Bitcoin – The King Among Cryptocurrencies

Investing in cryptocurrencies through Fumbi Index Portfolio means investing in a dynamically rebalanced portfolio of TOP cryptocurrencies on the market. This approach ensures that the investment in the portfolio will evolve according to the movements of the entire market. Such a strategy eliminates the risk of a wrong choice when investing in individual cryptocurrencies.

The main and the most important part of our dynamic portfolio is the most well-known and historically first cryptocurrency – Bitcoin. In the following post, we will introduce the essential characteristics and the fundaments of the birth of this cryptocurrency, which will probably forever remain an integral part of the financial space.

Historical Development of Bitcoin

In 2008 an individual (or a group) acting under the name of Satoshi Nakamoto published an initial document, the so-called whitepaper entitled “Bitcoin – A Peer-to-Peer Electronic Cash System.” This document describes a Peer-to-Peer version of electronic money that allows online payments sent directly from sender to recipient without intervention by any financial institution or other entity.

Bitcoin was the first realisation of this concept. However, there have been several similar attempts in the past. Usually, they failed because these projects eventually turned out to be centralised despite attempts at decentralisation. Others did function as decentralised but could not solve the issue of double-spending successfully. Bitcoin solved this issue with the peer-to-peer network concept thanks to applying the Proof-of-Work algorithm as a consensus tool.

Presently the term cryptocurrency, the main part of which is Bitcoin, includes the characteristics and description of all networks and exchange tools that use cryptography to secure transactions instead of systems where transactions are administered through a central trusted entity.

What is Bitcoin?

Bitcoin can be characterised as a collection of concepts and technologies that form the basis of the digital money ecosystem. Bitcoin is used mainly to store and transfer value among participants in the Bitcoin network. For communication within the network, users use the Bitcoin protocol.

This protocol is open-source software that can run on a wide range of computing devices, including laptops and smartphones, making the technology readily available to everybody.

The Bitcoin network is purposefully designed so nobody, including its authors, governments, banks, or interest groups, can directly control it, falsify, or influence the amount in circulation. There is no “central point” or authority that could make decisions about the network.

The Key Characteristics of Bitcoin

Decentralisation – In traditional centralised transaction systems, every transaction must be verified through a particular central trusted agency (e.g. a central bank). This leads to unnecessary costs, obstacles, and delays. However, a transaction within the Bitcoin network is executed between equal subjects in the P2P network without any central agency verification.

Pseudoanonymity – Every network user communicates with the blockchain through a generated address. Furthermore, each user can generate any amount of addresses to avoid revealing their identity. In this context, pseudo-anonymity means that the transaction participants do not act directly under their own name, but their identifying feature is their generated BTC address. However, it’s different at exchanges. The customers usually have to be fully verified, as nowadays, almost every exchange requires identity verification (KYC) for BTC trading.

Censorship resistance – Censorship resistance is considered one of the most significant contributions of Bitcoin. No country, company, or other third party have enough resources and authority to control who performs transactions or holds their wealth and resources within the Bitcoin network. Since no particular entity governs the Bitcoin network, censoring transactions within the network is virtually impossible.

Transparency – Every transaction within the network is verified and logged so users can easily check and trace all previous entries through the nodes on the distributed network. Users can look up any executed and confirmed transaction.

INVEST WITH FUMBIProof-Of-Work Consensus

Bitcoin uses the proof-of-work consensus as a mechanism to prevent double-spending. Through this algorithm, the miners solve various “mathematical and cryptographic problems” so they can add new blocks into the blockchain. This process of solving algorithms is called mining. POW consensus gives the network a consensus about the state and order of transactions to prevent double-spending of coins.

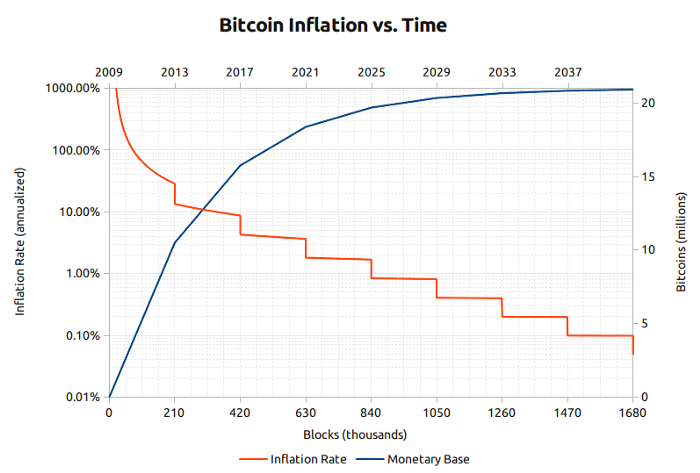

Every transaction within the Bitcoin network has to be added to the blockchain, which makes up the main “ledger” of all network transactions. The miners and their high-performance computers perform transaction verifications and add them into the blockchain. They have to use a large amount of computing power and energy for transaction verification to gain a financial reward currently at 6.25 BTC per block. Based on increasing mining difficulty and decreasing reward (so-called Bitcoin Halving), the last bitcoin should be mined around 2040.

Bitcoin as a Deflation Currency

The maximum amount of bitcoin in circulation should never go over 21 million. The moment the total possible bitcoin supply is mined, their adding in circulation will stop unless the protocol gets changed to allow for a higher amount in circulation. Presently, there is approximately 18.98 million BTC in circulation. Therefore, over 2.02 million has yet to be added into circulation.

Thanks to bitcoin having a fixed amount in circulation, we could say that this cryptocurrency has a deflationary character. While inflation causes a decrease in the purchasing power of money, deflation increases it. A fixed amount in circulation will eventually result in a gradual decrease of bitcoin in circulation.

If fewer and fewer bitcoins are available, according to the law of supply and demand, the demand will increase and thus positively impact its price. In the current situation, strongly influenced by the COVID-19 pandemic, many investors are trying to protect against inflation by investing in assets such as Bitcoin.

Bitcoin as a Reserve Asset

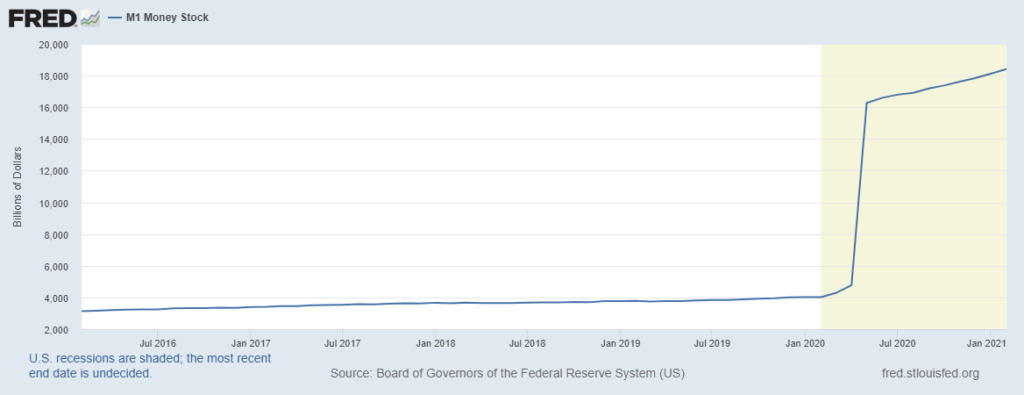

The whole financial sector currently finds itself in a very complicated and

unexpected situation. COVID-19 pandemic has completely changed the macroeconomic background of FIAT money, and FED (Federal Reserve System) continues its ultra-accommodative monetary policy of emitting dollars into circulation. The U.S. dollar’s devaluation is one of the main factors in increasing numbers of investors looking for alternative ways of preserving value.

The number of companies holding Bitcoin as part of their reserve assets is steadily growing. Institutional investors currently own over 1.6 million bitcoins. Companies such as MicroStrategy, Square, Tesla, and many others constantly strengthen the idea that Bitcoin is the right alternative to become the reserve asset, not just during a crisis. Institutional investors cumulatively own over 7.91% of all bitcoins in circulation.

The growth of interest rates on 10-year Treasury notes in the U.S. is connected to inflation worries. The combination of tax allowances, recovering American economy and accommodative currency policy has brought US inflation to its highest level in 40 years. That is just one of the reasons why we can expect another wave of capital influx from institutional investors into Bitcoin.

Risks Associated With Bitcoin

Volatility – In general, the crypto market is one of the most volatile markets in the world. Bitcoin is no exception, although out of the wide variety of cryptocurrencies is one of the least volatile assets on this market.

Regulatory risk – The cryptocurrency sector is generally subject to regulatory uncertainty. On 24 September 2020, the European Commission published a proposal for Markets in Crypto-Assets Regulation (MiCA). Its final version should be known around 2022 and probably won’t take effect until 2024. The main objective of these regulations is to set up generally enforceable rules to protect customers and network users.

51% attack – It represents one of the greatest dangers to blockchain technology. This attack is a hypothetical situation where a group of miners would control over 51% of the network’s total computing power. In such a case, the attackers would be able to prevent new transactions from getting validated, practically stopping transactions between network users. Furthermore, they would be able to influence already executed transactions, which could lead to double-spending. There is no record of a successful 51% attack on the bitcoin network. However, such an attack did succeed, for example, on the Ethereum Classic blockchain.

The baiins.com company describes the probability and costs of a 51% attack on its blog. At the current computing power of the Bitcoin network, the minimum hardware costs needed to perform the 51% attack would be more than $5.46 billion. That doesn’t take into account the costs of equipping datacenters. Furthermore, such an attack would consume an enormous amount of electricity daily.

The cost of one hour of 51% attack on the Bitcoin network was estimated at $716,000, or more than $17.1 million per day. Therefore, the possibility of executing the 51% attack on the Bitcoin network is practically very low and unrealisable. You can find out more about the 51% attack here.

If You Are Considering Investing in Cryptocurrencies, Fumbi Is Here for You

Naše algoritmom spravované portfólio presne sleduje pohyb cien na trhu s kryptomenami. Spoločnosť Fumbi je prvá svojho druhu, pretože ponúka kryptomeny širokej verejnosti, a to aj pri malom vklade. Investovanie do kryptomien prostredníctvom spoločnosti Fumbi je veľmi jednoduché a minimalizuje riziká.

Our algorithm administered portfolio mirrors the price movements of the entire crypto market. The Fumbi company is the first of its kind to offer cryptocurrencies to the general public, even with a small deposit. Investing in cryptocurrencies through Fumbi is very simple and minimises risks.

You can start with a deposit from €50.

INVEST WITH FUMBIHave you come across a term that you did not understand? Don’t worry. You can find all the essential terms related to cryptocurrencies in our Fumbi dictionary.

3 min •

3 min •