Ethereum Shanghai Upgrade -Cryptocurrency Market Overview (7.4.-20.4.)

Over the past two weeks, the total market capitalisation exceeded €1.11 trillion. The increase in market capitalisation over a 14-day period is 1.83%. The price of Bitcoin has risen by 2.7 % over the last 14 days to a current value of over €26,400. Bitcoin’s dominance is currently around 46 %.

Ethereum Shanghai Upgrade Goes Live

On the night of Tuesday, 12 April, an Ethereum network update called Shanghai was successfully implemented, officially launching the ability to withdraw staked ETH from the protocol and fully completing the Ethereum network’s transition to Proof-of-Stake.

As recently as last September, the Ethereum network underwent The Merge update, the essence of which was to migrate the network to the Proof-of-Stake consensus algorithm, forever changing the way the network verifies transactions and creates new ethers (ETHs). However, the funds deposited into the deposit contract as well as the rewards generated, were locked into the deposit contract and could not be manipulated until now. Only now, with the implementation of the Shanghai update, Ethereum has thus fully completed the network’s transition to Proof-of-Stake with all important features.

The road to the Shanghai update and the ETH selection option has been long and full of compromises, especially from the Ethereum developers who made several concessions just so that the update could be delivered to the network as soon as possible. Shanghai was originally supposed to include several other enhancements, including so-called proto-danksharding or a set of necessary updates for the Ethereum Virtual Machine (EVM). However, these enhancements have been removed from this update to ensure that ETH withdrawals are launched as soon as possible.

Immediately after the update was activated, approximately 285 withdrawals were processed in epoch 194,408, amounting to approximately 5,413 ETH (roughly $10 million). However, data from the Nansen analytics platform shows that the deposit of new ETH into staking currently exceeds staking withdrawals. Source

eToro Announced Integration With Twitter

Popular stock and other asset trading platform eToro has partnered with the social network Twitter.

The essence of the new partnership is that users can follow asset charts for various financial instruments directly on the social network Twitter. The way it works is that Twitter users can enter the ticker of a stock in a search along with the “$” symbol, which will show them the asset’s price trend and the option to click through to the eToro trading platform.

In addition to stocks or other types of assets, the feature should also be added for the most popular cryptocurrencies. For example, if a user types “$BTC” into a Twitter search, they should be shown the price trend of Bitcoin with the option to click through to buy BTC.

Source: Twitter

However, immediately after integrating the new feature, there were issues with searching for cryptocurrencies via the aforementioned instructions. An eToro representative told Decrypt Portal via email that they “had the same issue” when searching for BTC using the “$” symbol. “We are checking with Twitter, so hopefully, this will be resolved soon,” the eToro representative said.

Today, however, the feature is working, and anyone can check the price trend of Bitcoin or Ether directly on Twitter. Source

Bitcoin Whitepaper Found Hideen in macOS

In the first half of April, some very interesting information surfaced regarding Bitcoin and Apple’s Mac computers, which sparked heated discussions in the crypto community.

Every Mac computer that has been upgraded to use a version of the MacOS Mojave operating system and above since 2018, according to the information released, hides within it a copy of the Bitcoin Whitepaper – an early document about Bitcoin published by its founder Satoshi Nakamoto himself.

This information was uncovered by tech blogger Andy Bai, who discovered that anyone who owns a Mac can open Whitepaper on their computer by typing the following command into the Terminal command:

open/System/Library/Image\Capture/Devices/VirtualScanner.app/Contents/Resources/simpledoc.pdf

However, Apple has not provided any information on how the file was added to macOS. The tech giant also did not respond to questions from journalists and media outlets that became interested in this information.

The Internet immediately began to spread speculation and conjecture about how Whitepaper got into Mac devices. Some even started spreading the word that Steve Jobs, one of the co-founders of Apple, is believed to be Bitcoin’s mysterious founder. However, the truth is probably somewhere else entirely. Bitcoin Whitepaper is believed to be used as a sample document for Mac devices to scan images in the Virtual Scanner II app, while Apple’s MacRumors website said it could be a sample document for the system to transfer photos from iOS devices to Macs. Source

MiCa Regulation Vote This Week

The final vote on the ratification of the Market in Crypto Assets (MiCa) regulatory framework, which covers a wide range of issues within the crypto sector, including regulations for companies issuing crypto assets or regulations for providers of related crypto services, is scheduled for 19-20 April.

The regulatory framework is expected to be debated in the European Parliament on Wednesday this week, with a final vote expected to follow a day later on Thursday. Affected companies, once the framework is ratified, will include not only crypto exchanges or crypto asset custodians but also investment advisers, stablecoin issuers and other entities operating in the European market.

Following a vote in the European Parliament, the law is likely to enter into force in July this year, with some of the most important provisions expected to come into force 12 to 18 months later. Although the draft law was outlined and finalised in July, MiCA has still not entered into force due to numerous delays related to discussions on the legal document, which must be translated into all official languages of the member states. It is precisely the translation delays that have caused the final vote on the MiCa to be postponed two times already.

According to MiCa supporters, the new bill will help Europe attract crypto companies while setting clear rules on how these companies should operate. Currently, it is the clarity of regulation that is one of the most significant factors influencing crypto companies when choosing which jurisdiction to operate in.

Regulation will also allow crypto companies to operate in all Member States on the basis of uniform rules. MiCa should introduce a licensing regime that should cleanse the market of rogue players, as doing business in the sector will be conditional on obtaining the necessary licence. Source

Update: The MiCA (Markets in Crypto-Assets) regulatory framework was approved this afternoon ( 20.4.2023) by 517 votes to 38, with 18 MEPs abstaining. We will provide you more information on this update soon.

Microstrategy Investments Back in Green

Microstrategy’s investment, which owns a total of up to 140,000 Bitcoins, is in positive numbers for the first time in a long time.

Back in August 2020, MicroStrategy co-founder (and then-CEO) Michael Saylor announced for the first time that the company was converting some of its cash reserves into bitcoin due to inflation concerns. Since then, the company has gone on to make many more purchases, and Saylor and his company have become something of an icon among institutional investors who accumulate bitcoin.

The company has managed to accumulate more than 140,000 bitcoins worth a total of $4.2 billion in just over two years. Although the company has been in the black on its investment for a relatively long time, the plunge in the value of crypto assets in 2022 caused the company a huge unrealised loss.

However, after the BTC price rose above $30,000, the company appears to have once again made an unrealised profit on its investment. The company’s average purchase price per Bitcoin is at $29,803, bringing the company’s investment back into positive territory at the current price of roughly $30,200.

According to available information, the company plans to continue its bitcoin policy and plans to continue to purchase additional Bitcoins from the available funds. Shares of Microstrategy (“MSTR”) have risen over 125% since the beginning of the year, gaining 25% in the last month. Source

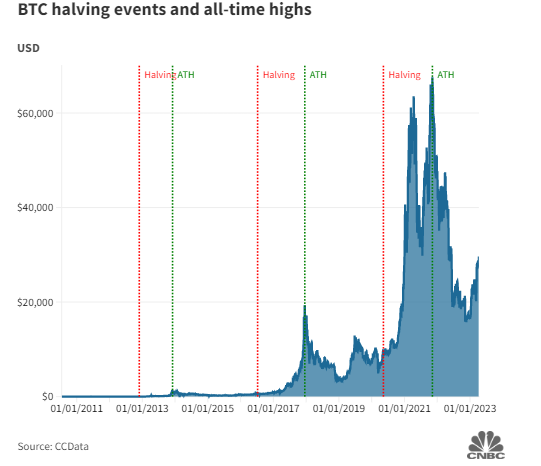

Interesting Fact: Bitcoin is One Year Away From Halving

In just about one calendar year, Bitcoin will undergo one of the most significant technological events encoded in Bitcoin’s source code since its inception.

In April or May 2024, Bitcoin will undergo another halving, which reduces the amount of newly mined bitcoins in each block by half. Currently, as each block is mined (roughly every 10 minutes), 6.25 new bitcoins are put into circulation, which will go to the miner who successfully verifies that block first. This reward will be halved in about a year to exactly 3.125 BTC per newly mined block.

The maximum number of bitcoins that will ever exist in circulation is limited to 21 million. This is ensured by the aforementioned halving mechanism, with the rewards for mining bitcoins eventually being reduced to zero sometime around 2140.

Before the last halving, which occurred on 11 May 2020, the price of bitcoin had increased 19% in the previous 12 months from $7,191.36 to $8,568.88, according to data from CCData. During the halving before that – which occurred on 9 July 2016 – bitcoin rose 142% compared to the previous 12 months, rising from $269.14 to $651.83.

The first-ever halving, on 28 November 2012, caused the price of bitcoin to rise 384% from $2.55 to $12.35.

Source: CCData

Many experts are noticing similar behaviour today, with Bitcoin up more than 70% since the start of the year. “By analysing historical halving patterns, it appears that investors often hoard bitcoins before halving, although the exact timing and magnitude of post-halving returns can vary,” Jamie Sly, an analyst at CryptoCompare, told CNBC.

Historically, Bitcoin has tended to rise even more after halving. After the 11 May 2020 halving, Bitcoin appreciated by as much as 688.31% in the following 546 days, reaching its record high of over $67,000 on 8 November 2021. Following the July 2016 halving, Bitcoin saw growth of up to 2,824% over the next 17 months, reaching its then all-time high of $19,065 in December 2017.

It will be very interesting to see if the Bitcoin price behaves similarly during the next halving, which is scheduled for 2024. However, it is still true that historical returns are no guarantee of future returns, and therefore this analysis should not be taken as an investment recommendation but only as an assessment of historical events. Source

INVEST WITH FUMBI

5 min •

5 min •