Bitcoin Rose More Than 150% – Market Info

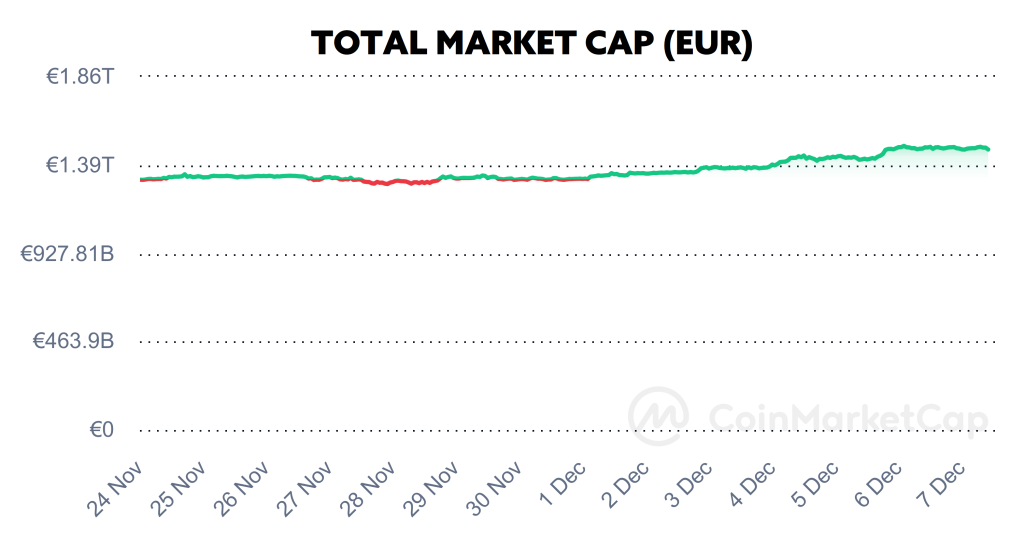

Over the past two weeks, the total market capitalisation exceeded €1.47 trillion. The increase in market capitalisation over a 14-day period is 13.07%. The price of Bitcoin has risen by 16.9% over the last 14 days to a current value of over €40,100. Bitcoin’s dominance is currently around 54.9%.

Source: Coinmarketcap

Bitcoin Rose More Than 150%

The price of Bitcoin, the most famous cryptocurrency, surged to $44,400 (€41,000) on Tuesday evening, reaching its highest level since April 2022, as investors bet on the possible approval of a spot ETF in the United States as well as the Federal Reserve (Fed) probably won’t raise interest rates anymore. Earlier this year, Bitcoin was trading at around $16,000 and has risen by more than 150% over the course of this year.

At a press conference last Friday, Fed Chairman Jerome Powell stated that central bank policy is currently in “very restrictive territory,” noting that the balance of risks between hitting inflation too much or too little is now nearly balanced. Expectations that the Fed has finished raising interest rates and will move to lower them in 2024 have helped kick-start gains in the stock and cryptocurrency markets.

Part of the market’s current positive sentiment and enthusiasm hinges on expectations that the Securities and Exchange Commission will approve a bitcoin-focused exchange-traded fund (ETF), which approval could come as early as early next year. A spot bitcoin ETF would allow traditional investors and institutions to gain exposure to bitcoin without actually having to own it and worry about its custody. There have been attempts to launch a spot ETF several years back, but according to analysts, the chances of it being approved are now higher than ever. According to analysts at Bloomberg, the probability of a spot ETF being approved in the US is as high as around 90%. This argument is supported by the fact that the SEC has been actively meeting with spot ETF applicants in recent weeks, communicating with them about their applications and suggesting potential modifications.

The rise in the Bitcoin price has caused Bitcoin to significantly strengthen its market position at the moment. Bitcoin’s dominance has increased by almost 4% in the last month alone and is currently hovering around the 54.9% level. Source

Brazil’s Largest Bank Enters the Crypto World

Itau Unibanco, Brazil’s largest bank, launched a cryptocurrency trading service for clients on its investment platform a few days ago, directly confirming its entry into the digital asset market.

While in its early days, the service currently supports trading in Bitcoin and Ethereum cryptocurrencies. However, according to Guto Antunes, head of digital assets at Itau, the bank plans to expand its offerings to other digital assets in the future. “It starts with Bitcoin, but our overarching strategic plan is to expand to other crypto assets in the future,” said Antunes, who also added that the potential expansion of the range of crypto assets available will depend on the evolution of crypto regulation in the country.

Itau aims to compete with local players in the cryptocurrency sector, such as crypto exchange MB or Mynt, a company under investment bank BTG Pactual, as well as international giants such as Binance. One of the distinctive features that Itau seeks to leverage is its role as a custodian, which provides a high level of security for users’ assets. According to the head of digital assets at Itau, it is their company that will stand out from competitors as it also acts as a custodian that protects the assets of its users. Source

Microstrategy Bought Bitcoin for Another $600 Million

Business intelligence firm MicroStrategy announced late last week that it had purchased an additional 16,130 bitcoins for approximately $593.3 million. This brings Microstrategy’s current holdings to 174,530 bitcoins acquired for $5.28 billion at an average price of $30,252 per BTC.

According to MicroStrategy founder and executive chairman Michael Saylor, who posted the news on Twitter, the company made its latest purchase at an average price of $36,785 per BTC. The current value of bitcoins held by Microstrategy is roughly $7.7 billion, while the company itself is valued at $8.8 billion, according to finance website Yahoo. The company is also making an unrealized profit of more than $1.4 billion on its investment.

MicroStrategy made its first major bitcoin purchase back in August 2020 and has since continued its bitcoin policy, regularly buying up more BTC, even during periods when the bitcoin price has fluctuated sharply. Saylor said Bitcoin acts as a reserve asset at the company, allowing the company to avoid inflationary pressures. Source

Paying Tax via Cryptocurrencies?

The Swiss city of Lugano is boosting its Bitcoin adoption by allowing citizens and businesses to pay for utilities and taxes via cryptocurrencies, according to the latest information.

On Tuesday, December 5, the city of Lugano officially announced that the local government has launched the ability to pay with Bitcoin and Tether (USDT) cryptocurrencies for taxes and all other community fees. The city has chosen the Swiss cryptocurrency platform Bitcoin Suisse as a partner in providing the new services. According to the announcement, citizens of Lugano can pay all local fees regardless of the nature of the service or the amount invoiced via supported cryptocurrencies. Also new in this area is the ability to pay taxes via QR codes by scanning the code on the invoice and paying with your preferred mobile wallet and the cryptocurrency of your choice.

The latest move in cryptocurrency adoption in Lugano is part of the so-called Plan B, in which the city is working with Tether in an effort to use Bitcoin technology as the basis for transforming the city’s financial system. Crypto platform Bitcoin Suisse is supporting the city of Lugano in its plan by serving as a technical partner in the integrated payment solution and providing the necessary infrastructure for accepting payments in cryptocurrencies. Source

A Small Miner Managed a Hussar Trick

In late November, the world of cryptocurrencies was hit by the sensational and very interesting news that a small individual miner had managed to mine a block on the Bitcoin network. The unknown miner mined a block with the serial number 818,588, and his mining brought him a total reward of 6,887 BTC, including the block reward and transaction fees from the mined block.

The miner has managed to extract a block with an output of only 2 PH/s, which was very lucky. According to experts, miners with equivalent computing power manage to extract a block once in five years.

The total computing power of the Bitcoin network is currently roughly 488 exahash per second (EH/s). In comparison, the share of this single miner with 2 PH/s represents only 0.0004% of the total computational power of the network, indicating a very low probability of mining a block and a great deal of luck. Source

Bitcoin Adoption in El Salvador Is Starting to Pay Off

El Salvador, the first country to adopt Bitcoin as legal tender, has finally turned a profit on its investment in the cryptocurrency Bitcoin after months of waiting and regular investing. El Salvador’s President Nayib Bukele announced on Monday that his country is currently in profit of roughly $3.6 million from its bitcoin investment.

Bukele also said that his government has purchased 550 bitcoins, which are worth nearly $28 million at the current market price. If Bukele had decided to sell these bitcoins at the current market price, the state would have recovered its entire investment and made a profit of $3,620,277.13.

“Of course, we have no intention of selling; that has never been our goal. We are fully aware that the price will continue to fluctuate in the future, this does not affect our long-term strategy,” Bukele wrote on the social network Twitter. The Salvadoran president also asked the media and critics to retract articles and statements that have ridiculed his Bitcoin strategy in the past.

El Salvador’s bold experiment, which was launched back in September 2021, was met with both praise and scepticism at the time. While some considered his decisions too risky and gamble-taking for such a fragile economy, others hailed his stance as a potential catalyst for economic diversification, an influx of foreign investment, and cryptocurrency-based financial education. Source

START INVESTING

3 min •

3 min •