The report from KPMG, titled “Bitcoin’s Role in the ESG Imperative,” describes an in-depth analysis of the three pillars of the ESG framework – environmental, social and governance. A significant part of the report focuses specifically on the environmental aspects of bitcoin mining – a process that many believe is still controversial, especially due to the high consumption of electricity.

However, KPMG states in the report that the mining industry is focused on moving towards net zero emissions. The company also compares BTC mining to other key industries such as tourism and fashion, explaining that Bitcoin consumes only a fraction of the electricity consumed by the tourism or fashion industries. The publication also outlines several strategies to reduce the carbon footprint of mining, such as the use of renewable energy and recycled heat.

The social aspect of the report touches on the hotly debated myth that Bitcoin is only used by criminals and that Bitcoin is only used for illegal activities. In this area, KPMG noted that Bitcoin in particular has recently provided many positive examples of its use, such as crowdfunding support for Ukraine in its war with Russia, providing access to electricity in Africa, and last but not least, the use of Bitcoin as an alternative currency in various countries around the world that are struggling with massive inflation and corruption.

Last but not least, KPMG looks at the governance aspect of Bitcoin, specifically the decentralized aspect of the network, which it writes is one of its “most prominent features.” The analytical report notes that the rules of the Bitcoin network cannot be modified or changed by those who are “currently in power,” pointing to its robust governance structure, which provides a high degree of trust in the system as a whole. Source

Fed Wants to Increase Oversight of Banks’ Crypto Activities

With the launch of a new program focused on crypto assets and blockchain technology, the United States Federal Reserve (Fed) wants to expand its influence on cryptocurrencies beyond monetary policy.

The United States central bank unveiled its plans to oversee new activities at banks on Tuesday. These activities are to include, by definition, “technology-driven partnerships with non-banks to provide banking services,” the provision of custody, trading or secured lending services for crypto assets, and the tokenization of securities.

As the crypto-industry grows in influence and value, it is increasingly possible to see how it is gradually becoming intertwined with the traditional financial system. This is evidenced by the Fed’s supervisory statement on Tuesday, whereby the central bank acknowledges the significant impact and importance of cryptocurrencies. However, whether this surveillance will have a positive or negative impact on the crypto sector in the United States is still questionable. Source

INVEST WITH FUMBI

3 min •

3 min •