Binance Has Accepted a Settlement With DOJ – Market Info

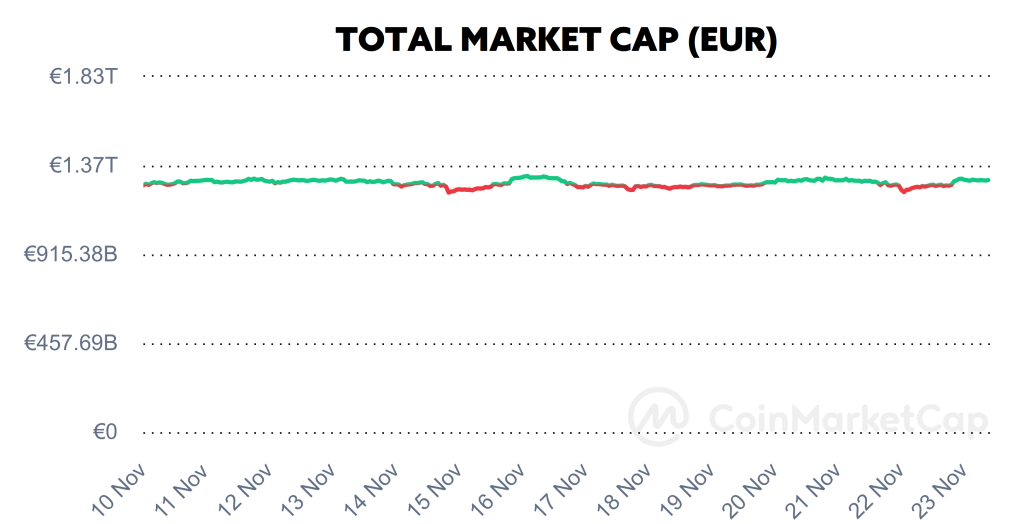

Over the past two weeks, the total market capitalisation exceeded €1.30 trillion. The increase in market capitalisation over a 14-day period is 1.56%. The price of Bitcoin has fallen by 0.06% over the last 14 days to a current value of over €34,300. Bitcoin’s dominance is currently around 51.5%.

Source: Coinmarketcap

Binance Has Accepted a Settlement With DOJ

The Binance crypto exchange experienced one of the busiest days in its history this Tuesday.

On Tuesday evening, the US Department of Justice (DOJ) announced the completion of an investigation and a $4.3 billion settlement with Binance Holdings, the world’s largest crypto exchange. Furthermore, Binance CEO Changpeng Zhao (known as CZ) resigned from his position as CEO and pleaded guilty to violating the Anti-Money Laundering (AML) and Bank Secrecy Act.

Changpeng Zhao accepted a plea agreement and a $50 million fine. He was therefore released on bail pending sentencing in February. Additionally, Zhao must pay $150 million to the U.S. Commodity Futures Trading Commission (CFTC) as part of the settlement.

According to the disclosures, Binance violated U.S. anti-money laundering laws and failed to report more than 100-thousand suspicious transactions with organisations the U.S. has designated as terrorist groups, including Hamas, al-Qaeda and the Islamic State.

However, several legal experts have said that the settlement of the disputes between Binance and government institutions is a good outcome for Binance and for Changpeng Zhao himself. At the same time, Changpeng Zhao will not lose his assets, and the settlement will also allow him to keep his stake in Binance, the cryptocurrency exchange he founded back in 2017.

“Binance became the world’s largest cryptocurrency exchange in part because of the crimes it committed – now it is paying one of the largest corporate penalties in U.S. history,” Attorney General Merrick B. Garland.

Binance must now pay $1.81 billion within 15 months and forfeit another $2.51 billion as part of the deal. Zhao, who was born in China and moved to Canada at the age of 12, pleaded guilty in a Seattle court Tuesday afternoon. “Today, I stepped down as CEO of Binance,” Zhao said on social media after the settlement was announced. “Admittedly, it was not easy to let go emotionally. But I know it is the right thing to do. I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself.”

The new CEO of crypto exchange Binance is Richard Teng, Binance’s global head of regional markets, who will take over as CEO. “We operate the world’s largest cryptocurrency exchange by volume. The trust placed on us by our 150m users and thousands of employees is a responsibility that I take seriously and hold dear. With CZ’, and our leadership team’s support, I have accepted this role so that we can continue to meet and exceed the expectations of stakeholders while achieving our core mission, the freedom of money,” Teng said on the social network X. Source

SEC Sues Crypto Exchange Kraken

Crypto exchange Kraken, which is among the top 5 crypto exchanges in the world, got sued by the U.S. Securities and Exchange Commission (SEC) on Monday night, accusing it of illegally operating as a securities exchange without having the regulatory authority to do so.

The SEC’s lawsuit against Kraken is evidence of SEC Chairman Gary Gensler’s continued efforts to bring cryptocurrencies under the purview of the SEC, which has repeatedly stated that it considers digital assets to be investment contracts subject to federal securities laws.

The SEC said in its lawsuit that Payward Inc and Payward Ventures Inc, which operates as Kraken, have made hundreds of millions of dollars since 2018 brokering the purchases and sales of cryptocurrencies while “turning a blind eye” to securities laws designed to protect investors. Kraken has also been accused of inadequate internal controls and poor recordkeeping, which was partly reflected in commingling customer money with its own funds and paying operating expenses directly out of customer funds.

On the margins of the lawsuit, representatives of the Kraken crypto exchange said that they will defend themselves fiercely against any allegations. According to the company’s management, Congress should decide how to regulate cryptocurrency exchanges, not the SEC, which has its own biased opinion on the matter. Kraken also said in its statement that if by chance there was a commingling of funds, it was an insignificant amount that was less than the service fees collected from clients. The exchange also said that the lawsuit will in no way affect its more than 10 million clients. Source

Grayscale Met With SEC Officials

According to the latest information, Grayscale’s management company executives met with officials from the U.S. Securities and Exchange Commission (SEC) to jointly discuss matters related to the transformation of Grayscale’s Bitcoin Trust (GBTC) into a spot ETF.

A November 20 SEC report revealed that Greyscale CEO Michael Sonnenshein, legal chief Craig Salm, ETF chief Dave LaValle and four other executives, along with five representatives from law firm Davis Polk, met with the SEC’s Division of Trading and Markets. The report states that the discussions concerned “a proposed rule change by NYSE Arca, Inc. to list and trade shares of the Grayscale Bitcoin Trust (BTC) pursuant to NYSE Arca Rule 8.201-E.”

Grayscale said it has entered into a transfer and services agreement with BNY Mellon , according to a filing shared by Bloomberg ETF analyst James Seyffart. The bank will act as an agent for the Grayscale Bitcoin Trust (GBTC), which will arrange and facilitate the issuance and redemption of shares, as well as the maintenance of shareholder accounts.

On November 21, James Seyffart noted in a post on Social Network X (Twitter) that the SEC’s Division of Trading and Markets is responsible for approving or disapproving Forms 19b-4, which are used to notify the SEC of a proposed rule change by a self-regulatory organization. Seyffart also noted that the agreement between Grayscale and BNY Mellon is something that would have been required at some point anyway and is not an indicator that GBTC will be instantly transformed into an ETF.

ETFStore President Nate Geraci opined in a post on social network X that the most significant aspect of the meeting between Grayscale and the SEC is that the GBTC conversion is referred to as “uplisting” in the report. This, in his view, does not suggest any issues with the conversion to spot ETFs. We will actively monitor the situation surrounding the conversion of GBTC to a spot ETF and bring you verified and fresh information. Source

Argentina Has a Pro-Bitcoin President

The people of the South American country of Argentina, which has a population of more than 45 million, have elected Javier Milei, a pro-bitcoin and far-right populist, as their new president. The new Argentine president, who has long been known and celebrated for his critical stance towards central banks, won the second round of the presidential election with 55% of the vote.

According to the media, the election results reflect a significant political shift in Argentina, heavily influenced by Milei’s strong opposition to the central bank, which he describes as a “scam” and a tool for politicians to collect inflationary taxes from the population. His views grew in popularity during Argentina’s inflation crisis, where the Argentine peso experienced year-on-year inflation of more than 140%.

The victory of the new president is a very positive signal not only for the people themselves but also for Bitcoin and cryptocurrencies. The president-elect has been a long-time supporter of Bitcoin and sees Bitcoin as the key to Argentina’s economic recovery while advocating the return of monetary control to the private sector. However, it is important to add that shortly after his victory, Milei did not communicate any future adoption of BTC in the country but rather unveiled his plans for the dollarization of Argentina.

The contrast between Milei and his opponent Sergio Massa in the election campaign was drastic. Massa proposed the launch of a Central Bank Digital Currency (CBDC) to combat Argentina’s inflationary crisis while showing different economic philosophies across the country’s political spectrum. On the other hand, Milei presented a radical departure from traditional economic policies. At one of his pre-election meetings, he vowed to close the central bank, replace the Argentine peso with the US dollar, and embrace the adoption of decentralized finance. His approach has also been referred to as “economic shock therapy”, signalling a drastic shift away from Argentina’s current monetary strategy.

Whether Argentina will adopt Bitcoin as legal tender in the future due to high domestic currency inflation is still questionable. However, its stance could potentially lead the country to at least hold Bitcoin as a reserve asset, following the example of El Salvador. However, integrating Bitcoin into the Argentine economy could foster a more decentralized, inflation-proof financial system, which could ultimately have a positive impact on the value of Bitcoin itself. Source

Tether Froze Hundreds of Billions of USDT

The issuer of USDT’s largest stablecoin, Tether, and crypto exchange OKX have worked with the United States Department of Justice (DOJ) to freeze approximately USDT 225 million linked to international human trafficking in Southeast Asia, according to disclosures.

The investigation was conducted using a blockchain analytics tool from Chainalysis to identify wallets used in a large-scale scam called “pig butchering” that targets victims around the world.

“Pig butchering” is a type of online scam where a fraudster feigns interest in a romantic relationship. Scammers spend time building trust with the other party, and then after weeks or months of communication, they ask for money from their victim, often on the condition of a fabricated story or a unique investment opportunity.

“Through proactive engagement with law enforcement worldwide and our commitment to transparency, Tether aims to set a new standard for safety in crypto,” said Paolo Ardoino, CEO of Tether. “Our collaboration with the DOJ highlights our dedication to fostering security.”

The freezing of illegally obtained funds was uncovered through an analysis of the flow of funds on the blockchain. The frozen wallets are located on the secondary market and are not directly linked to Tether customers. Source

U.S. Inflation Is Slowing

The Consumer Price Index (CPI) was flat in October compared to the previous month but rose by 3.2% year-on-year. However, year-on-year inflation, as measured by the CPI, was lower than analysts’ expectations.

The Consumer Price Index, which measures the prices of a basket of commonly used consumer goods and services, rose 3.2% on Tuesday from the previous October, according to seasonally adjusted data from the Labor Department. Economists in a Dow Jones survey had expected year-over-year inflation of 3.3%. The level of year-over-year inflation reached the lowest in two years but still remains above the Fed’s 2% target.

The fall in inflation is a hopeful sign that the policy of raising interest rates in the US has been effective and potentially signals the Federal Reserve (Fed) to stop raising interest rates. Fed officials have even admitted to a series of interest rate cuts that could begin as early as April next year. Source

INVEST WITH FUMBI

INVEST WITH FUMBI

3 min •

3 min •