Will Argentina Follow El Salvador? – Market Info

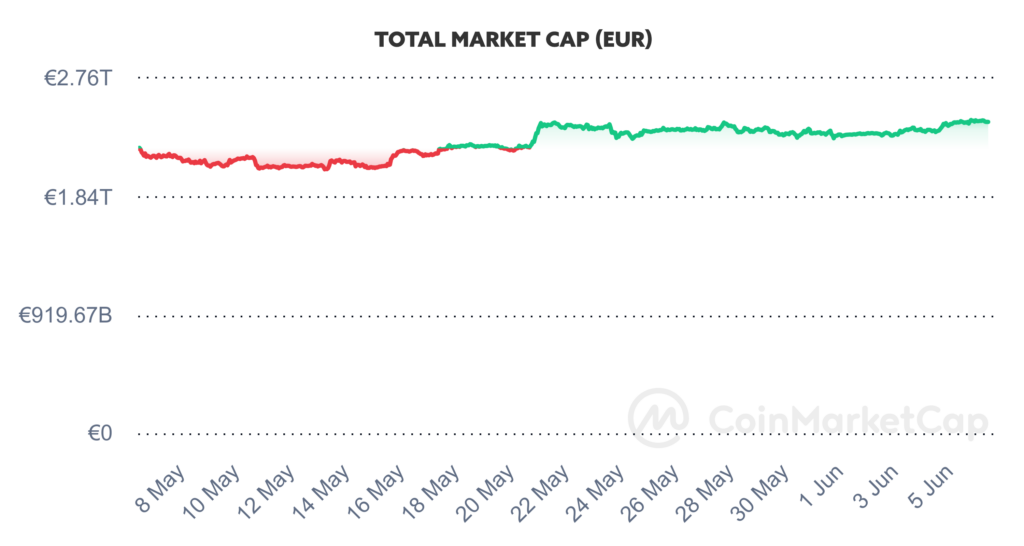

Over the past two weeks, the total market capitalisation exceeded €2.42 trillion. The increase in market capitalisation over a 14-day period is 1.25%. The price of Bitcoin has risen by 1.24 % over the last 14 days to a current value of over €65,200. Bitcoin’s dominance is currently around 54.5%.

Source: Coinmarketcap

Will Argentina Follow El Salvador

Representatives of the Argentine Securities Commission (CNV) met a few days ago with representatives of the National Commission for Digital Assets (CNAD) in Bitcoin’s El Salvador, to discuss the adoption and regulation of cryptocurrencies in the two countries.

At the May 23 meeting, the president of the Argentine Commission, Roberto Silva, the vice president of the Commission, Patricia Boedo, and the president of the National Commission in El Salvador, Juan Carlos Reyes, jointly discussed El Salvador’s experience regarding the adoption of Bitcoin as legal tender in the country. El Salvador adopted Bitcoin as its legal tender back in September 2021.

Argentine President Silva highlighted that El Salvador has not only emerged as a global leader in Bitcoin adoption but has also excelled in the broader cryptocurrency industry. He stressed the importance of the industry knowledge discovered by CNAD, which oversees and regulates the digital asset market in El Salvador. “We want to strengthen ties with the Republic of El Salvador, and therefore, we are going to explore the possibility of signing collaboration agreements with them.” Roberto Silva said on the sidelines of the meeting.

CNV Vice President Boedo, who was also part of the meeting, highlighted the key role of El Salvador’s expertise in the crypto industry. According to her, the National Securities Commission of Argentina wants them to effectively collaborate and engage with the crypto-industry, as well as to establish appropriate regulations on digital assets.

Social media immediately began to spread speculation that recent talks with El Salvador officials could be the beginning of Argentina’s gradual adoption of Bitcoin. Moreover, at the end of 2023, Javier Milei, a Bitcoin enthusiast and opponent of central banks, was elected president of Argentina. However, this was likely just a routine exchange of information on the regulation of digital assets, as Argentina has not yet presented its plans for the possible adoption of Bitcoin in the country in any way. Source

ETH Outflow From Exchanges Continues

More than $3 billion in the cryptocurrency Ethereum has left centralized exchanges since May 23, when the launch of spot Ethereum ETFs was officially approved. According to available information, the amount of available Ether dropped by 797,000 ETH between May 23 and June 2, which is equivalent to $3.02 billion.

In practice, the lower amount of Ether on exchanges means that investors are moving ETH into their wallets, effectively reducing the amount of Ether available for immediate sale. Glassnode’s data also shows that the percentage of the circulating stock of ethers held on exchanges is at historic lows, with approximately 10.6% of the circulating stock of ethers currently held on exchanges.

Bloomberg ETF analyst Eric Balchunas pointed out last week that the official launch of Ethereum ETF trading could begin as early as the end of June. Analysts believe that ETH could surpass its all-time high of $4,870 in November 2021 when Ethereum ETFs begin trading due to increased demand- similar to what happened with Bitcoin.

At the same time, cryptoanalyst Michael Nadeau said in his May 28 post that Ether could benefit from demand pressures even more than Bitcoin because it doesn’t have the same level of structural selling pressure. This means that while bitcoin miners are sometimes forced to sell off their BTC to cover the costs associated with mining, this is not the case with ether – because the Ethereum network operates on a Proof-of-Stake algorithm, where transaction validation costs are orders of magnitude lower.

However, there are also concerns that Grayscale’s Ethereum Trust (ETHE), which currently holds about $11 billion in ETH, could negatively impact the price of ether after its transformation into a spot ETF. We have already seen a similar case with Bitcoin ETFs, where the Grayscale Bitcoin Trust (GBTC) saw massive capital outflows after its transformation into a spot ETF. Source

Australia Launches First Bitcoin ETF With Direct Holdings

Earlier this week, the first spot Bitcoin ETF officially began trading in Australia. The fund from Monochrome Asset Management began trading on Monday after the opening of the Cboe Australia exchange under the ticker IBTC and carries a management fee of 0.98%.

The fund’s launch makes IBTC the first fund in the country to offer investors access to Bitcoin through an ETF by directly holding BTC. The new fund differs from the two existing spot bitcoin ETFs in Australia, which provide investors with exposure to BTC without directly holding bitcoin.

Prior to the launch of IBTC, Australian investors could only invest in ETFs that indirectly hold bitcoin or through offshore bitcoin products, both of which do not benefit from the investor protection rules under the Australian Financial Services Licensing (AFSL) licensing regime for directly held crypto assets.

The launch of the first spot BTC ETF in Australia with direct bitcoin holdings follows the successful launch of spot bitcoin ETFs in the United States earlier this year. These ETFs have seen considerable success, reflecting strong investor interest and confidence in Bitcoin. In addition, bitcoin ETFs in Hong Kong, bitcoin ETPs in London and bitcoin ETCs in Germany were also launched during the year. Developments in recent months in various countries around the world further confirm the global trend towards accessible Bitcoin investment products. Source

Everyone Should Own Some Bitcoin

Matt Horne, head of digital asset strategies at Fidelity Investments, says investors should invest at least a small portion of their capital in Bitcoin. In a June 4 CNBC report, Horne mentioned the problem of decision paralysis that plagues many traditional investors and asset managers when it comes to investing in Bitcoin and other cryptocurrencies.

In his words, when investing in Bitcoin, it is very important to understand why you should really want to own Bitcoin, as well as to understand the potential of the technology and make decisions accordingly. Horne also stated that a 1-5% equity allocation to bitcoin within an investment portfolio is outright desirable, as such a small allocation would not significantly affect the portfolio assuming bitcoin were to fall to zero. However, in his words, this allocation is high enough to allow investors to affect the portfolio’s total return in the event of a continued rise in the price of bitcoin.

Fidelity currently has nearly $5 trillion in assets under management, and the company is one of the largest asset management companies in the world. Horne also stated that they are currently seeing increased interest from institutional investors and portfolio managers in Bitcoin and other cryptocurrencies. Source

BlackRock’s ETF Fund Surpassed Grayscale

BlackRock’s bitcoin spot ETF (IBIT) surpassed the Grayscale Bitcoin Trust (GBTC) a few days ago to become the world’s largest bitcoin ETF.

According to the data, the fund from BlackRock holds a total of 291,563 BTC worth $20.68 billion as of May 4, while the fund from Grayscale currently holds 285,081 BTC worth approximately $20.22 billion.

The change in the leader in spot ETFs comes just months after spot ETFs were approved and officially began trading in January. During those months, a huge amount of capital flowed into the fund from BlackRock, while the fund from Grayscale, which underwent a transformation from a Bitcoin Trust to a spot ETF, saw huge capital outflows. The main reason for the massive outflows from Grayscale’s fund was the high fees, which motivated investors to move their funds into competing ETFs.

In addition, BlackRock disclosed earlier this week that it had added the IBIT fund to its two investment funds, namely the Strategic Income and Strategic Global Bond funds. The move thus confirms the growing institutional demand for Bitcoin, as BlackRock now owns shares of its Bitcoin ETF in several large and long-only investment funds. Source

Former Binance CEO to Serve Sentence

Binance founder Changpeng “CZ” Zhao reportedly checked himself into federal prison in California on Tuesday, where he will spend the next four months for failing to implement an adequate know-your-customer (also known as KYC) program on the world’s largest cryptocurrency exchange.

Zhao pleaded guilty to violating the Bank Secrecy Act (BSA) back in November. In April, a federal judge sentenced him to four months in prison – a much shorter sentence than federal prosecutors had sought, seeking a three-year prison term.

With an estimated net worth of $36.5 billion, based on data from the Bloomberg Billionaires Index, Zhao is considered the richest person ever to go to prison in the U.S. In addition to the sentence, Zhao was also fined $50 million and agreed to resign as Binance’s CEO. Binance, which pleaded guilty to money laundering and sanctions violations during Zhao’s tenure, settled the charges earlier this year with $4.3 billion in fines to various federal regulators and the appointment of an independent watchdog to monitor compliance at Binance.

Lompac II, where Zhao will serve his short sentence, is among the low-security prisons in Santa Barbara County on California’s Central Coast. According to Bureau of Corrections records, there are currently 2,160 inmates at the facility. Source

Invest with Fumbi today

Harness the potential of cryptocurrencies simply, safely and effectively. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. And if you want to earn a weekly reward from investing, choose the Staking Portfolio with an expected annual reward of 5-7% and no entry or annual fees.

INVEST WITH FUMBIHave you come across a term in the text that you don’t understand? Never mind, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •