Quarterly Report on The Cryptocurrency Market – Q1/2023

In the first quarter of this year, cryptocurrencies have seen relatively interesting price appreciation, even though events caused by the collapse of crypto giants are reverberating in the background of the market. However, the crypto market and its players are also plagued by other issues – namely regulatory ones. However, while some failures of regulators are hurting cryptocurrencies, their other failure, specifically in the banking sector, is benefiting cryptocurrencies.

You will also find this information in the full report:

- Bitcoin opened the new calendar year at $16,500 and closed it at $28,400 with a first-quarter appreciation of +72%.

- The South American nation of Brazil, with a population of more than 200 million, has passed a law that defines cryptocurrencies as one of the country’s legal payment methods.

- Everything is almost ready: Ethereum expects the Shanghai update this April.

- Bitcoin, the most popular cryptocurrency, celebrated its fourteenth birthday earlier this year.

- US and European banks are in huge trouble. Some of the major banks have not been able to cope with the turbulent times.

- The security of the Bitcoin network continues to grow. Bitcoin’s network hashrate has reached record highs.

- Music streaming platform Spotify is expanding its presence in the Web3 space with the integration of Web3 wallets.

- In the past quarter, Fumbi introduced a new product called Advanced Portfolios, which allows anyone to create their own diversified portfolio.

DOWNLOAD THE QUARTERLY CRYPTOCURRENCY MARKET REPORT

Bitcoin Price Development

Source: TradingView

The opening quarter of 2023 was marked by bullish sentiment and significant price growth in the cryptocurrency sector. Although Bitcoin opened the new calendar year at just $16,500, a month later, its price was already in the range of $22,800 to $23,200. During the first quarter, Bitcoin’s price rose by a total of 72% to a final value of $28,400 as of March 31, 2023. Bitcoin reached its three-month high on March 30, when it traded as high as $28,800.

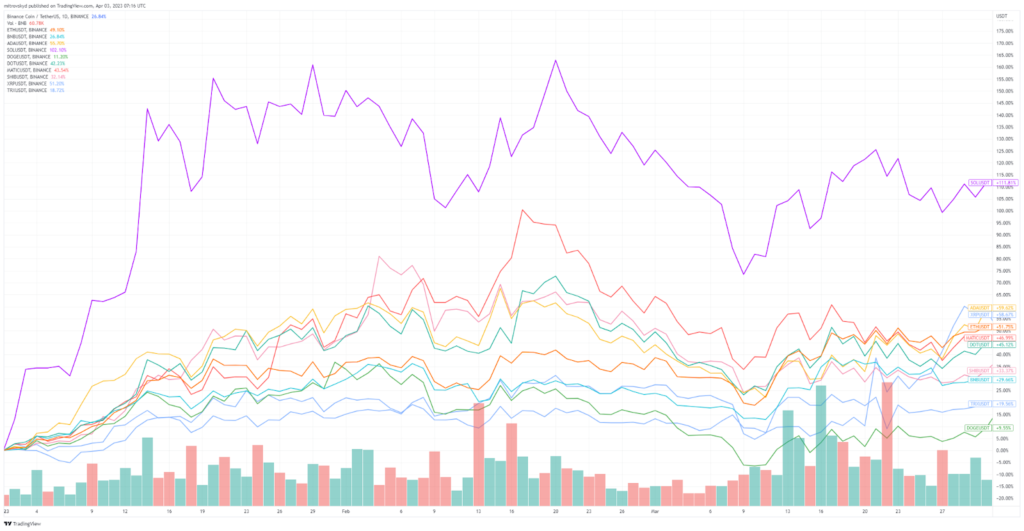

Price Development of the Top 10 Altcoins

Source: Tradingview

Of the top 10 altcoins (from which stablecoins were excluded), Solana (SOL) was the best-performing cryptocurrency during the first quarter, rising 111% in three months. Solana’s price increase comes after recovering from the FTX cryptocurrency crash, when it was revealed that Alameda Research had a huge amount of illiquid SOL tokens on its balance sheet, causing Solana to plummet by more than 70%.

Cryptocurrencies Cardano (ADA) and Ripple (XRP) also did very well in the opening quarter, rising by almost 60%. Dogecoin (DOGE) fared the worst among the cryptocurrencies tracked, rising by almost 10%.

The evolution of Bitcoin dominance and other important crypto metrics can be found in the full report. You can download it here.

Evolution of Cryptocurrency Market Capitalization

Source: Coinmarketcap

The cryptocurrency market capitalization was $795 billion at the beginning of the third quarter. The market capitalization increased significantly after the new year and once again broke the important threshold of one trillion dollars. At the end of the first quarter, the market capitalization was $1.17 trillion.

Bitcoin Celebrated Its Fourteenth Birthday

In early January, the Bitcoin market unit celebrated its 14th birthday. Fourteen years ago, on January 13, Bitcoin’s anonymous founder Satoshi Nakamoto mined the first-ever bitcoin block, still referred to today as the “genesis block” or “block 0.”

The first block in the Bitcoin network was created roughly two months after Nakamoto published a paper on Bitcoin on October 31, 2008, detailing the power of the new decentralized monetary system. The first bitcoin block was mined on January 3, 2009, at exactly 2:15 PM EST and the reward for mining it was 50 BTC. Since its inception, Bitcoin has grown massively to become the most significant cryptocurrency on the market, with a market capitalization of more than $540 billion.

US Banks in Huge Trouble

Chaos, panic and uncertainty. This is a simple way of describing the November banking crisis in the United States and Europe. Following massive interest rate increases by the Fed, several major US banks ran into trouble. The uncertainty in the banking sector subsequently spread from overseas to Europe and tested the stability of several European institutions.

The first bank to run into trouble was the US-based Silvergate, which was known for its pro-crypto orientation and business relationships with several crypto companies, including Coinbase and Paxos. Silvergate first delayed releasing a comprehensive 10-K report to the US Securities and Exchange Commission (SEC), which spooked investors and shareholders of the bank. The company became embroiled in a liquidity crisis, and, in agreement with the Federal Deposit Insurance Corporation (“FDIC”), the bank announced that it was ceasing operations.

What actually happened and which banks got into trouble? All the important information can be found in our quarterly report. You can download it here.

Total Value Locked (TVL)

Since 2017, DeFi has been steadily evolving and leaving a growing footprint in the emerging world of the new decentralized Web 3.0. Activity in this space grew significantly during the first quarter, mainly due to the challenges faced by banking entities in the Americas but also in Europe. Following the collapse of a number of banks, confidence in the traditional financial system has been severely eroded, causing capital to flow into the decentralized finance sector, where everyone has their own funds in their own hands.

Source: Defillama

For more information from the DeFi, Metaverse and stablecoin sectors, please see our full report. In addition, the report covers other important news from the world of cryptocurrencies, such as MiCa regulation, Ethereum Shanghai updates or how the Fed’s next monetary policy direction is likely to evolve.

3 min •

3 min •