The ETF Saga Continues – Market Info

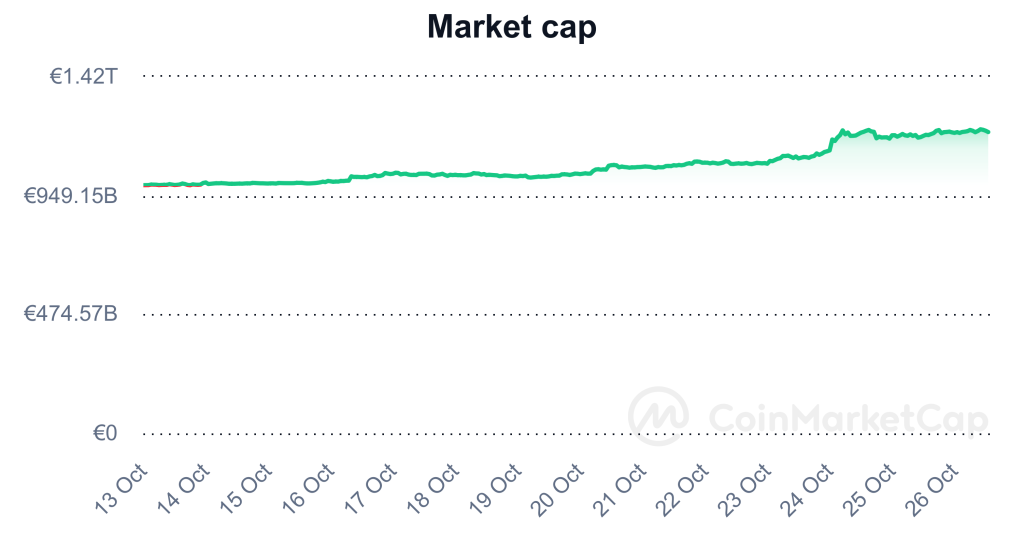

Over the past two weeks, the total market capitalisation exceeded €1.2 trillion. The increase in market capitalisation over a 14-day period is 21.45%. The price of Bitcoin has risen by 28.96% over the last 14 days to a current value of over €32,500. Bitcoin’s dominance is currently around 52.8 %.

Source: Coinmarketcap

The ETF Saga Continues

The beginning of this week was very interesting in the cryptocurrency market. News of the possible approval of a spot BTC ETF in the United States caused the price of Bitcoin to rise by more than 10% overnight from Monday to Tuesday, surpassing the 35,000 US dollars (almost 33 thousand euros) mark for the first time since May 2022.

One of the most significant reasons for this rise was the disclosure that BlackRock, the most famous applicant for spot ETFs and the largest asset manager in the world, managed to obtain a specific code with the designation “CUSIP”. Obtaining this code is an important step for the possible launch of an ETF. CUSIP is a specific code designed to identify a particular security. In response to this information, Eric Balchunas, Bloomberg’s chief analyst for ETF funds, said that this is a very important sign that may indicate that the first spot ETFs are on the way.

In addition, BlackRock’s spot ETF appeared Monday evening on the public list of ETF funds of the Depository Trust & Clearing Corporation, which provides clearing and settlement services in the financial markets. BlackRock’s ETF is the first-ever bitcoin fund to appear on DTCC under the ticker $IBTC. According to Bloomberg analysts, similar moves usually occur just before an ETF launches.

There is now widespread speculation on the social network Twitter about whether BlackRock has by chance already received as yet non-public information about the ETF’s future approval from the U.S. Securities and Exchange Commission (SEC). However, it’s all conjecture for now, and we may have to wait a few more months for the real information, as based on the filing date of BlackRock’s spot ETF application, the SEC has until January 10, 2024, to make a decision.

Our experts at Fumbi will be actively monitoring the situation surrounding the spot ETF for you and bringing you the most important information from it. Source

Long-Term Holders Are Breaking Records

Bitcoin’s price rise has not specifically affected long-term Bitcoin holders (known as LTH), who continue to accumulate and hold their BTC.

Long-term Bitcoin holders have been significantly increasing their exposure to BTC since roughly mid-2021, according to analyst data, and most continue to hold during the current bear market. According to current data, up to 80% of bitcoin is held by long-term investors who hold bitcoin at their addresses for more than 155 days. That figure represents a record high for the largest cryptocurrency on the market, which earlier this week made one of the most significant price moves this calendar year.

The data further suggests that there has been a significant accumulation of BTC in the $25,000 to $31,000 price range over the past few months, which may be indicative of long-term investor bullishness. The upcoming halving, expected as early as April next year, will further reduce inflation in the Bitcoin network, making the asset even more scarce. Analysts at banking giant Morgan Stanley said in their latest report on the crypto market that it is the upcoming halving event that will be an important catalyst for a new bull market.

There are currently more than 19.5 million BTC in circulation, meaning that only roughly 1.5 million new BTC will enter circulation over the next 100+ years. Furthermore, it is estimated that up to 20% of bitcoins are already lost forever, further reducing the real supply of BTC available for buying and selling. Source

World Bank Tokenizes Digital Bond

This week, the World Bank issued a €100 million ($105 million) digital bond on Euroclear’s new blockchain-based securities issuance platform, the first use of Euroclear’s Digital Securities Issuance (D-SI) service, which enables the issuance, distribution and settlement of tokenized securities directly on the blockchain.

The two-year bond, listed on the Luxembourg Stock Exchange, was issued by the International Bank for Reconstruction and Development (IBRD), one of the five institutions of the World Bank. Its purpose is to support the World Bank’s sustainable development activities.

Citi acted as the issuing and paying agent, TD Securities as a dealer and Euroclear Bank as an issuer and central securities depository. The bond was issued on the Corda enterprise blockchain platform developed by R3. Source

Cryptocurrency Market Sentiment Highest in Two Years

The mood in the cryptocurrency market is improving with the growing optimism around the spot ETF and the coming halving. This is evidenced by the Cryptocurrency Fear & Greed Index reaching its highest value in two years.

The index is currently at 72 points out of 100, putting it in the greed zone for the first time in a long time. The Fear & Greed Index rose thirteen points between Monday and Tuesday, rising as much as 22 points in the last 7 days. According to CoinGecko data, on November 14, 2021, the index last reached a score of 72 just four days after Bitcoin hit its all-time high of $69,044 on November 10, 2021.

Sentiment in the cryptocurrency market is strengthening, especially as BlackRock’s bitcoin spot exchange-traded fund (ETF) could be approved by the Securities and Exchange Commission in the near term.

The index currently collects and weights data from six key market performance indicators – volatility (25%), market momentum and volume (25%), social media (15%), surveys (15%), bitcoin dominance (10%) and trends ( 10%) – which it reviews on a daily basis to determine the current mood of the crypto market. Source

SEC Will No Longer Sue Ripple Officials

In a significant victory for Ripple in the sale of unregistered securities, the Securities and Exchange Commission (SEC) dropped charges against two of the company’s top executives.

The SEC originally charged Ripple co-founder and executive chairman Chris Larsen and CEO Brad Garlinghouse with aiding and abetting the company’s violations of federal securities laws related to XRP crypto transactions. However, after losing the lawsuit, the regulator last week voluntarily decided to drop those charges, saying it could not charge the entities with the same offences again in this case.

The dismissal of the charges against Ripple executives marks Ripple’s third consecutive victory against the SEC. In July, a judge ruled that the regulator failed to definitively prove that XRP transactions violated securities laws. The SEC also failed in its attempt to appeal to overturn that ruling in October.

Ripple’s legal director Stuart Alderoty characterized the SEC’s decision to drop the charges as “capitulation” in a post on the social networking site Twitter. Source

Microstrategy’s Investment Is in the Black Again

Microstrategy’s investment in Bitcoin has returned to profit after several months.

As of October 25, MicroStrategy owned a total of 158,245 BTC worth $4.68 billion, which is $699 million more than the amount originally invested. Bitcoins purchased by the company were reportedly acquired at an average price of $29,582 per BTC. At the current price of roughly 34 thousand dollars per Bitcoin, the company is thus in the plus of 4418 dollars per BTC.

MicroStrategy started buying bitcoins back in 2020 and intensified purchases in 2023 when the price of BTC dropped significantly under the influence of the bear market and the Fed’s monetary policy. If Bitcoin were to regain its previous high of $69,044, the value of Microstrategy’s investment could reach as high as $10.925 billion, assuming the company would not purchase any more BTC. Source

TAKE ADVANTAGE OF CRYPTO’S POTENTIAL

3 min •

3 min •