US Inflation Slows – Market Info

Over the past two weeks, the total market capitalisation exceeded €1.05 trillion. The decrease in market capitalisation over a 14-day period is 2.77%. The price of Bitcoin has fallen by 3.92% over the last 14 days to a current value of over €25,300. Bitcoin’s dominance is currently around 46.6%.

US Inflation Slows

Inflation in the world’s largest and most powerful economy has fallen below 5% for the first time in two years. The inflation rate has fallen for the tenth month in a row, reaching its lowest level since June 2021, according to a report released last week by the US Department of Labor.

Annual price growth in the United States came in at 4.9% in April and was slightly slower than analysts’ predictions, who had predicted annual inflation of 5.0%. However, month-on-month price growth accelerated to 0.4% in April, in line with expectations, from 0.1% in March. Housing, petrol and used car prices rose the most during the period. The cost of veterinary visits and gardening services also increased significantly.

Core inflation, which excludes price changes in food and energy, rose by 5.5% year-on-year in April. The rise in core inflation was in line with experts’ forecasts, who had predicted annual growth of 5.5-5.6%.

The Federal Open Market Committee (FOMC) indicated at its last meeting in May that it was considering a temporary pause in its interest rate hiking spree. The Fed began raising interest rates in March 2022, and since then, the benchmark rate has risen by as much as five percentage points to a range of 5-5.25%. Interest rates in the US are the highest they have been since 2006. The reason for the sharp increase was high inflation, which climbed to 9.1% last July but has been gradually falling since then under the influence of the measures.

The current expectation is that the Fed will either keep interest rates at their current level or start to cut rates gradually. If the Fed stops raising rates, risk assets such as equities and cryptocurrencies may see a positive recovery based on historical data. A rate cut would make credit cheaper for companies and individuals, improving market liquidity. Periods of low interest rates are often associated with bullish periods in markets for risk assets such as equities and cryptocurrencies. Source

The Ordinals Craze Continues

The growing activity and euphoria around Ordinals and the BRC-20 standard, which allows users to issue exchangeable and non-exchangeable tokens directly on the Bitcoin blockchain, is a major cause of the congestion on the Bitcoin network and the associated massive increase in transaction fees.

Demand for interactions on the Bitcoin network was so high in early May that Bitcoin transaction fees rose by several hundred percent between May 7 and 10, with the average transfer fee on the Bitcoin network reaching as high as $19.20. The increase in fees was also related to unprocessed transactions trapped in the so-called mempool, as over 440 thousand transactions were waiting to be processed at the time. Bitcoin miners, who are clearly happy with the high fees, are certainly enjoying the situation.

According to JAN3 CEO Samson Mow, the huge hype around ordinals and tokens on Bitcoin will disappear within a few months. “These guys are basically paying huge amounts of fees that are going directly to the bitcoin miners, and there’s no way to keep that going,” Mow said in an exclusive interview with Cointelegraph.

According to Mow, the mass adoption of bitcoin will occur because of its use cases related to saving and using bitcoin as a medium of exchange, not because people are minting JPEG images and keeping them on a chain. However, many members of the crypto community perceive that Ordinals may just be the new use case that will make bitcoin more attractive and increase its global adoption.

It will be very interesting to see how the euphoria around Ordinals develops in the future and whether it will be a short-term thing based on a wave of euphoria or if Ordinals will indeed prove to be one of the new use cases for Bitcoin. Source

Bitcoin as TOP 3 Alternative in Case of US Debt Default

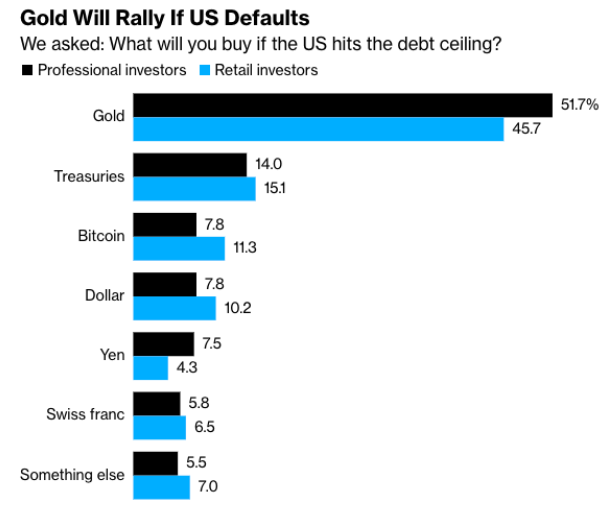

Bitcoin, the most popular cryptocurrency, could become the third most sought-after asset in the event of a theoretical failure to raise the US debt ceiling, according to a new survey.

As US President Joe Biden prepares to meet with Congress to jointly discuss the US debt ceiling, investors are actively seeking hedging options to protect their savings in the event of a default.

According to a published Markets Live Pulse survey by Bloomberg of a sample of 637 respondents, including professional and retail investors, most professional investors would consider gold, with more than 50% of financial professionals saying they would buy gold if the US government fails to avoid defaulting on its debt. The second most sought-after asset would be US Treasury bills, which about 14% of professional investors would reach for. Surprisingly for many, Bitcoin came in third place, which would be an alternative for 7.8% of professional investors and 11.3% of retail investors.

Source: Bloomberg

According to the survey, Bitcoin has become a more popular and preferred choice than the US dollar, the Japanese yen or the Swiss franc. Markets and market participants are increasingly nervous about the US debt ceiling, as US Treasury Secretary Janet Yellen recently warned that the US risks catastrophic bankruptcy as early as June 1, 2023, assuming it is not raised. President Biden subsequently declared that if the US did not pay its debt, the whole world would be in huge trouble. The failure and eroded trust in the traditional financial system show that Bitcoin is becoming an increasingly popular alternative to traditional fiat currencies. Source

Liechtenstein will accept Bitcoin

The small central European state of Liechtenstein, which covers just 158 square kilometres, is planning to add bitcoin as one of the payment methods for government services. Any cryptocurrencies accepted as payment will likely be immediately exchanged for Swiss francs, Liechtenstein’s national currency, said Prime Minister Daniel Risch. “Crypto like bitcoin are currently still too risky. But this assessment can change,” Risch said in a statement.

Although Liechtenstein is not directly a member of the European Union, the approved MiCA regulation may also affect the country. This is because Liechtenstein is part of the larger European Economic Area (EEA), to which the relevance of the regulatory framework can be extended. The aim is to attract crypto companies to the region that are looking for countries with clear and transparent legislation for their business. Liechtenstein has long been known for its support of cryptocurrencies and blockchain technology, making it a sort of small “technology hub” in Europe. Source

Do You Own at Least One Whole Bitcoin? There May Not Be a Similar Opportunity in a Few Years

The number of bitcoin addresses holding at least 1 BTC surpassed the one million mark.

As the price of BTC and other cryptocurrencies dropped significantly during 2022, many users embarked on an accumulation phase and started buying Bitcoin in bulk. According to the data, the strongest accumulation of BTC occurred during the collapse of the crypto exchange FTX, when at one point, Bitcoin was trading for as little as $15,000. Since the beginning of February and during the banking crisis, as many as 190,000 new “wholecoiners” – or users who own at least one Bitcoin – have been added to the Bitcoin network.

The co-founder of popular analytics platform Glassnode Negentropic said on Twitter that the best time to buy Bitcoin is right when the market is bleeding. The commentary on the market situation comes just in the wake of numerous large bank collapses in the United States, as well as the Fed looking to potentially pause interest rate hikes in the coming months. Negentropic believes that these reasons will ensure that Bitcoin reaches a price as high as $35,000 in the medium term (June to July).

It should not be forgotten that the maximum amount of Bitcoins that will ever circulate will never exceed 21 million. In addition, more than 3 million Bitcoins are reportedly already lost forever, further reducing the total available supply of BTC. In practice, this may mean that with Bitcoin’s massively increasing adoption and acceptance, it may not be as easy to own one whole Bitcoin in a few years as it is today. Source

Interesting Fact: Cryptocurrency Taxation Bill Heads to Second Reading

Cryptocurrency users have been impatiently waiting for several years for any change regarding the taxation of virtual assets in Slovakia. Slovakia is one of the countries with very poorly set legislation in the field of taxation and is one of the worst countries in the world in this statistic.

Following the failure in November to reduce the tax rate and abolish the health levy on sales from cryptocurrencies, a modified bill that aims to introduce a time test on the sale of virtual currencies and abolish the health levy on sales has been submitted to Parliament.

After last week’s session, Parliament clearly moved the proposal to a second reading, with 113 of the 145 MPs present voting in favour, 4 voting against and 28 abstaining. Our Fumbi experts will be actively monitoring the situation. We all believe together that Slovakia deserves better crypto legislation that will promote the technological potential of cryptocurrencies and attract foreign companies operating in this field to Slovakia. Source

INVEST WITH FUMBI

3 min •

3 min •