The Amount of Bitcoins on Exchanges Is Decreasing

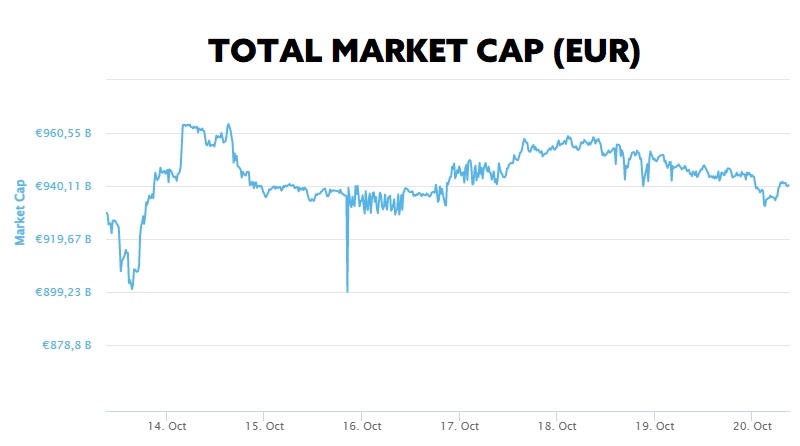

This week, the total market capitalization exceeded €940 billion. The increase at the 7-day interval is 0.32%. Bitcoin decreased by 0.51% during the week to a current value of over €19,500. Bitcoin dominance is 39.9%.

The Amount of Bitcoins on Exchanges Is Decreasing

The number of bitcoins available on exchange wallets continues to decline. On Tuesday, October 18, more than 37,800 bitcoins left exchange wallets, according to data from CryptoQuant. This is the highest outflow of bitcoins from exchanges since mid-June when investors withdrew almost 68,000 bitcoins from exchanges in a single day.

Over 121,000 bitcoins worth $2.4 billion have left exchanges in the past 30 days. Increased bitcoin outflows from exchanges are a positive signal in the cryptocurrency market as investors move their assets to private wallets to hold them for the longer term. On the other hand, bitcoin inflows to exchanges are perceived as negative because they create more selling pressure.

Another interesting on-chain metric is the tracking of accumulation by bitcoin whales. Glassnode’s Accumulation Trend Score Indicator showed that wallets holding 1,000 to 10,000 bitcoins had been massively accumulating new bitcoins since the end of September.

Investment products targeting institutional investors saw their fifth week of consistent capital inflows from institutions. Over the past week, the most capital flowed into Bitcoin, which saw a weekly inflow of $8.8 million, with institutions investing totalling $291 million in Bitcoin-focused funds since the beginning of the year. Worse off, however, is the cryptocurrency Ethereum, which saw a weekly capital outflow of $3.9 million, with more than $368.7 million in capital outflow on Ethereum-focused funds since the beginning of the year. Source

BNY Mellon Will Provide Crypto Custody

BNY Mellon, America’s oldest bank, founded in 1784, has decided to enter the crypto world and bring its clients the option of custody of digital assets.

The bank received the necessary approval from the New York Financial Supervision Authority earlier this year when it also launched its custodian services for institutional investors. Since October 11, however, the bank has also been providing these services for bank customers.

Clients can deposit their Bitcoin and Ethereum holdings, and the banking giant will store the keys required to access and transfer the assets. Thus, BNY Mellon now acts not only as a custodian for various investment funds but also as a custodian of digital assets. Source

Ethereum Launches Testnet for Shanghai Upgrade

Ethereum, the second most popular crypto on the market, which underwent a transition to the Proof-of-Stake consensus algorithm just a month ago, continues its evolution. According to the latest information, the developers of the Ethereum network have confirmed the launch of a testnet for a future hard fork called Shanghai, which should allow unlocking Ether currently locked in a staking contract, among several other enhancements.

The testnet is expected to test, among other things, the EIP-3540, the upcoming Ethereum Virtual Machine (EVM) upgrade that powers the Ethereum network’s smart contracts. It is one of the community’s most-anticipated updates since it separates coding from data, which could benefit on-chain validators.

In addition, a proposal called EIP-4895 will also be tested, will allow sETH and earned rewards withdrawals via the Beacon Chain. Among the proposals under consideration, the upgrade will also introduce changes to layer-2 protocols, reducing gas prices by equalizing block sizes and increasing calldata efficiency in the network. Moore also noted:

The testing process is expected to continue until September 2023. However, it can be seen that after the successful update of The Merge, Ethereum developers have not rested on their laurels and are immediately continuing their development towards an interoperable and scalable Ethereum. Source

Bitcoin Energy Use Has Increased

According to the latest data, the Bitcoin network’s energy consumption has increased by up to 41% year-on-year. This information was released by the Bitcoin Mining Council (BMC) for Q3 2022, which represents 51 of the world’s largest Bitcoin mining companies.

The report found that bitcoin mining currently consumes only 0.16% of global energy production. The BMC considers this amount to be negligible, and Bitcoin’s energy consumption can be roughly compared to that of the computer gaming sector. In addition, BTC mining has produced only 0.10% of the world’s carbon emissions, which is again negligible given the innovation that Bitcoin has brought to the world.

The increase in energy consumption is a logical outcome of the growing computing power of the Bitcoin network, which has recently been steadily surpassing its all-time highs. In practice, this means that more and more miners are getting involved in Bitcoin mining, making the network more decentralized and much more secure. The year-on-year increase in hashrate in October is up 73%.

Michael Saylor of Microstrategy said on Twitter that BTC mining efficiency was up 23% year-on-year, with a sustainable power mix of up to 59.4%. This means that for the sixth consecutive quarter, miners are using more than 50% renewable energy for mining. Source

Bitcoin Volatility at Record Lows

Even though the public still perceives Bitcoin as an unpredictable and risky asset, recent weeks, in particular, seem to show that Bitcoin’s volatility is decreasing over time.

Data from the crypto market provider Kaito shows that Bitcoin’s 20-day volatility has come to equal that of the NASDAQ for the first time in two years. But while Bitcoin’s price has remained roughly the same since the start of September, both the NASDAQ and S&P have fallen 13% and 10%, respectively, since then.

Historically, Bitcoin’s price has been shown to correlate closely with technology stocks, but in contrast, Bitcoin has higher volatility. However, despite strong declines in both the cryptocurrency market and the stock market in May and June, crypto has proven to be one of the best-performing asset classes in Q3.

The current situation, accompanied by high inflation and rising interest rates, does not generally play into the hands of risky assets. However, this is a good period to accumulate assets as well as to generate income, for example, from staking. This is also why Fumbi has created the new Fumbi Staking Portfolio, with which you invest in cryptocurrencies that can be staked. This allows you to earn an annual reward of 5-7% directly in crypto. Source

Developer Activity Is Still High

Despite the ongoing crypto winter, developers in the cryptocurrency and Web3 ecosystem continue to actively develop and build various crypto protocols and applications.

A new Q3 2022 report dated October 13, coming from the Web3 developer platform Alchemy, states that 2022 could be the biggest year yet for Web3 developers. Approximately 36% of all smart contracts ever deployed and verified on the blockchain were deployed during this calendar year. In absolute numbers, this is approximately 118,000 smart contracts deployed on blockchains this year.

The data also shows that deployments of new smart contracts increased 143% year-over-year in the third quarter, with as many as 48,500 contracts deployed in the third quarter. Many of these contracts were deployed roughly two weeks after the Ethereum network’s migration to Proof-of-Stake. This signals that some developers were likely waiting to see how this update would play out and were deciding whether to deploy their contracts on Ethereum based on that.

You can read more interesting statistics regarding the developer update at this link.

Start investing safely in cryptocurrencies now.

QUICK REGISTRATION

5 min •

5 min •