Ethereum ETF Is Delayed- Market Info

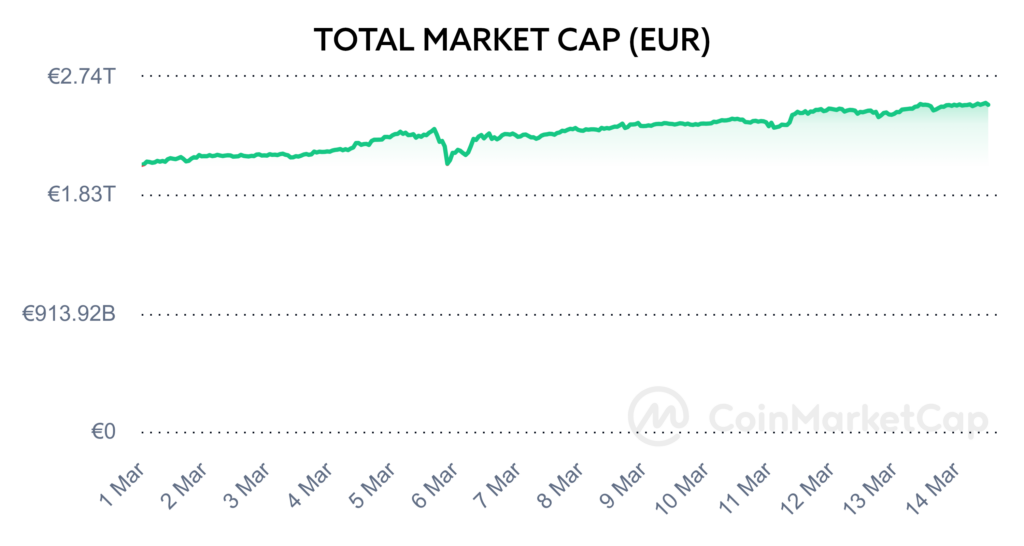

Over the past two weeks, the total market capitalisation exceeded €2.52 trillion. The increase in market capitalisation over a 14-day period is 17.57%. The price of Bitcoin has risen by 15.05% over the last 14 days to a current value of over €66,500. Bitcoin’s dominance is currently around 53.7 %.

Source: Coinmarketcap

Ethereum ETF Is Delayed

A few days ago, the US Securities and Exchange Commission (SEC) once again postponed its decision regarding the possible launch of a spot ETF for the cryptocurrency Ethereum, giving the SEC time to reconsider the proposals submitted.

In filings from BlackRock for its iShares Ethereum Trust and Fidelity for its Ethereum Fund, the SEC said it needed more time to analyze each filing. The move comes as no surprise, according to analysts, and it is very likely that the SEC will delay its decision until the last possible date, as it did with the approval of Bitcoin ETFs.

The SEC first delayed its decision on spot Ethereum ETFs from BlackRock and Fidelity back in January, shortly after it had approved several spot bitcoin ETFs. The SEC can delay its decision up to three times on each filing before making a final decision.

In a Feb. 7 post, Bloomberg analyst James Seyffart said on the social network X that the only relevant date in the case for possible approval of an Ethereum spot ETF is May 23 – the day during which the SEC must rule on VanEck’s application, with no possibility of further stretching and delaying its decision.

The price of the cryptocurrency Ethereum has risen significantly over the past few weeks. Since the beginning of this calendar year, Ethereum has risen by over 76% and has surpassed the $4,000 price level for the first time in more than two years. Ethereum reached its all-time high back on November 16, 2021, when it traded at US$4,891. Source

BlackRock Plans to Buy Bitcoin for Its Fund

BlackRock, the world’s largest institutional asset manager, has announced plans to diversify its global asset allocation fund to include Bitcoin in the near future. In a filing with the SEC, BlackRock revealed its intention to add Bitcoin to the fund, which currently holds about $18 billion in assets.

BlackRock’s Global Allocation Fund, which was launched in 1989, seeks to maximize returns for investors by building a diversified portfolio of U.S. and international asset classes. As of March 7, the fund had $17.8 billion in investments under management, according to BlackRock.

In a filing with the SEC, BlackRock details the fund’s approach to bitcoin ETFs, explaining that it also plans to diversify the fund into bitcoin ETFs that are listed and traded on national securities exchanges.

The effort to add bitcoin to its allocation fund is in response to the ever-growing demand for bitcoin from the firm’s clients, according to BlackRock Chief Investment Officer Rick Rieder. BlackRock launched its own Bitcoin-focused spot ETF two months ago, and BlackRock’s fund is currently the largest of the newly launched Bitcoin ETFs. Source

Grayscale Fund Continues to Sell Out

Grayscale’s Bitcoin Spot Fund, which has been transformed from a Bitcoin Trust to a spot ETF, continues its massive asset sell-off. For the first time ever since spot bitcoin ETFs began trading in the US on January 11, GBTC’s market share has fallen below 50%.

As of March 12, total assets under management in the Grayscale Bitcoin Trust (GBTC) have plunged to $28.5 billion – meaning the fund now holds roughly 48.9% of the $56.7 billion held among the ten US bitcoin ETFs.

On the first day of trading, the fund’s market share was as high as 99.5%, largely because while the other funds were starting virtually from scratch, GBTC was undergoing a transformation and held more than 500,000 BTC. Over time, however, consistent daily outflows from GBTC, which averaged $329 million per day over the past week, have reduced this spot ETF’s market share.

Also playing an important role in the massive sell-offs in the GBTC fund was a February court decision that allowed Genesis, which declared bankruptcy, to liquidate approximately $1.3 billion worth of GBTC shares. Genesis thus began selling off its holdings in GBTC in an effort to return money to investors affected by the company’s bankruptcy.

To date, total outflows from GBTC have reached more than $14 billion, with the pace of outflows slowly but surely decreasing. Source

Miners Make Record Revenues

According to data compiled by CryptoQuant, miners on the Bitcoin network made a daily revenue of $78.6 million on March 7, breaking the previous record set during the peak of the crypto boom in April 2021. Miners are involved in verifying transactions and blocks on the network, for which they collect rewards in the form of newly mined bitcoins as well as transaction fees.

The increase in bitcoin miners’ revenues corresponds with the rise in the price of Bitcoin, which has risen by as much as 70% since the beginning of this year to reach a new all-time high of US$73,000.

Bitcoin miners, however, were one of the hardest hit entities during the 2022 bear market, which saw several crypto scandals and bankruptcies of several companies, including one of the most popular crypto exchanges, FTX. The prolonged slump drove two of the largest firms at the time, Core Scientific Inc. and Compute North, into bankruptcy, while several other companies ran into liquidity problems. However, Core Scientific managed to emerge from bankruptcy and began trading on the exchange again in January.

The upcoming bitcoin halving, which will halve the reward from newly mined bitcoins while reducing the supply-side addition of new bitcoins, will also have a significant impact on the profitability of miners. A much lower amount of new coins will enter circulation, which may put pressure on the bitcoin price.

The current record revenues of miners are allowing companies to expand and buy new mining equipment before the coming halving. Many of them have embarked on massive expansions of their mining operations, with the associated costs of acquiring equipment as well as rising electricity costs. However, many of them need to be vigilant as the price of Bitcoin will play the most important role in their business operations in the coming months. Source

Bitcoin Has Risen 1800% Since the Start of the COVID Pandemic

Exactly four years ago, the arrival of the COVID-19 pandemic caused a crash in various financial markets, with risk assets taking the hardest hit. At that time, Bitcoin plunged by over 50% in two days and reached a value it has never recovered.

On March 12, to be precise, Bitcoin opened its trading day at $7,960 and closed at $4,830, before continuing its massive decline the following day, reaching a price low of $3,860. Its fall was caused by the spread of the coronavirus, with harsh measures and actions being taken by governments, which resulted in economic turmoil.

However, the slump caused by the pandemic was only a momentary affair. Less than a month and a half after the plunge, Bitcoin began to rise again, reaching a price of $10,000. What happened next is something we probably all remember – Bitcoin began to rise sharply, reaching an all-time high of $69,045 roughly a year and a half after the event.

Now, with Bitcoin trading at over $73,000 and reaching new all-time highs, it turns out that Bitcoin has risen as much as 1,800% since the COVID-19 pandemic-induced slump. This means that if you had invested $1,000 in Bitcoin at the time, the value of your investment would now be as high as $18,000.

In the United States, so-called stimulus cheques were also distributed during the pandemic to stimulate consumption and thus prevent a possible economic crisis. Citizens received their first stimulus cheque of $1,200 which was delivered in April 2020. It turns out that if they had used the money from this allowance to buy Bitcoin, the value of their investment would currently be $12,930 – up tenfold. Source

Once Again, Microstrategy

Business intelligence firm Microstrategy earlier this week announced the successful fundraising of $800 million, which it used to purchase additional BTCs. The company used all of the funds and some of its excess cash to purchase an additional 12,000 BTC, bringing the total amount of BTC held by Microstrategy to over 200 thousand BTC.

According to the press release, MicroStrategy raised the funds through a private placement of senior unsecured convertible promissory notes at an interest rate of 0.625% per annum. The fundraising announcement came just under a week after MicroStrategy founder and executive chairman Michael Saylor revealed that the firm was looking to raise $600 million via convertible notes in order to further expand its BTC reserves.

According to available data, Microstrategy currently owns 205,000 BTC, purchased at an average price of $33,706 per BTC. At the current price, the company’s unrealized profit on its BTC investment is thus as high as $8 billion. Source

START INVESTING

3 min •

3 min •