Decreasing Bitcoin Supply Could Significantly Impact the Market – Market Info

Since May 23, 2025, the cryptocurrency market has experienced a slight decline. The total market capitalization has dropped by approximately 4.9% and is currently around €2.88 trillion. Bitcoin’s market share remains stable, with no significant changes in dominance observed.

As for investor sentiment, it has slightly shifted towards caution. The Fear and Greed Index decreased from its previous value of 73 to 57, signaling a return to a neutral sentiment after a period of optimism.

Source: Coinmarketcap

Decreasing Bitcoin Supply Could Significantly Impact the Market, Sygnum Warns

Swiss bank Sygnum, in its latest analysis, highlights the growing trend of the decreasing available Bitcoin supply on exchanges. According to its data, liquid Bitcoin reserves have decreased by approximately 30% over the past 18 months. The main reason is that institutional investors and funds are buying up assets and moving them off exchanges into their own custody. This development reduces the supply of the open market and has historically been associated with upward price pressure.

Analysts point out that since the end of 2023, approximately one million BTC have been removed from cryptocurrency exchanges. At the same time, the number of companies issuing stocks or bonds to buy Bitcoin as part of their reserves is growing. Macro-economic factors also play a role – a weakening dollar, rising US national debt, and uncertainty in global markets are leading investors to seek alternative stores of value, with Bitcoin and gold being prominent choices.

Another interesting development is the growing effort to include Bitcoin in official reserves. In the USA, three states – including New Hampshire and probably Texas – have already passed legislation enabling such a move. On the international level, Pakistan’s government and the British Reform UK are also considering a similar approach. Although there have not been direct purchases yet, Sygnum predicts that any implementation could trigger another rise in demand and strengthen Bitcoin’s position as a strategic asset.

Source: cointelegraph

The report also highlights positive developments in volatility. Over the last three years, the number of upward price movements for Bitcoin has been higher than the number of declines, which, according to Sygnum, indicates market maturation and an increasing share of stable, long-term investors.

Renewed interest is also visible in the case of Ethereum. The latest update, named Pectra, has attracted the attention of major players who are building infrastructure on its network for the tokenization of real-world assets, from bonds to real estate. Source

Crypto Takes Another Step into the World – Circle on NYSE

Circle, the issuer of the USDC stablecoin, is preparing to enter the New York Stock Exchange (NYSE) via a public offering (IPO). The company plans to offer 24 million Class A shares, of which 9.6 million are issued directly by Circle, and the rest are provided by existing shareholders. The expected price range for the shares is $24 to $26, which could raise up to $624 million for the company. The shares will be traded under the symbol CRCL, and the offering also includes an option for underwriters to purchase an additional 3.6 million shares.

Source: circle

The IPO has attracted significant attention from major financial players. Investment giant BlackRock is reportedly considering buying around 10% of the entire offering, according to Bloomberg. ARK Invest’s Cathie Wood is also interested in the shares, planning to invest up to $150 million. Reports indicate that the offering has been oversubscribed multiple times, suggesting high demand from investors.

A number of prominent banks are involved in the IPO – among the main underwriters are JPMorgan, Citigroup, and Goldman Sachs, with European banks such as Barclays and Deutsche Bank also involved. Other investment firms, including BNY Capital Markets, Oppenheimer, and Santander, are co-managers. However, the proceeds from the shares sold by the original shareholders will not go directly to Circle’s coffers.

Circle is continuing its efforts toward transparency and establishing a stable position in the cryptocurrency world. According to CEO Jeremy Allaire, going public on the NYSE is proof of their commitment to responsibility toward the public and regulatory oversight. The company reported revenues of $1.67 billion in 2024, but its net profit dropped by 42%. Nevertheless, it continues to strengthen its position in the stablecoin market, where it currently holds the second spot behind Tether, which is not planning an IPO at the moment. Source 1 / Source 2

Michael Saylor Expands His Bitcoin Portfolio Again

MicroStrategy co-founder Michael Saylor continues his active Bitcoin buying spree – now for the eighth week in a row. On the social network X, he recently shared a graph with the note: “Orange is my favorite color,” which the community again interpreted as a reference to Bitcoin. On May 26, the company announced the purchase of another 4,020 BTC worth approximately $427 million. This brings the company’s total holdings to 580,250 BTC, making Strategy the largest known Bitcoin holder in the world, surpassing even the US and China.

This massive accumulation is not going unnoticed. CryptoQuant analyst Ki Young Ju points out that such large-scale institutional buying could reduce the available liquidity in the market and push Bitcoin’s price even higher. Similar views are coming from Swiss crypto bank Sygnum, which highlights growing market tension caused by demand from large investors. For many investors, Strategy is becoming an alternative to directly buying Bitcoin.

However, there are also growing questions about the true extent of the company’s Bitcoin reserves. Strategy does not publicly disclose its cryptocurrency holdings, which raises doubts. Michael Saylor argues that disclosing addresses could jeopardize the company’s security and make it a target for cyberattacks. He considers blockchain transparency a double-edged sword, offering openness but also increasing the risk of threats.

This debate has also been joined by the analytical platform Arkham Intelligence, which claims to have linked an additional 70,816 BTC (worth approximately $7.6 billion) to Strategy. According to Arkham, they have identified up to 87.5% of the company’s total Bitcoin assets. However, Saylor disputes these figures and warns against disclosing wallet details. Critics also point out that Arkham has made several incorrect identifications in the past, advising caution with these numbers. Source 1 / Source 2

Crypto Firms in Singapore Must Cease Overseas Activities by End of June

Singapore is significantly tightening regulations for the cryptocurrency sector. The country’s central bank, the Monetary Authority of Singapore (MAS), has ordered all crypto firms registered in Singapore to cease offering services abroad by June 30, 2025, unless they obtain special permission. This decision follows the expansion of powers under the Financial Services and Markets Act of 2022, which allows MAS to oversee the activities of firms outside the country if they are officially registered in Singapore.

According to the new rules, any company based in Singapore is considered to be operating from its territory, regardless of where it provides its services. If firms do not cease their overseas activities by the deadline or fail to obtain a license under section 137 of the Act, they face fines of up to 250,000 Singapore dollars (approximately $200,000) and up to three years in prison.

Legal experts suggest that MAS will grant these licenses only in exceptional cases. The strict conditions aim to minimize the risks associated with money laundering and terrorism financing. Lawyer Hagen Rooke from Gibson, Dunn & Crutcher pointed out that very few companies will be able to meet all the requirements. He also advised companies to reconsider their structure and sever ties with Singapore if they wish to continue their overseas operations.

This move fits into Singapore’s broader strategy to tighten regulation of digital assets. The law passed in 2022 already allowed the central bank to intervene in the operations of firms that are based in the country but operate exclusively outside it. The goal is to limit cases where firms exploit Singapore’s reputation as a regulated financial hub while actually operating in unregulated or lightly regulated foreign markets. Source

Education Company Classover Invests in Solana, Plans Purchase Up to $500 Million

Educational technology company Classover, focusing on online courses for children and teenagers from kindergarten to high school, has announced an ambitious entry into the world of digital assets. The company plans to build reserves of the cryptocurrency Solana (SOL) and will finance the purchase through the issuance of convertible bonds totaling up to $500 million. Classover intends to use 80% of the raised funds directly to buy Solana. The first steps have already been taken – in early June, the company purchased 6,472 SOL worth approximately $1.1 million.

The company also hinted that this issuance could be supplemented by an existing investment agreement worth $400 million. Combined, Classover could invest up to $900 million in Solana. The partner in this initiative is Solana Growth Ventures, an organization focused on supporting the growth of the Solana ecosystem.

The announcement triggered a strong market reaction. Classover’s shares saw a significant increase – on June 3, they were traded on the Nasdaq for $5.45, marking a 46.5% daily gain. The company has joined the growing number of publicly traded companies integrating cryptocurrencies into their financial and growth strategies.

The growing interest in Solana is also noticeable outside of Classover. Canadian company SOL Strategies has applied for permission to acquire up to $1 billion, which it plans to use for staking operations within the Solana network. Similarly, Nasdaq-listed Upexi saw its stock increase by 630% after announcing that 90% of its $100 million funding would be invested in Solana. Source

Invest With Fumbi Today

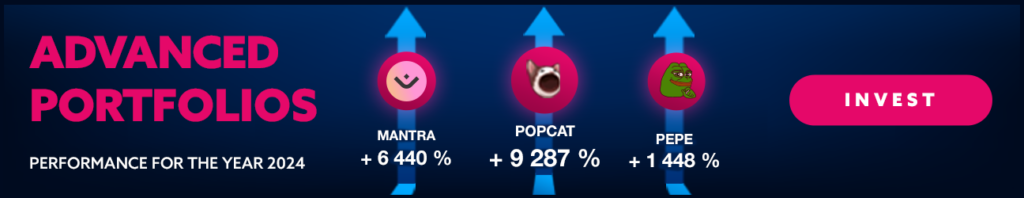

Harness the potential of cryptocurrencies simply, securely and efficiently. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in the Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. If you want to build your own crypto portfolios, choose the Advanced Portfolios product, where you will have access to over 110 cryptocurrencies and templates created by our team that focus on different areas within the crypto universe.

TAKE ADVANTAGE OF CRYPTO’S POTENTIALHave you come across a term in the text that you don’t understand? Never mind, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •