Another Bank Collapse in America – Market Info

Over the past two weeks, the total market capitalisation exceeded EUR 1.08 trillion. The decrease in market capitalisation over a 14-day period is 2,7 %. The price of Bitcoin has fallen by 0,2 % over the last 14 days to a current value of over €26,350. Bitcoin’s dominance is currently around 47,1 %.

Another Bank Collapse in America

Although for a while it seemed that the March banking crisis had blown over and everything was back to normal, the opposite is true. Monday’s collapse of a medium-sized US bank shows that the banking system remains very fragile at the moment and that it is still necessary to be on our guard.

In the early hours of the first day of May, regulators closed the well-known First Republic Bank, whose collapse became the second-biggest bank failure in US history. All deposits and most of the assets were sold to what is now the largest US bank, JP Morgan Chase, which also took over all of First Republic’s branches and reopened them under its own brand.

In total, up to 84 branches were reopened as branches of JPMorgan Chase, which acquired $92 billion in deposits and $203 billion in loans and other securities through the bank’s acquisition. But it looks like the bank’s shareholders will be wiped out as part of the deal and will not be compensated in any way.

In a conference call with reporters and investors, Jamie Dimon, the head of JPMorgan Chase, said he believes the banking crisis is now, at least temporarily, over. In fact, other mid-sized banks released their results last week, and the vast majority of them showed that deposit levels at those banks have stabilised.

While it was still operating under its recovery plan, the bank planned to sell off its unprofitable assets, including the low-interest mortgages it had been providing to wealthy clients. It also announced plans to lay off up to a quarter of its workforce, which totalled up to 7200 employees at the end of the year. However, these steps proved insufficient and came too late.

First Republic is the third mid-sized bank to fail in the past two months. Its collapse ranked second in size, just behind that of Washington Mutual, which collapsed at the height of the financial crisis in 2008. In 2008, as now, the bank was taken over by JP Morgan in a government-organised deal. Source

Biden Administration Wants to Raise Taxes to Miners

According to an official announcement released by the Council of Economic Advisers in the United States, the Biden administration is attempting to impose a new, up to 30% tax on cryptocurrency mining. The main reason for launching the campaign to increase taxes is supposed to be the fact that the mining industry is associated with a strong negative impact on the environment.

The new tax, referred to as the Digital Asset Mining Energy (DAME) excise tax, is intended to be an effort to shift responsibility to crypto companies mining Bitcoin for their environmental impact. This tax is reportedly expected to be equal to 30% of the cost of the energy consumed. At the same time, the Council of Economic Advisers estimates that the new excise tax could generate up to $3.5 billion over 10 years.

However, the crypto-mining community has described the introduction of this tax as unfair and unethical. Representatives of the community said that the tax does not incentivise the use of clean energy in any way and that the government should rather focus on how to support miners who try to use as much renewable energy as possible in their mining. Source

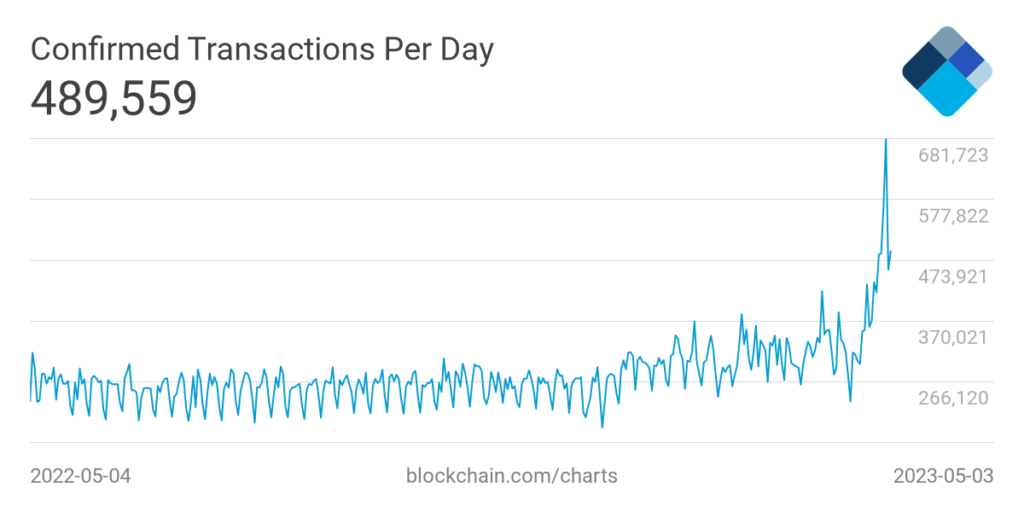

Bitcoin Network Sees Record Number of Daily Transactions

The craziness around NFTs on Bitcoin continues. On Monday alone, more than 372,000 so-called inscriptions were created on the Bitcoin network, contributing to a new Bitcoin network record of 682,281 bitcoin transactions within 24 hours. Network transaction fees reached 69 BTC in one day, which is worth roughly $2 million.

The main catalyst for the huge increase in transactions on the Bitcoin network are so-called Bitcoin Ordinals, which allow users to embed text inscriptions or images directly into the smallest Bitcoin currency unit, called satoshi. It is a process similar to minting NFTs on blockchains like Ethereum, with this option expanding the user base on Bitcoin by allowing users to do more than just receive and send Bitcoins. Overall, as much as 54.6% of Monday’s transactions came from Ordinals, according to data from Dune Analytics.

The massive growth in demand for transactions is directly related to the increase in transaction fees on the network. The average transaction fee on the network has risen from the $3 recorded in late April to $7, an increase of 133%.

The strong demand for block space on the Bitcoin network may be critical to Bitcoin’s success in the long term. Thus, the days when Bitcoin was only used for routine transfers between users seem to be a thing of the past. Source

Liquid Staking Is Gaining Popularity

Following the Shanghai update, which allowed Ethereum users and owners to withdraw their deposits and rewards from the depository log, popular crypto exchanges have seen a huge outflow of Ether (ETH). The update unlocked Ether worth up to $35 billion in total, which was still being deposited into the protocol as of December 2020.

According to information available from analytics platform Dune Analytics, crypto exchange Coinbase has seen a net outflow of $367 million in staked ETH since April 12, and withdrawals of staked ETH, including rewards, have far outpaced new deposits. Similarly, the most popular crypto exchange Binance saw a net outflow of ETH worth roughly $340 million, according to the data.

Decentralised protocols focused on liquid staking, on the other hand, saw a surge in deposits. Frax Finance and Rocket Pool, which are among the most popular ETH-focused staking protocols, saw net ETH inflows of $56 million and $68 million, respectively. Lido Finance, currently the largest decentralised protocol focused on liquid staking, which houses more than $11 billion in assets, has seen a capital inflow of $28 million (15,208 ETH) since 12 April.

Liquid staking protocols work on a decentralised principle by issuing a “derivative” token that represents a number of staked tokens and allowing that token to be used for other decentralised financial services. An example of this is the use of these tokens as collateral for DeFi loans. If a user wants to get their staked ETH back, they give back the derivative tokens, which are burned, and allow the staked coins to be made available to the user. Source

Sports Illustrated Launches NFT Ticketing Platform

The popular American sports magazine Sports Illustrated has unveiled the launch of a ticketing platform in the form of non-negotiable tokens (NFTs) built on the Polygon network.

The ticketing platform, called SI Tickets, was reportedly developed by Box Office in partnership with Consensys, the software firm behind the crypto wallet Metamask. Officially released information states that this will be the world’s first complete NFT ticketing service, allowing event organisers, festivals or promoters to use Box Office’s service to sell tickets. The platform also opens up new opportunities for promoters in the form of the sale of various collectables or the sale of so-called “Super Tickets”.

The use of NFT as a ticketing platform for various events is often cited as one of the potential use cases for Web3 technology. Such a major and world-renowned brand as Sports Illustrated can give ticket sales through NFTs an added impetus to their wider adoption. Source

Interesting Fact: The Whale’s Awakening

At the end of April, another whale that hadn’t moved its bitcoins for several years woke up.

The owner of the address “12At4GGP8J5p4MtdjNy1SPSkqKEM1mw2FS” who hadn’t touched his bitcoins in almost a decade, after a very long time, moved more than 279 BTC worth $7.8 million into three new wallets. According to data from blockchain explorers, this whale accumulated a total of up to 1,128 BTC in the months of October 2012 and May 2013, when the average bitcoin price was $12 and $195. In total, this investor holds more than $30 million worth of bitcoins.

According to research by the Bank for International Settlements, bitcoin whales are the most successful investors in crypto sector. The bank said in its February research that those who hold their assets for long periods of time tend to do well, while the retail investor who buys and sells in a short time frame usually lost money on their investment. Source

INVEST WITH FUMBI

3 min •

3 min •