Institutions Have Taken Over the Crypto Market- Market Info

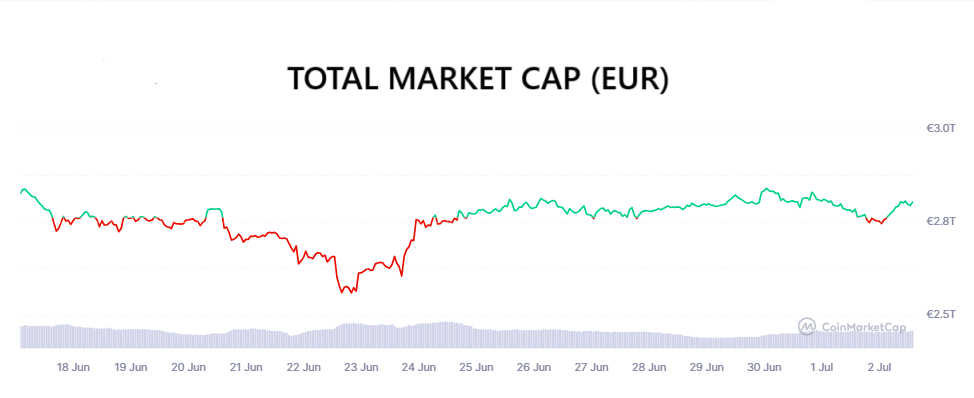

The cryptocurrency market has declined slightly over the past two weeks. The total market capitalisation has fallen by approximately 1.05% and currently stands at 2.81 trillion euros. Bitcoin’s market share has slightly strengthened again, and Bitcoin’s dominance has reached 65.6%.

However, investor sentiment in the cryptocurrency market has improved following the end of the conflict between Iran and Israel. The Fear and Greed Index is at 63 points, signalling optimism in the cryptocurrency market.

Institutions have taken over the crypto market

Despite the growing interest of large institutions and corporations adding Bitcoin to their reserves, the price of BTC has been fluctuating between $102,000 and $110,000 for nearly two months. According to analyst Charles Edwards from Capriole Investments, this phenomenon is driven by long-term holders—so-called OG HODLers—who are gradually realizing profits and selling parts of their portfolios to Wall Street investors. He aptly called this situation “OGs dumping on Wall Street.”

Interestingly, over the past two months, new corporate and ETF investors have managed to buy approximately the same amount of BTC that long-term holders sold over the past 18 months—yet the market has remained balanced and the price has not changed significantly.

On short-term charts, a so-called “lockdown” is visible—Bitcoin has been moving in the $102,000 to $110,000 range for several weeks, without any clear breakout. Institutions have poured over $3.2 billion into spot ETFs in the past 14 days alone, and the number of companies planning to invest in BTC is growing daily.

In addition, the market has experienced several sell-off waves in recent weeks—linked to the conflict between Israel and Iran, as well as tariffs in the United States.

This paradox—where new investor demand offsets the massive sell-off by long-term holders—keeps the price in a consolidation zone. However, if a new catalyst emerges (macro news, major ETF purchases, or breakthroughs in trade negotiations), the market could explode again—a new inflow of capital from ETFs and companies could break the stagnation and increase retail interest in cryptocurrencies. Source

Analysts raise odds of ETF approval for altcoins

Bloomberg analysts Eric Balchunas and James Seyffart significantly revised their expectations this week, raising their estimates for the approval of spot ETFs for cryptocurrencies like Solana, XRP, and Litecoin to 95% in 2025. Originally, the probability stood at 80%, and later increased to 90%. Now, they anticipate a wave of new ETFs to begin in the second half of 2025.

The analysts also noted that other altcoins—such as Dogecoin, Cardano, Polkadot, Hedera, and Avalanche—are following closely, with an estimated 90% chance of approval. Tokens like Sui and Tron have a lower estimated approval probability, around 60%, according to the analysts.

One important signal of progress is the launch of the first staking ETP in the U.S.—the REX Osprey Solana Staking ETF, which allows holders to earn staking rewards directly through the fund. Although this product came under SEC regulation in an unusual way—without formal approval but with permission to launch—it marks a significant milestone.

Another notable development is that ETF issuers are responding to SEC feedback—they have submitted various amendments to their S-1 filings and clarified fund management, custody mechanisms, and creation processes. This follows the same pattern observed during the launch of Bitcoin ETFs in January 2024 and Ether ETFs a few months later.

If everything goes according to plan and the SEC gives the green light by October, investors will gain new entry points to the market—without the need for direct purchases, wallet management, or asset conversion. Source

SEC approves conversion of combined fund into spot ETF

The U.S. SEC has approved the conversion of Grayscale’s Digital Large-Cap Fund into a fully-fledged spot ETF. This fund includes the five largest cryptocurrencies by market capitalization, with approximately 80% in Bitcoin, 11% in Ethereum, 4.8% in XRP, 2.7% in Solana, and 0.8% in Cardano. The change allows for daily creation and redemption of shares via NYSE Arca, eliminating arbitrary differences between the net asset value (NAV) and market price that previously enabled arbitrage.

With this move, Grayscale officially closes one of the longest chapters in the development of crypto ETFs—from its lawsuit against the SEC in 2022, to a court victory in 2023, and the decisive Bitcoin ETF approval in January. Transforming the trust into a full ETF is also a win for investors—it simplifies trading, narrows price spreads, and increases transparency.

Notably, the fund maintains a diversified composition, offering investors exposure not only to Bitcoin but also to other altcoins, without requiring direct ownership. Crypto experts view this as a historic milestone, as the SEC has approved a crypto ETF that includes more than one cryptocurrency, potentially setting a regulatory precedent for similar future products. The end of Grayscale’s trust signals the beginning of a new era, where cryptocurrencies can be seamlessly integrated into the portfolios of traditional financial investors. Source

Figma invests in Bitcoin

Figma, a leading design software company, has revealed in its IPO filing that it holds approximately $70 million in Bitcoin ETFs and plans to continue purchasing BTC in the future. According to documents filed with the U.S. Securities and Exchange Commission (SEC), the company invested $55 million into the Bitwise Bitcoin ETF in March 2024. As of March 31, 2025, the value of that investment had increased by about 26%, bringing the total to roughly $69.5 million.

The company has also approved an allocation of an additional $30 million in USDC (a stablecoin), which is expected to be gradually converted into Bitcoin. This strategy allows Figma to accumulate BTC more smoothly, without needing to liquidate other assets.

As a result, Figma’s total Bitcoin exposure may soon reach $100 million, around 4% of its liquid assets. This move places Figma among a growing group of tech companies that view Bitcoin as a strategic financial reserve, sending a strong signal to other startups that digital assets are no longer just speculative instruments but a legitimate part of modern treasury management. Source

Powell: Digital assets are now mainstream

During last week’s Senate testimony, Federal Reserve Chair Jerome Powell publicly stated for the first time that Bitcoin and other cryptocurrencies are no longer merely fringe assets. According to Powell, digital assets have matured significantly and are steadily securing a place in the traditional financial system.

He noted that the Fed has revised one of its key guidelines, specifically the 2023 directive that had classified cryptocurrencies as “reputationally risky” for banks. “This sector is maturing, and our understanding of it is improving,” Powell said during the hearing. “And in some sense, it is becoming much more mainstream.”

One of the most notable parts of Powell’s statement was his clear support for banks’ freedom to choose their clients and products—including crypto services—provided it is done “safely and responsibly.” The crypto community sees this as a hopeful sign that could curb the practice of “debanking,” where crypto businesses are unjustly denied access to banking services.

This shift marks a strategic breakthrough: regulators are beginning to recognize crypto more naturally and are focusing on risk assessment based on transparency rather than blanket restrictions. Although this doesn’t instantly lead to a surge of new crypto-friendly bank accounts, it does represent progress—and hope—for the sector. The Fed’s position paves the way for deeper integration between crypto and traditional finance, enhancing the long-term legitimacy of digital assets among investors, banks, and regulators. Source

Bitcoin continues to leave exchanges

The amount of Bitcoin available on centralized exchanges has dropped to below 15% of the total circulating supply, marking a continued trend of accumulation by investors and shrinking market liquidity. This decline, now at a five-year low, suggests that Bitcoin holders increasingly prefer to move their coins into safer storage solutions and hold them long-term off exchanges.

From a supply perspective, this represents a “positive problem.” If strong demand—especially from institutions—continues, Bitcoin’s limited availability and reduced exchange liquidity could lead to a sharp price surge.

Another key indicator is the decreasing balances on addresses historically associated with OTC trading and Bitcoin miners. These entities have withdrawn significant amounts of BTC from the market, signaling their belief in Bitcoin’s long-term upside. Meanwhile, spot Bitcoin ETFs have seen a surge in capital inflows since mid-June—over $4.7 billion in just the past few weeks. This strong institutional interest has created a scenario where demand significantly outweighs supply, forming ideal conditions for potential price growth.

However, traders are keeping a close eye on the $100,000 level. This price zone is not only psychologically important but also technically significant—over $6 billion in leveraged long positions are concentrated below it. A liquidation cascade at that level could trigger a strong sell-off. The market thus stands at a delicate point, caught between a looming “supply shock” and the risk of corrections if key levels are breached.

Still, the overall outlook remains positive. With less Bitcoin in circulation, growing demand, and institutional buying pressure, the next chapter in Bitcoin’s growth story may be just beginning. Source

Invest with Fumbi today

Harness the potential of cryptocurrencies simply, securely and efficiently. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in the Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. If you want to build your own crypto portfolios, choose the Advanced Portfolios product, where you will have access to over 110 cryptocurrencies and templates created by our team that focus on different areas within the crypto universe.

TAKE ADVANTAGE OF CRYPTO’S POTENTIALHave you come across a term in the text that you don’t understand? Never mind, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •