ETF Funds: What Are ETFs, Their Performance, and How to Invest in Them

In this article, you will learn:

- What Are ETF Funds

- The Most Well-Known Types of ETF Funds

- How Investing in ETF Funds Works

- The Average Performance of ETF Funds

- Risks of ETF Funds

- Cryptocurrency Funds as an Alternative to ETF Funds

- What and How to Invest with Fumbi

What Are ETF Funds?

ETFs, or Exchange Traded Funds, are investment funds traded on the stock exchange similarly to stocks. Their primary goal is to replicate the performance of a specific index, such as the S&P 500, Nasdaq, FTSE, or DAX. ETF funds allow investors to gain exposure to a broad range of assets with minimal effort.

Last year, the financial world reached a significant milestone in cryptocurrency investments when ETF funds focused on Bitcoin and Ethereum were approved and introduced to the market for the first time. These innovative funds enable investors to gain exposure to the growing cryptocurrency market without the need to directly purchase and manage individual cryptocurrencies.

An ETF is typically a combination of multiple assets, offering several advantages:

- Diversification of Funds: A single investment can include hundreds of stocks, bonds, or commodities.

- Flexibility: Today, investors can choose from a wide range of ETF funds.

- Broad Coverage: By purchasing an ETF fund that replicates the S&P 500 index, you gain exposure to the 500 largest U.S. companies, including Apple, Microsoft, and Amazon.

Why Have ETF Funds Gained Popularity?

- Low Costs: Management fees (TER – Total Expense Ratio) are often below 0.1%, which is significantly lower than those of traditional mutual funds.

- Simplicity of Investing: ETFs are accessible through online platforms and mobile applications.

- Passive Investing: Since ETFs track indices or specific underlying assets, they do not require active management.

What Are the Most Well-Known Types of ETF Funds?

Equity Funds

Equity ETFs track the performance of specific stock indices or sectors, offering an efficient and cost-effective way to diversify your portfolio. Some ETFs replicate their underlying index exactly, while others use sampling methods such as futures, options, or swaps. Sampling provides flexibility, but excessive use can lead to deviations. These funds also support different investment styles, such as value or growth strategies, making them a versatile option for investors.

They are popular due to their ability to provide instant diversification at lower costs compared to actively managed mutual funds. Whether your goal is to track the performance of a broad market index like the S&P 500 or focus on a specific sector, such as renewable energy or technology, equity ETFs allow you to align your investments with your financial objectives.

Bond Funds

Bond ETFs are exchange-traded investment instruments designed exclusively for bonds, offering various investment strategies—from government bonds to high-yield corporate bonds, with different maturities ranging from short-term to long-term.

Unlike traditional bonds, bond ETFs are traded on major stock exchanges, such as the NYSE. Their global accessibility allows investors to easily diversify their portfolios, while bond funds help maintain stability during short-term market fluctuations.

Commodity Funds

Commodity funds focus on investments in raw materials and primary agricultural products, known as commodities. These include precious metals such as gold and silver, energy resources like oil and natural gas, and agricultural products like wheat. Some of these funds also invest in companies that produce these commodities.

Currency Funds

Currency ETFs offer investors an efficient way to gain exposure to foreign currencies and exchange rate movements. These funds allow investments in one or multiple currency pairs, providing access to the forex market.

Similar to other ETFs, currency ETFs are traded on major stock exchanges, making them easily accessible for buying and selling during regular trading hours. Most of them are passively managed and track the performance of a single currency or a basket of currencies.

Real Estate Funds (REITs)

REIT ETFs are exchange-traded funds that primarily invest in REIT securities and related derivatives. These ETFs are usually passively managed and track indices composed of publicly traded companies operating in the real estate sector. Many REIT ETFs hold shares in REITs that generate income through rents and leases of properties such as warehouses, apartment buildings, and hotels.

How Does Investing in ETF Funds Work?

The first step in investing in ETFs is selecting your preferred fund:

- Decide what you want to invest in—for example, large-cap stocks, technology companies, or gold.

- Focus on funds with low fees and check whether they reinvest dividends or distribute them.

Next, the steps involve opening an investment account:

- To invest, you need an account with a broker. Choose one that is reputable, has low fees, and offers a wide range of ETFs.

Finally, We Reach the Expected Step: Buying ETFs

- Search for the fund by its name or ticker symbol (e.g., SPY for the S&P 500) and place a buy order.

It is important to manage your investments and reassess them when necessary:

- Monitor the performance of your investment and regularly invest additional funds as needed.

The final step in investing is selling ETFs:

- If you need money, want to realize a profit, or change your investment strategy, you can easily sell your ETF.

Average Performance of ETF Funds

The average performance of ETFs can be measured in two ways: absolute difference and relative difference.

Absolute Difference indicates the percentage change a fund has achieved over a certain period. For example, if a fund increases from €10 to €11 in a year, its absolute performance is +10%. This method considers only the fund’s individual growth or decline without factoring in broader market conditions or benchmark comparisons.

Relative Performance compares the fund’s returns to a benchmark index, such as the S&P 500 or the European MSCI Europe index. If a fund grows by 10%, while the benchmark increases by 8% in the same period, the fund has achieved a relative performance of +2% over the index. This approach helps investors determine whether the investment has outperformed or underperformed the market.

To illustrate ETF performance, we use the well-known S&P 500 index, representing the 500 largest U.S. companies. Many ETFs track this index, but in this example, we focus on the Invesco S&P 500 UCITS ETF.

At first glance, the chart shows two nearly identical curves, yet they reveal an interesting growth story. The green-red line represents the S&P 500 index itself, while the pink line shows the performance of the ETF tracking this index.

Over the past 10 years, the value of the S&P 500 index has increased by 355%, which is already an impressive growth. However, the ETF went even further, achieving a 630% increase! This indicates that the ETF has consistently outperformed the index, delivering nearly 1.8 times the market’s growth.

What Does This Mean? Although an ETF tracks the S&P 500, its performance demonstrates that it can go even further and is not strictly limited to the index’s returns.

Source: yahoo finance

Determining the average performance of ETFs is quite challenging, as there are multiple types to choose from—ranging from equity ETFs to real estate funds, as discussed in the section “What Are the Types of ETF Funds?” However, we can analyze the performance of different ETF categories based on selected funds.

For this analysis, we will track 10 ETFs that manage over €500 million in assets and have a history of at least three years.

The table shows that the average 5-year return of the largest equity ETFs is 103.86%, which translates to an approximate 20% annual return.

| Fund name | 1 Y | 3 Y | 5 Y |

| iShares Core S&P 500 UCITS ETF USD (Acc) | 35,12% | 43,11% | 116,74% |

| iShares Core MSCI World UCITS ETF USD (Acc) | 28,11% | 35,98% | 89,44% |

| Vanguard S&P 500 UCITS ETF (USD) Distributing | 33,31% | 44,36% | 116,45% |

| Invesco S&P 500 UCITS ETF | 34,06% | 45,78% | 119,53% |

| iShares Core MSCI Emerging Markets IMI UCITS ETF (Acc) | 18,98% | 6,33% | 27,28% |

| iShares Core S&P 500 UCITS ETF USD (Dist) | 33,35% | 44,40% | 116,60% |

| Vanguard S&P 500 UCITS ETF (USD) Accumulating | 33,32% | 44,36% | 116,45% |

| iShares Nasdaq 100 UCITS ETF (Acc) | 35,35% | 46,98% | 177,74% |

| iShares MSCI ACWI UCITS ETF USD (Acc) | 27,03% | 32,28% | 79,49% |

| Vanguard FTSE All-World UCITS ETF (USD) Accumulating | 26,82% | 31,82% | 78,88% |

| | 30,55% | 37,54% | 103,86% |

Source: justETF

Bond ETFs do not generate as high returns for investors, as they are a more conservative investment tool. Their average annual return is 7%, which corresponds to approximately 1.4% capital appreciation per year.

| Fund name | 1 Y | 3 Y | 5 Y |

| iShares USD Treasury Bond 0-1yr UCITS ETF (Acc) | 7,99% | 19,40% | 19,48% |

| iShares Core EUR Corporate Bond UCITS ETF (Dist) | 6,44% | -3,04% | -1,18% |

| SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF | 6,83% | 0,04% | – |

| iShares EUR High Yield Corporate Bond UCITS ETF EUR (Dist) | 8,33% | 7,32% | 11,88% |

| iShares USD Treasury Bond 3-7yr UCITS ETF (Acc) | 5,69% | 3,55% | 7,31% |

| iShares Core Euro Government Bond UCITS ETF (Dist) | 3,94% | -12,36% | -10,22% |

| iShares USD Short Duration Corporate Bond UCITS ETF (Acc) | 8,24% | 13,68% | 16,98% |

| Amundi Index Euro Corporate SRI UCITS ETF DR (C) | 6,39% | -3,31% | -1,61% |

| iShares USD Treasury Bond 1-3yr UCITS ETF (Acc) | 7,03% | 11,74% | 13,65% |

| iShares J.P. Morgan USD Emerging Markets Bond UCITS ETF (Dist) | 13,43% | 4,53% | 7,56% |

| | 7,43% | 4,16% | 7,09% |

Source: justETF

Commodity ETFs are somewhat of a middle ground between equity ETFs and bond ETFs, with an average 5-year return of 56%, which translates to approximately 11% per year.

| Fund name | 1 Y | 3 Y | 5 Y |

| iShares Bloomberg Roll Select Commodity Swap UCITS ETF USD | 10,68% | 31,53% | 67,46% |

| Amundi Bloomberg Equal-weight Commodity ex-Agriculture UCITS ETF Acc | 14,52% | 23,56% | 48,95% |

| WisdomTree Copper | 14,74% | 6,33% | 56,06% |

| iShares Diversified Commodity Swap UCITS ETF | 10,30% | 21,83% | 47,07% |

| UBS ETF (IE) CMCI Composite SF UCITS ETF (USD) A-acc | 10,85% | 33,43% | 77,83% |

| L&G Multi-Strategy Enhanced Commodities UCITS ETF USD Accumulating | 9,62% | 40,02% | – |

| WisdomTree Brent Crude Oil | 13,78% | 63,25% | 76,25% |

| WisdomTree WTI Crude Oil | 14,27% | 54,32% | 17,45% |

| | 12,35% | 34,28% | 55,87% |

Source: justETF

Risks of ETF Funds

Although ETFs are an effective tool for long-term investing, it is important to recognize that they are not risk-free. Every investor should be aware of the following risks:

Market Risk

ETF funds depend on the performance of the underlying asset or index. If the value of the market that the fund tracks (e.g., S&P 500 or Nasdaq) declines, the value of the ETF investment will also decrease. Market fluctuations can be caused by economic crises, political events, or unexpected global occurrences.

Currency Risk

When investing in ETFs denominated in a foreign currency (e.g., USD), exchange rate fluctuations can affect the investment’s performance. If the fund’s currency depreciates against the investor’s domestic currency, it can reduce the final return.

Liquidity Risk

Although ETFs are generally liquid and traded on the stock exchange, some less popular or narrowly focused ETFs may have lower trading volumes. This means that, in case of need, you might not be able to sell your shares quickly at the desired price.

Concentration Risk

ETFs focused on a specific sector, region, or asset type (e.g., technology companies) are more vulnerable to negative developments in that area. Therefore, these funds carry a higher level of risk compared to broadly diversified ETFs.

Index Tracking Risk (Tracking Error)

ETF funds aim to replicate the performance of a specific index, but in practice, deviations can occur due to management costs, fees, or incorrect portfolio rebalancing.

Interest Rate Risk

ETF funds focused on bonds are sensitive to interest rate changes. An increase in interest rates can reduce the value of bonds in the portfolio, thereby lowering the fund’s returns.

Cryptocurrency Funds as an Alternative to ETF Funds

Cryptocurrency funds are becoming increasingly popular and attracting public attention. Unlike direct cryptocurrency purchases, these ETFs combine the security of traditional investment instruments with the growth potential of digital assets.

These funds operate similarly to traditional ETF funds—they can track the price of a specific cryptocurrency (such as Bitcoin) or function as index funds that include multiple cryptocurrencies, with the fund’s share price calculated accordingly. There are also funds that do not focus directly on cryptocurrencies but rather on blockchain technology. These funds invest in companies developing and innovating in the blockchain sector.

The advantage of cryptocurrency ETFs is their ease of access, as they do not require a crypto exchange. Instead, they can be purchased directly through your broker or investment platform.

Another advantage is security, as these funds are managed by professionals and traded in a regulated environment, where the risk of fraud is minimal. Additionally, diversification is a key benefit—some cryptocurrency ETFs provide exposure to multiple cryptocurrencies, helping to spread portfolio risk.

You might be wondering when to consider investing in cryptocurrency ETFs. These funds are suitable for investors who want to:

- Gain access to the growth potential of cryptocurrencies.

- Invest in cryptocurrencies securely in a regulated environment.

- Avoid the technical complexity of purchasing cryptocurrencies.

- Diversify their portfolio.

If you already know that you are an investor who does not want to miss out on financial innovations and wants to ride the wave of cryptocurrencies, you may be interested in where and how to buy cryptocurrencies or cryptocurrency ETFs.

One of the great solutions for both beginners and advanced investors is Fumbi, which offers the Fumbi Index Portfolio, considered an index fund for cryptocurrencies. The Fumbi Index Portfolio consists of more than 20 cryptocurrencies, collectively representing over 80% of the total market capitalization of the crypto market.

The unique Fumbi Algorithm evaluates and dynamically manages the cryptocurrency portfolio daily to closely mirror the overall market growth, minimizing the risks associated with individual crypto assets. Additionally, the portfolio composition is reviewed and adjusted every three months to ensure that investors are only investing in top verified cryptocurrencies with the highest growth potential.

Your investment is protected with maximum security through the Fireblocks custody platform, which is considered one of the safest cryptocurrency custody solutions in the world. All cryptocurrencies remain under your direct ownership, with Fumbi acting solely as a custodian, ensuring that you have full control over your assets.

What and How to Invest in with Fumbi

Fumbi offers the opportunity to invest in portfolio products as well as individual cryptocurrencies. It’s entirely up to you and your preferences—whether you want to invest only in Bitcoin or balance your investment with other cryptocurrencies.

If you’re interested in cryptocurrencies and want to invest in them, Fumbi could be the right solution for you. Investing is accessible to virtually anyone, and you can start investing in cryptocurrencies with Fumbi from just €50, all in just a few clicks.

Overview of Fumbi Products

Our most popular product, the Fumbi Index Portfolio, currently consists of more than 20 top verified cryptocurrencies. The sophisticated Fumbi Algorithm replicates the growth of the entire cryptocurrency market within this portfolio.

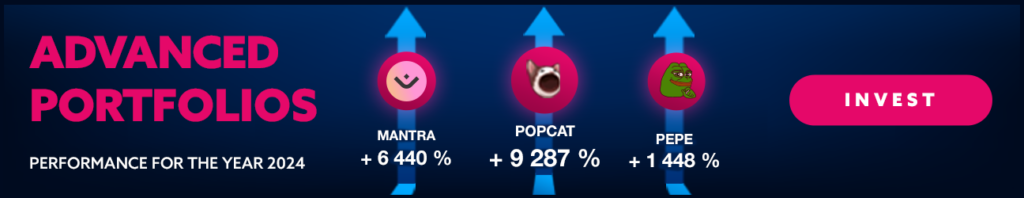

Creating portfolios is now easier than ever. With Advanced Portfolios, you gain access to more than 90 cryptocurrencies and expertly designed templates created by our team, focusing on various sectors within the crypto world. Additionally, you can customize your own portfolio by selecting different cryptocurrency allocations that align with your investment strategy.

In the Staking Portfolio, you will find 10 cryptocurrencies that we will stake on your behalf. These cryptocurrencies have a lower market capitalization than Bitcoin, making them more volatile. However, with higher risk comes the potential for higher returns.

With Fumbi Custom, we offer everyone the opportunity to invest in a cryptocurrency of their choice. Select your preferred cryptocurrency and invest easily, conveniently, and securely. Currently, you can choose from fifteen of the most popular cryptocurrencies on the market.

Bitcoin and Gold

The world-unique product Bitcoin and Gold tracks the value of Bitcoin and the PAX Gold cryptocurrency, which is backed by real gold. The algorithm allocates funds in a 50:50 ratio, intelligently buying the cryptocurrency that has decreased in value and selling the one that has increased. This combination allows you to save for your future easily and without stress.

With Fumbi Gift Vouchers, you can now surprise and delight your loved ones in a unique way—by gifting cryptocurrencies. Give them the opportunity to experience the world of crypto and invest in their future.

Invest safely, easily, and in just a few clicks with Fumbi, starting from €50.

TAKE ADVANTAGE OF CRYPTO’S POTENTIAL

3 min •

3 min •