Bitcoin Continues to Flow Out of Exchanges – Crypto Weekly Update

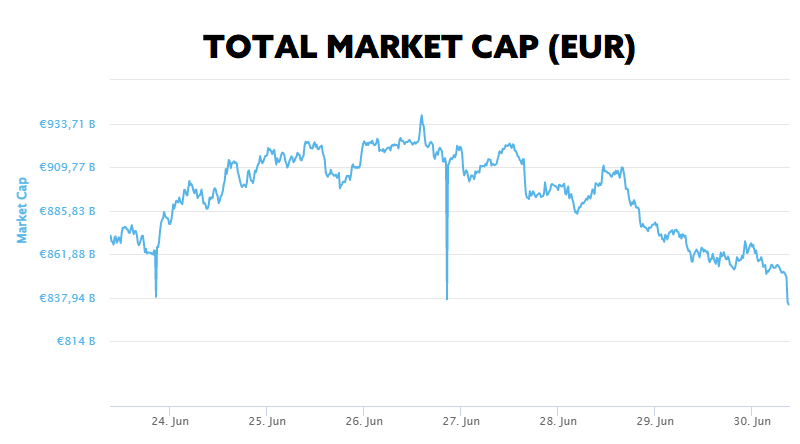

This week, the total market capitalization exceeded 834 billion EUR. The decrease at the 7-day interval is 2.91%. Bitcoin decreased by 3.47% during the week to a current value of over 18,600 EUR. Bitcoin dominance is 42.6%.

Bitcoin Continues to Flow Out of Exchanges

Although the mood in the cryptocurrency market is not the best at the moment and Bitcoin has hit its 18-month low, still there are some positive signals that have a positive impact on the growth of the Bitcoin price in the long term.

One, very important and significant news, based on data from Glassnode, is that investors have stopped transferring bitcoins from their private wallets to exchanges. As a result, the number of coins held on exchanges has dropped significantly, reaching a 3-year low of 2,384,477 BTC. The outflow of bitcoins from exchanges signals that investors bought bitcoins during the dip and transferred them to their private wallets for longer-term holding.

Glassnode further reports that retail investors ,which have shown a growing interest in the past few weeks, are back in the game. The number of non-zero addresses on the bitcoin network has reached an all-time high of over 42 million. In addition, the number of addresses that own at least one bitcoin has also increased significantly.

According to Glassnode, the typical duration of a bear market is somewhere between 260 to 410 days. If we consider that the bear market started after BTC’s fall from the all-time high reached in November, we will slowly but surely be approaching the first mentioned number. However, no one can really estimate how long and how intense this bear market will be. Source

Marathon Digital Holdings in Trouble

Bitcoin mining company Marathon Digital Holdings has revealed that up to 75% of its mining facilities are still down since a severe storm hit Montana back on June 11.

Marathon released a statement on its website on Tuesday explaining that the storm struck across the town of Hardin, Montana on June 11, damaged the power generating facility that supplies Marathon’s local mining operations. Fortunately, based on Marathon’s investigation and testing, no mining equipment was physically damaged by the storm.

The company noted that 30,000 devices, or 75% of the company’s fleet, have been out of action since the storm. As a result, Marathon’s bitcoin production has been significantly reduced and will not be restored to its original levels until repairs to the power generating facility in Montana can be completed.

Marathon’s CEO Fred Thiel stated that the facility could begin mining again at a reduced capacity as early as the first week of July if certain repairs are made in time. Source

Metaverse Development Giants Join Forces

More and more technology companies around the world are developing products and services based on the use of virtual and augmented reality. For this purpose, a number of ‘common direction’ groups are being set up to try to keep the industry on the same page.

Companies such as Meta, Microsoft, Epic Games, NVidia and Sony have joined forces to form a joint forum called the “Metaverse Standards Forum”, which aims to drive open interoperability, which could make it easier for developers to build across platforms.

“Like the internet, the metaverse will be an interconnected system that transcends national borders, so there will need to be a web of public and private standards, norms and rules to allow for it to operate across jurisdictions,” said Nick Clegg, president of global affairs at Meta.

The Metaverse Standards Forum is free to join and plans to focus on “pragmatic, action-based projects” like hackathons and open source tooling. Source

Solana Unveils its Own Mobile Phone

Just because cryptocurrencies have seen a decline in recent weeks doesn’t mean that developments in blockchain technology are on the wane. It’s just the opposite.

The CEO of cryptocurrency company Solana Labs, Anatoly Yakovenko, and his company announced last week that a new Android smartphone will enter the market next year, which will bear the name Solana Saga.

The innovative Android smartphone will feature a Qualcomm Snapdragon 8+ Gen 1 processor, a 6.67-inch OLED display, 12GB of RAM and 512GB of internal storage. At the announcement, Yakovenko added that the device, which is estimated to sell for $1,000—will represent the gold standard for a Web3-centric smartphone, and showcase the full array of capabilities of the Solana Mobile Stack.

The Solana Mobile Stack will consist of three separate components – the mobile wallet adapter, Seed Vault and the Solana Pay. The Mobile Wallet Adapter will be used to connect the hardware wallet to your phone, while the Seed Vault will take care of the security of your cryptocurrencies.

The third and final part of the kit will be Solana Pay – a system similar to Google Pay or Apple Pay that will allow users to pay with Solana or other cryptocurrencies. According to Yakovenko, the goal of creating a custom mobile phone and Solana Mobile Stack kit is to solve the problem of people needing to pull heavy laptops to deal with NFTs and cryptocurrencies. Source

MakerDAO Allocates Part of its Capital to Treasuries and Bonds

MakerDAO, the decentralized autonomous organization behind the DAI stablecoin, is currently voting on a proposal that aims to help the protocol overcome a severe bear market and efficiently allocate untapped reserves by investing 500 million DAI into United States Treasury bills and bonds.

MakerDAO allows participants to vote on proposals through the staking of MKR tokens. The option to split DAI between Treasury bills and bonds has 99.3% support so far. Governance participation at Maker is currently at its lowest level in 2022, with 169,196 MKR tokens staked.

Once an option is chosen, European wholesale lender Monetalis will provide MakerDAO access to the financial instruments it wants. This proposal represents a major step for Maker DAO, as it signals its intent to extend beyond the crypto realm and earn yield from traditional “safe” financial investments with its flagship DAI. Source

Interesting Fact: Cristiano Ronaldo Part of The NFTs

Football superstar Cristiano Ronaldo has signed an exclusive multi-year NFT partnership with crypto exchange Binance. The collaboration aims to introduce football fans to the Web3 ecosystem through NFT’s global campaigns.

In an announcement to news portal Cointelegraph, Binance states that the deal includes the creation of a series of NFT collections featuring Ronaldo. These will be sold exclusively on the Binance NFT platform, with the first collection coming out later this year.

Changpeng Zhao , CEO and founder of Binance, praised Ronaldo’s achievements in football, stating that the athlete has “transcended sport to become an icon in multiple industries.”

“My relationship with the fans is very important to me, so the idea of bringing unprecedented experiences and access through this NFT platform is something that I wanted to be a part of.” Ronaldo himself said of the deal. Source

Start investing safely in cryptocurrencies now.

START INVESTING

5 min •

5 min •