Honda Accepts Bitcoin – Market Info

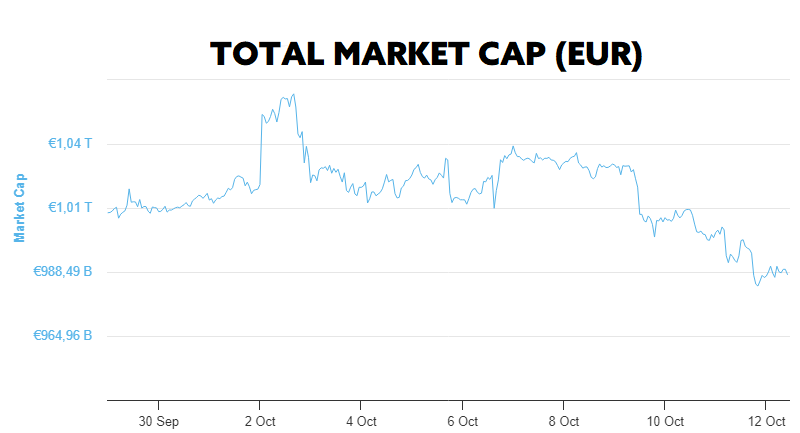

Over the past two weeks, the total market capitalisation exceeded €988 billion. The decrease in market capitalisation over a 14-day period is 2.87%. The price of Bitcoin has risen by 0.36% over the last 14 days to a current value of over €25,200. Bitcoin’s dominance is currently around 49.9%.

Source: Coinmarketcap

Honda Accepts Bitcoin

Japanese automotive giant Honda has partnered with a blockchain payment system FCF Pay to jointly allow customers to purchase Honda products directly in cryptocurrencies.

According to published information, customers can finance, lease, or purchase their dream Honda car through the FCF Pay system. Clients can make payments with Honda products via multiple cryptocurrencies, including Bitcoin, Ethereum, and XRP. Stablecoins and various meme coins such as Dogecoin, Shiba Inu or Pepe Coin are also supported. Honda’s collaboration and its penetration into the world of cryptocurrencies was not only to expand payment methods and improve the customer experience but also for future operations in the Web 3 space.

In the first phase of this project, payment via FCF is only available to citizens in the US, but according to available information, there are plans to expand it to other countries. Fees for cryptocurrency payments are $3 + 2% in cryptocurrency. Users can not only use cryptocurrencies to purchase new vehicles, but they can also use them to pay for leasing or renting cars or motorcycles from Honda.

The partnership between Honda and FCF Pay represents a significant step towards the gradual adoption of cryptocurrencies and blockchain integration. We are confident that we will see a growing trend of collaborations of a similar nature in the coming years. Source

The Court Rejected the SEC’s Appeal

A US court has thwarted an effort by the Securities and Exchange Commission (SEC) to appeal a ruling in a lawsuit brought against Ripple. The SEC sought to overturn a ruling that digital tokens sold through exchanges to retail clients are not securities.

Federal Judge Analisa Torres in the Southern District of New York issued her ruling on the appeal in the case of Ripple Labs and its XRP token last Wednesday, commenting on the SEC’s appeal that there was no “substantial ground for difference of opinion” on her findings.

It was Analisa Torres who was the judge who ruled in July that XRP is only a security if it is sold to institutional investors. The sale of XRP on public exchanges and through algorithms to retail customers was, in her view, in compliance with federal law, and so she ruled in this case that XRP was not a security.

The judge’s decision has sparked a very positive response in the crypto world, as the ruling also set a precedent for a number of other cryptocurrencies that the SEC has accused of being securities. Her decision last week to dismiss the SEC’s appeal further reinforced the hope that the SEC will not be successful in its crusade against cryptocurrencies.

“This victory is another example of a court halting the SEC’s efforts of regulation by enforcement against crypto firms”, said Daniel Stabile, a partner at law firm Winston & Strawn, which represents both Ripple Labs and cryptocurrency exchange Binance in other legal matters. Ripple’s cryptocurrency (XRP) has surged more than 5% in the wake of the dismissal of the appeal. Source

Crypto Investment Funds in Green Numbers

Investment products focused on investing in digital assets have seen significant capital inflows in the past week, reaching the highest volumes since July 2023, according to a report published by CoinShares.

Crypto investment products saw capital inflows for the second week in a row totalling $78 million. Most capital flowed into Bitcoin, which saw inflows totalling $43 million last week. In second place, surprisingly, was Solana, which saw the largest week of capital inflows since March 2022, totalling $24 million. Investors put roughly $10 million into funds focused on the cryptocurrency Ethereum.

In addition to individual asset analysis, the report also notes that nearly 90% of all capital inflows came from investors in Europe, while investment funds in the U.S. and Canada are experiencing a slight downturn. According to the data, the most significant capital inflows came from investors in Germany and Switzerland, who together poured up to USD 68.6 million into crypto funds. Source

Lightning Network Grew by 1200 %

Lightning is a layer-two (L2) scaling solution built over the Bitcoin network, but also over other networks such as Litecoin. The Lightning Network is effectively separate from the blockchain it is built on top of – it has its own nodes, and its own software, but still communicates with the main blockchain. Bitcoin itself is only capable of processing about 7 transactions per second. Lightning Network aims to solve this limitation entirely by providing fast and cheap transactions, with network throughput that can reach up to 1,000,000 transactions per second.

It is estimated that Lightning Network has seen an increase in routed transactions of up to 1,212% over the past two years, with approximately 6.6 million routed transactions in August 2023, a significant jump from the 503,000 routed transactions in August 2021.

A total of $78.2 million in transactions were processed on the Lightning network in August 2023, also an increase of over 546% from the August 2021 figure of $12.1 million. In August 2023, the average transaction size on the Lightning network was around 44,700 satoshi, or roughly $12. In September 2023, there were an estimated 279,000 to 1.1 million active users on the Lightning network. Source

SBF’s Ex-Girlfriend Testified About His Activities

Caroline Ellison was one of Sam Bankman-Fried’s (SBF) closest associates and was also, according to the findings, his romantic partner. However, Ellison decided to save her own skin after the crash of the FTX crypto exchange and accepted a plea deal to testify against her former lover.

Ellison ran the day-to-day operations at Alameda Research, a cryptocurrency trading company with close ties to FTX and its founder, Sam Bankman-Fried. In her Tuesday testimony, she said SBF directed her to take approximately $14 billion from FTX customers to pay off debts that Alameda Research had accumulated.

Ellison also stated that she sent information to the company’s creditors that SBF directly dictated to her, which made the company look much better financially on the outside than it actually was. According to her, the crimes she committed at Alameda were not committed by herself, but under orders from SBF.

Caroline Ellison further stated that FTX made multi-million dollar loans to FTX executives, including SBF itself, some of which were signed in Alameda’s name. The purpose of these loans, according to her, was to start a business related to investing in gambling startups, as well as to make political donations.

The 29-year-old Ellison’s testimony was her first-ever public statement on what happened when one of the largest crypto exchanges, FTX, completely collapsed last November. The collapse of that exchange meant billions of dollars in losses and led to the arrest and indictment of 31-year-old Bankman-Fried.

Ellison is a key witness in the case, corroborating earlier testimony by an FTX member and Alameda co-founder, Gary Wang, who said at his deposition that Alameda had essentially unfettered access to FTX customer funds. Source

Former BlackRock Director Sees ETF Approval as Positive

Former CEO of financial giant BlackRock Steven Schoenfield, who is now CEO of MarketVector Indexes, thinks the US Securities and Exchange Commission (SEC) will approve spot BTC ETFs within the next three to six months.

Schoenfield made his approval estimate during a panel discussion on ETFs at CCData’s Digital Asset Summit in London, where he was joined by another former BlackRock director, Martin Bednall, who is now CEO at Jacobi Asset Management. Schoenfield also expressed confidence that the SEC is likely to approve all spot ETF applications at the same time. Indeed, he doesn’t think the SEC would want to give anyone a first-mover advantage. Source

TAKE ADVANTAGE OF CRYPTO’S POTENTIAL

3 min •

3 min •