The Cryptocurrency Market Is Booming Again – Cryptocurrency Market Overview (13.1. – 26.1.)

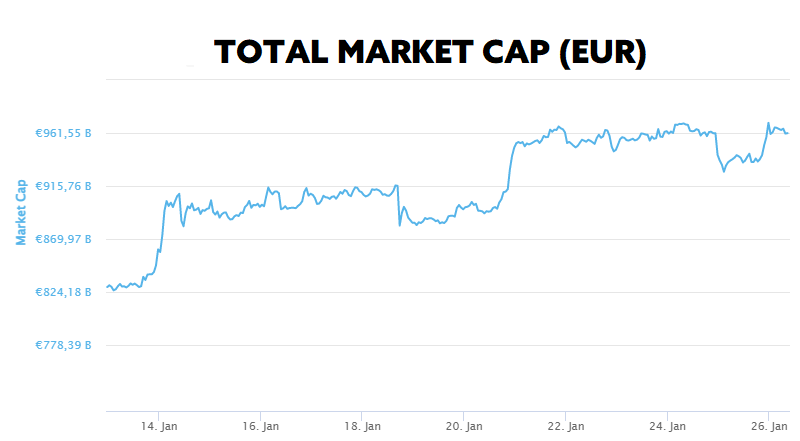

Over the past two weeks, the total market capitalisation exceeded €961 billion. The increase in market capitalisation over a 14-day period is 16.91%. The price of Bitcoin has risen by 25.22% over the last 14 days to a current value of over €21,100. Bitcoin’s dominance is currently around 42.3%.

The Cryptocurrency Market Is Booming Again

An important and considerable price recovery in the cryptocurrency market marked the first month of this year.

Since 1 January, when Bitcoin traded at around $16,500, its price has climbed upwards by 36.89% over the course of this month to a level that currently consolidates between $22,500 and $23,000. The price of Bitcoin and several altcoins have thus fully recovered from the price slump caused by the bankruptcy of the crypto exchange FTX.

There are several factors behind the improvement in market sentiment. First of all, December’s drop in annual inflation in the United States to 6.5% has injected a dose of positivity into the stock and cryptocurrency markets. Traders believe the positive data will prompt the Fed to raise interest rates less aggressively at the Federal Open Market Committee (FOMC) meeting on 1 February.

A resurgence of interest in bitcoin can also be seen from miners. Bitcoin’s hashrate, a key security metric, reached a new high of 273 million TH/s last weekend, according to data from blockchain.com. Moreover, the latest data from Glassnode analysts shows that the selling pressure of bitcoin miners has decreased to lows last seen back in 2019.

Long-term bitcoin holders are also aware of the potential market bottom. In the latest edition of its weekly newsletter, “The Week On-Chain,” analyst firm Glassnode pointed out that long-term BTC holders have remained calm despite the January price surge and are not yet exiting the market but instead are accumulating even more. The amount of bitcoins held by long-term holders (more than 155 days) increased during this month, which is a signal of their strong belief in the growth of the bitcoin price in the long term.

In early February, however, investors should prepare for possible increased volatility. The FOMC meeting, where the public will hear information on the Fed’s next monetary policy path, may bring increased volatility to the market. Inflation data for January will also be important. As is customary, many retailers tend to raise the prices of their goods and services after the New Year, which could bring a more negative CPI than perhaps expected. Source

Genesis Global Declared Bankruptcy

One of the leading crypto lenders, Genesis Global, a subsidiary of the popular venture capital fund Digital Currency Group, has declared bankruptcy. The company’s bankruptcy is reminiscent of the recent collapse of the crypto exchange FTX, as both companies failed to raise additional capital to meet their obligations amid a liquidity crisis.

Back on November 16, Genesis Global announced the temporary suspension of withdrawals as well as the creation of any new loans on its platform. In explaining its decision, the company cited high market turbulence related to the FTX collapse, which resulted in the launch of a huge amount of withdrawals that Genesis said exceeded its current liquidity.

Gemini crypto exchange co-founder Cameron Winklevoss has written several open letters via social media over the past few weeks calling for Digital Currency Group founder Billy Silbert to step down from his position. The reason for this is said to be a dispute regarding Genesis allegedly owing $900 million to the Gemini crypto exchange, which the crypto exchange loaned to Genesis specifically through the Gemini Earn program. DCG’s management has called this claim false and misleading.

It seems that the market was counting on the possible collapse of Genesis. Asset prices were almost unchanged after the bankruptcy announcement and even began to rise significantly a few hours later. Source

New FTX Management Reportedly Located $5 Billion in Assets

Adam Landis, a lawyer representing the defunct crypto exchange FTX, said during a recent hearing that FTX has recovered more than $5 billion in various assets.

“We have located over $5 billion of cash, liquid cryptocurrency and liquid investment securities measured at petition date value,” stated Landis, who works as an attorney at Sullivan & Cromwell.

The company’s lawyer further opined that the $5 billion figure most likely excludes Alameda Research’s positions in tokens such as SRM, FIDA, MAPS or OXY. FTX had previously disclosed high holdings of these tokens on its balance sheet, despite the fact that the tokens were illiquid and it would not be able to sell them off without causing their respective markets to crash.

In addition to the $5 billion in liquid assets reportedly found by FTX’s new management, $425 million is currently held by the Bahamas Securities Commission, and more than $490 million was seized by the Justice Department on Monday from one of Sam Bankman-Fried’s holding companies.

However, it is still unclear how much FTX actually owes its creditors. The company said in its initial bankruptcy filings that the hole in its balance sheet was between $1 billion and $10 billion. The exact amount, however, is still unknown due to many uncertainties in the company’s accounting. Source

Blockstream Raises $125 Million for Mining Expansion

Blockstream, which develops a range of products and services for storing and transferring bitcoins and other digital assets, announced it had raised an investment totalling $125 million to fund the expansion of its institutional bitcoin mining services.

The round of funding was led by UK-based investment firm Kingsway Capital, which was joined by other investors such as Fulgur Ventures and Cohen & Company Capital Markets.

The company said in its Tuesday press release that it would use the funds to expand its mining facilities to meet strong demand for its extensive hosting services. Hosting is a service or process in which a third party hosts mining facilities on behalf of a client. In most cases, the client purchases the mining equipment directly through the hosting company. The client fully owns the mining rig and pays the provider a monthly hosting fee. Source

Bitzlato Exchange Investigation Continues

The United States Department of Justice has launched a major international action against the relatively unknown cryptocurrency firm Bitzlato and arrested its founder Anatoly Legkodymov, a Russian national living in China.

The State Department considers Bitzlato to be a major player in money laundering related to Russian illicit financing. The exchange allegedly laundered money derived from illegal activities. According to available findings, the exchange received a total of $206 million from darknet markets, $224.5 million from various scams, and $9 million from ransomware attackers.

According to the latest information, funds derived from criminal activity have largely flowed from Bitzlato to Binance, the largest cryptocurrency exchange, despite its anti-money laundering (AML) standards. The United States Financial Crimes Enforcement Network has reported that the crypto exchange Binance is among the top three receiving counterparties of illegal funds. It should be noted, however, that in this regard, Binance does not face any charges of knowingly accepting illicit funds. Source

Interesting Fact: Final Vote on MiCa Regulation Postponed

The final vote on the long-awaited MiCa regulatory framework in the European Union has been postponed until April 2023. It marks the second delay in the final vote, which was previously postponed from November 2022 to February 2023.

The latest delay of the vote is due to a technical problem related to the fact that it has not yet been possible to translate the official 400-page document into all 24 official languages. Legal documents such as the MiCA, which are drafted in English, must comply with EU regulations and be published in all 24 official languages of the union.

The first delay in November 2022, which postponed the final vote until February, was also due to translation problems. The delay in the final vote means European financial regulators have to wait longer to draft implementing rules for the legislation. Once MiCA receives official approval, financial regulators have 12 to 18 months to develop technical standards.

The European Parliament’s committee approved the MiCA legislation in October 2022, almost two years after it was first introduced in September 2020. The importance of regulation has grown in recent months in the wake of the FTX crypto exchange crash, as appropriate regulation should help prevent similar events in the future. Source

Start investing safely in cryptocurrencies now.

INVEST WITH FUMBI

3 min •

3 min •