Will Bitcoin Threaten the US Dollar’s Dominance? – Market Info

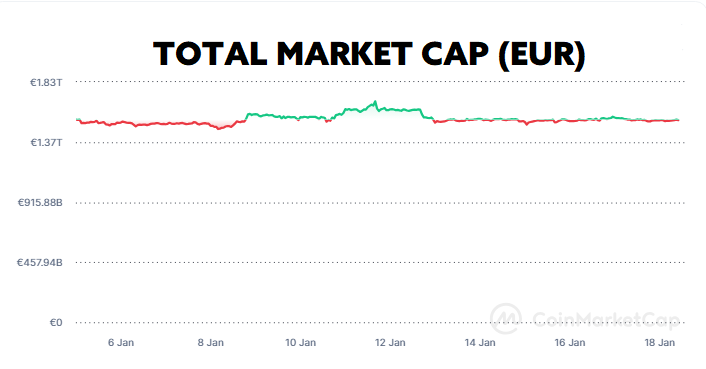

Over the past two weeks, the total market capitalisation exceeded €1.50 trillion. The increase in market capitalisation over a 14-day period is 3.33%. The price of Bitcoin has risen by 0.1% over the last 14 days to a current value of over €39,250. Bitcoin’s dominance is currently around 51.2 %.

Source: Coinmarketcap

Will Bitcoin Threaten the Dollar’s Dominance?

The perception of Bitcoin and digital currencies by traditional financial institutions is constantly evolving and moving forward. This is evidenced by the latest statement by representatives of the Wall Street investment bank Morgan Stanley that Bitcoin could threaten the dominance of the US dollar as a global currency.

While the US dollar currently accounts for roughly 60% of global foreign exchange reserves, a paradigm shift in the global perception and use of digital assets could challenge and threaten the US dollar’s leadership position, according to Andrew Peel, head of digital assets at Morgan Stanley.

Peel also said that this shift in the perception of digital assets will be further accelerated by the approval of several bitcoin spot exchange-traded funds (ETFs) in the U.S.. In addition, Peel focused his attention on the “remarkable” global adoption of bitcoin over the past 15 years as evidence of its continued growth, noting that as many as 106 million people worldwide now own bitcoin, adding that there are now bitcoin ATMs in more than 80 countries.

Peel also sees so-called central bank digital currencies (CBDCs) as a risk, which he said have the potential to create a single standard for cross-border payments that could reduce reliance on traditional intermediaries and thus the use of dominant currencies such as the dollar. According to data from the Atlantic Council’s CBDC Tracker portal, as many as 130 countries representing more than 98% of global gross domestic product (GDP) are currently exploring or developing CBDC projects, a huge increase from just a few years ago.

While Bitcoin and CBDC could impact the dominance of the US dollar, Peel noted that stablecoins could prove to be a more useful complement to traditional currencies, describing them as very interesting himself. Peel also thinks that dollar-backed stablecoins, with their growing importance, will have a profound impact on the entire financial sector, potentially reshaping the way money moves across borders in the future. Source

Bitcoin ETFs Are Breaking Records

Total transaction volume across the 10 spot bitcoin ETFs surpassed the total volume on all 500 ETFs launched in 2023 by more than three times on Tuesday, Jan. 16.

Data from Yahoo Finance’s platform shows that the 10 spot bitcoin ETFs approved just days ago generated a total trading volume of $1.8 billion on Jan. 16, with funds from Grayscale, Blackrock and Fidelity representing as much as $1.6 billion (88%) of the total. By comparison, the combined volume from Tuesday for all 500 ETFs launched in the U.S. in 2023 came in at just $450 million.

In terms of spot bitcoin ETFs, BlackRock’s iShares Bitcoin Trust is emerging as the clear leader in terms of net capital inflows so far, with $497 million flowing into it in the first three trading days. The total volume of spot bitcoin ETFs reached nearly $10 billion in the first three trading days, according to data from Bloomberg analyst James Seyffart.

Significant capital outflows during the first trading days were seen by Grayscale’s GBTC fund, which is the most expensive of the ETFs on offer in terms of fees. The Grayscale Bitcoin Trust (GBTC) has seen total outflows of more than $579 million since Jan. 11. According to Bloomberg analyst Eric Balchunas, Blackrock’s spot ETF will be a big draw for investors, and he thinks that over time the fund will overtake Grayscale’s fund to become the new “liquidity king.” Source

Elon Musk Plans to Launch P2P Payment Service

A few days ago, Social Network X, formerly known as Twitter, owned by Tesla founder Elon Musk, announced plans related to the launch of peer-to-peer payment services as early as the end of this calendar year.

In a blog post published on the social network X, the company revealed its plans for 2024, which include the introduction of an option for users to send money directly through the network. “We will launch peer-to-peer payments, unlocking more user utility and new opportunities for commerce, and showcasing the power of living more of your life in one place,” the blog post stated.

This new payment feature would allow X’s millions of users to securely transfer money between each other, potentially turning the platform into a financial services provider. X CEO Elon Musk has previously hinted at his ambitions to turn the platform into an “everything app” with integrated payments, e-commerce and social media features.

Last year, X obtained money transfer licenses in several US states, a regulatory prerequisite for launching similar functionality related to storing and transferring funds on behalf of users. In addition, X has also integrated payments via digital assets in the past, adding support for sending “tips” using the cryptocurrencies Bitcoin and Ethereum in 2022. It will be very interesting to see if Elon Musk, who is a big fan of Bitcoin and Dogecoin, will somehow incorporate the use of digital assets on his social network X. Source

Will We See a Spot ETF for Ethereum?

After several Bitcoin spot ETFs were approved just a few days ago, discussions and speculation immediately began to spread about whether and when spot ETFs on Ethereum could be approved.

Bloomberg ETF analyst Eric Balchunas has even previously stated to crypto news portal Cointelegraph that he does not see a scenario in which spot Bitcoin ETFs would be approved, but spot Ether ETFs would not. At the time, Balchunas also stated that he had received information from confidential sources that spot Ethereum ETFs would be fine.

On the topic of Ethereum ETFs, digital asset lawyer Joe Carlasare said that he thinks spot Ether ETFs could be approved later this year, but at the same time, he said it will take a bit longer than people expect. Carlasare also said that the SEC will try to carefully set some sort of precedent that will allow them to retain some leeway in determining which digital assets can be offered through ETFs in the future.

Balchunas, a leading Bloomberg analyst, said he estimates a 70 percent chance that a spot ETH ETF will be approved as early as May – which is the month the SEC must issue a final opinion and decision for several Ethereum ETF applications. However, he thinks the launch won’t be as quick as the Bitcoin ETF, and it’s possible that trading won’t begin until the third quarter of 2024.

His fellow Bloomberg analyst James Seyffart also believes that the SEC will give the green light to a spot ETF on Ethereum in the future, as the SEC implicitly accepted Ether as a commodity when it approved an Ether futures ETF in September 2023 after a long stretch.

Among the applicants to launch a spot ETF on Ethereum are giants such as BlackRock, VanEck, ARK 21 Shares and Fidelity. The SEC has until May 23 to make a decision on VanEck’s application. Source

Stablecoin TrueUSD in Trouble

TrueUSD (TUSD), the fifth-largest stablecoin on the market with a market capitalisation of nearly $2 billion, which is pegged to the US dollar, experienced problems related to a deviation from one-dollar parity on Monday, with its price falling to $0.985.

Based on data from crypto exchange Binance, the TUSD stablecoin saw total inflows of $301.54 million in 24 hours on Monday, with outflows totalling $147.77 million. The inflow of stablecoins to the exchange subsequently caused massive selling, causing the price of the stablecoin to deviate from its peg value.

Market experts have linked these whale-induced sell-offs to reports that TrueUSD has recently had trouble providing real-time confirmations of its reserves. These concerns, which suggest that stablecoin could be under-collateralised (under-backed), first surfaced back on January 10. For this reason, a number of investors began to swap their TUSD stablecoins for competing stablecoins such as USDT or FDUSD.

The TUSD stablecoin is currently trading at USD 0.9908 and has so far failed to get back to USD 1 and restore parity with the US dollar. We will continue to monitor the situation regarding this stablecoin and will keep you updated if necessary. Source

Interesting Fact: Only the Best Survive

A few days ago, the analytics platform Coingecko, which deals mainly with aggregating crypto market data, published an interesting report that more than half of all tokens listed on the Coingecko platform since 2014 no longer exist today. Of the more than 24,000 crypto assets that have been tokenised on Coingecko so far, as many as 14,039 of them have been declared dead by the platform.

Most of these failed crypto assets were reportedly launched during the last bull market in 2020 and 2021. During this period, Coingecko has listed as many as 11,000 new tokens, with as many as 7,530 (68.5%) ceasing to function and halting any development on them. This represents up to 53.6% of all dead tokens on the platform. According to the report, the highest number of cryptocurrencies died in 2021, with more than 5,700 tokens failing during that year, which is more than 70% of the total number of failures during 2020 and 2021.

By comparison, the bull market between 2017 and 2018 saw a similar trend, albeit with fewer new projects. During this time, more than 3,000 tokens were flooded on the platform, and around 1,450 of them are now virtually non-existent.

The study categorizes tokens as “dead” or “non-functional” based on various criteria, including zero business activity in the last 30 days, fraud confirmations, requests from projects to deactivate, or for various other reasons such as team breakups or rebranding.

At Fumbi, we constantly stress the importance of doing your own research and investing in verified cryptoassets that have real people behind them and have real technological potential. When adding new cryptocurrencies to Fumbi, our analysts constantly research all important aspects and select only the best and time-tested cryptoassets for you. Therefore, we are very happy that you invest in cryptocurrencies wisely and safely through Fumbi. Source

Invest with Fumbi today

Capitalise on the potential of cryptocurrencies simply, safely and efficiently. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in the Fumbi Index Portfolio tracks the price movements in the cryptocurrency market for you. And if you want to get a weekly reward from investing, choose the Staking Portfolio with an expected annual reward of 5-7% and no entry or annual fees.

START INVESTING

Did you come across a term in the text that you didn’t understand? Don’t worry, you’ll find all the important cryptocurrency-related terms in one place in our new Fumbi Dictionary.

3 min •

3 min •