Hong Kong Approves Spot ETF – Market Info

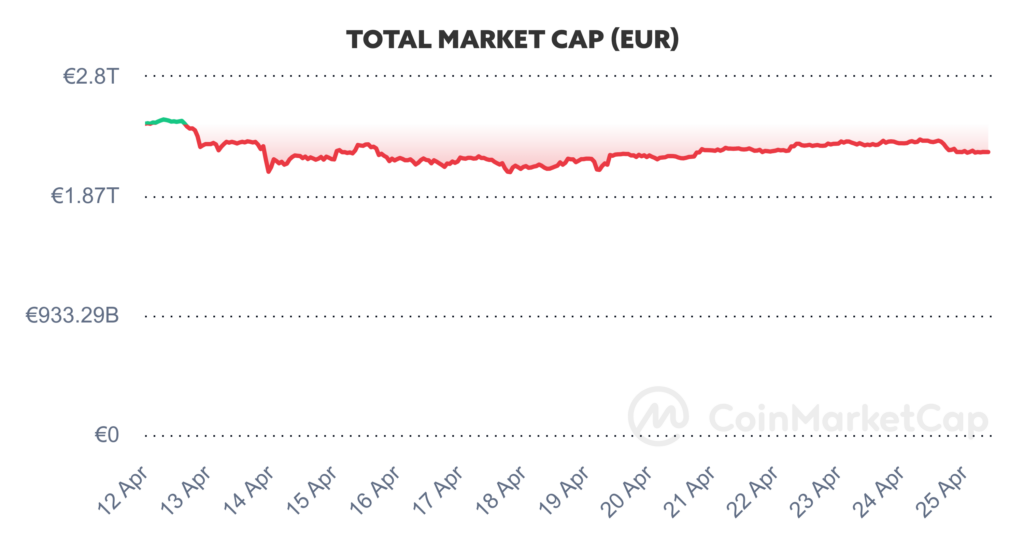

Over the past two weeks, the total market capitalisation exceeded €2.21 trillion. The decrease in market capitalisation over a 14-day period is 8.3%. The price of Bitcoin has fallen by 9.1% over the last 14 days to a current value of over €60,100. Bitcoin’s dominance is currently around 54.9%.

Source: Coinmarketcap

Hong Kong Approves Spot ETF

Hong Kong regulators last Monday officially approved the launch of spot ETF funds focused on cryptocurrencies Bitcoin and Ethereum. Hong Kong will thus follow the United States, which launched the first Bitcoin spot ETF a few months ago.

According to Reuters as well as social media posts, Hong Kong’s Securities and Futures Commission (SFC) has conditionally approved the launch of three funds from Harvest Fund Management, Bosera Asset Management and China Asset Management (ChinaAMC), which will launch their funds in the coming weeks.

Bosera Asset Management will launch its spot crypto ETFs in partnership with Hong Kong-based HashKey Capital, according to information available. ChinaAMC and Harvest Fund Management will operate their funds in partnership with OSL Digital Securities, one of the popular licensed digital asset platforms in Hong Kong.

The Hong Kong regulator has also reportedly approved that the spot BTC and ETH funds will be launched as a so-called “in-kind model,” meaning that new shares in the funds will be able to be issued using BTC and ETH. This model contrasts with the cash-generated redemption model, which allows issuers to create new shares in a fund using only cash. The cash model is currently used for spot bitcoin ETFs in the U.S., as the U.S. Securities and Exchange Commission (SEC) has only allowed applicants to use this model.

Trading start dates are not yet confirmed. Stakeholders are reportedly currently working hard to launch their funds as soon as possible. The launch of these funds is expected to significantly increase capital inflows into the digital asset market in Hong Kong. Source

Three Leading AI Projects Form Joint Alliance

A trio of leading artificial intelligence (AI)-related crypto-tokens will merge after a successful community vote, resulting in the formation of the Artificial Superintelligence Alliance and the creation of a new token called ASI.

The new ASI token will be created by merging the Fetch.ai (FET), SingularityNET (AGIX) and Ocean Protocol (OCEAN) tokens into one common token. In its official statement, the alliance said the new ASI token will have a projected market capitalisation of $7.5 billion when the merger is completed during May.

With the merger also representing the coming together of three different communities, Fetch.ai CEO and new Alliance chairman Humayun Sheikh said that the three projects will continue to operate and develop independently, with only the members of the Artificial Superintelligence Alliance board deciding on new contributions to the Alliance. He said all the projects will continue to operate independently, as is the case now, but will still bring together new and innovative technology to function as a whole.

Back in March, the three crypto-projects announced the formation of the so-called Superintelligence Alliance, whose main goal will be to accelerate investment and development of artificial general intelligence (AGI) and access to AI models and databases. According to the CEO of the SingularityNET project, the goal of the alliance is to compete with corporations that have a high share and control of artificial intelligence.

The alliance also said that the FET token will be renamed the ASI token with a new circulating inventory of 2.63 billion tokens. The AGIX and OCEAN tokens will then undergo conversion to the new ASI token with conversion ratios of 0.433350:1 and 0.433226:1, respectively. The Alliance also confirmed that AGIX and OCEAN tokens will be retired once the merger is complete. AGIX and OCEAN tokens held on exchanges or with asset managers will be automatically converted to the new ASI token.

Our team at Fumbi is actively monitoring the whole situation and will keep you updated on a regular basis. The Fumbi team is also currently preparing everything necessary to convert and upload the new token to our platform. Source

BlackRock Bitcoin ETF Broke a New Record

BlackRock’s Bitcoin ETF on Tuesday ranked among the top 10 ETFs of all time in terms of maintaining a streak of daily inflows into the fund.

On Tuesday, IBIT saw its 70th consecutive day of inflows overall, which effectively means the fund saw a positive increase in total holdings of the underlying asset, in this case, Bitcoin. BlackRock’s fund has also yet to record a single day of Bitcoin outflows from the fund since its launch.

This milestone comes after a series of spot Bitcoin ETF approvals earlier this year that proved extremely successful. Since their launch, U.S. bitcoin ETFs have surpassed an impressive total cumulative trading volume of $200 billion, which only confirms the high demand for bitcoin among U.S. investors. It is BlackRock’s fund that has been the fastest growing fund since its launch, accumulating over 273 thousand BTC worth $18.1 billion to date.

The growing involvement of large institutional players in the cryptocurrency world is a clear sign that Bitcoin is here to stay and will play an increasingly important role in the global financial environment. Source

Bitcoin After Halving

Bitcoin, the most famous cryptocurrency, is currently trading for over 66 thousand US dollars, which is roughly two percent higher than it was during the weekend halving, which was one of the most anticipated events in the cryptocurrency sector this year and which reduced the reward for mining a new block from 6.25 BTC to 3.125 BTC.

Many investors and crypto enthusiasts were surprised by the high fees over the weekend. The halving that took place on the turn of Friday and Saturday drove fees on the Bitcoin network to record highs. According to the website mempool.space, average fees on Saturday were over $120 per transaction, a new record for the Bitcoin network. These fees were driven by the huge number of new transactions, with a high likelihood that investors were willing to pay high transaction fees just to have their transaction included in the block with the serial number 840,000. On Saturday, however, fees on Bitcoin were also rising due to the launch of the new Runes protocol, which brought a new standard for creating tokens on Bitcoin. However, the fees have since dropped significantly and are currently in the $12-$14 range.

A curiosity during Bitcoin halving was one user who paid a fee of $507,000 for his $0.70 transaction. However, it is unknown whether this was an mistake in sending the transaction or whether this user strongly desired his transaction to be included in the halving block.

Block 840,000 was successfully mined by the ViaBTC miner, who collected a generous reward of 37,626 BTC (nearly $2.5 million) in transaction fees in addition to the 3.25 BTC reward for mining the block.

Now, only 450 new Bitcoins will be circulated per day, down significantly from the previous figure of 900 BTC per day. On Tuesday alone, U.S. spot ETFs accumulated more than 1,500 BTC, more than 3 times the daily BTC issuance. Analysts at Bybit even predict that given the reduced issuance of new BTC as well as the current amount of BTC on exchanges, it is possible to predict that BTC will experience a huge supply shock within 9-12 months.

After halving, the Fear & Greed Index increased from 66 points to the current 72 points, which indicates the greed zone. The Fear & Greed Index reached its highest level this year back on March 5, when it reached 90 points and the extreme greed zone. Source

Former Binance Boss May Serve Three-Year Prison Sentence

The U.S. Department of Justice (DOJ) is proposing to sentence Binance founder and former CEO Changpeng Zhao, also known as CZ, to a 36-month prison sentence and a $50 million fine in connection with his role in federal sanctions and money laundering violations by crypto exchange Binance.

In a document released Tuesday night, DOJ lawyers propose an increase in CZ’s prison sentence from the 18-month maximum set in his November 2022 plea agreement. Zhao pleaded guilty to violating the Bank Secrecy Act, with both the prosecution and defence agreeing to a $50 million fine.

Justice Department officials emphasize the seriousness and magnitude of Zhao’s misconduct, and state that the recommended sentence would serve as a strong deterrent to others considering violating U.S. laws for their own financial gain.

Zha’s hearing, originally scheduled for late February, was postponed by mutual agreement to April 30. Since his first appearance in federal court in Seattle, Washington, last year, Zhao has been unable to return to Dubai, where his partner and some of his children reside. Source

Grayscale and BlackRock await SEC decision

The U.S. Securities and Exchange Commission (SEC) will again delay its decisions on applications from BlackRock and Grayscale to launch a spot ETF for Ethereum. The SEC on Tuesday evening released announcements of a delayed decision in the case of an application from Grayscale and a supplemental proposal from BlackRock, just hours after the agency postponed its decision on an Ethereum ETF in the case of an application from Franklin Templeton’s company.

The SEC’s decision to convert Grayscale’s ETH Trust to a spot ETH traded on NYSE Arca was supposed to be made on April 24, but after the SEC postponed that decision, it will now be extended for 60 days until June 23.

Based on the published notice, the Commission believes it is appropriate to provide a longer period of time to issue a decision to approve or disapprove the proposed rule change in order to allow the Commission sufficient time to consider the proposed change.

BlackRock filed an amendment to its application a few days ago, on April 19. The SEC’s announcement on Tuesday, April 23, details the changes found in the addendum, which primarily relate to stock creation and repurchases. The notice also extends the comment period on the proposal for 21 days after it is published in the Federal Register, and no new deadline for the SEC to make a decision has been set in this case.

BlackRock filed an S-1 application for a spot Ethereum ETF back in November 2023. A decision on that application was first delayed in March. In March, the SEC also delayed decisions regarding Hashdex and ARK21 for two months until the end of May. In the case of these companies, however, this is already the final deadline by which the SEC must decide whether or not to approve the Ethereum spot ETF, with no further delay possible. Source

Invest With Fumbi Today

Capitalise on the potential of cryptocurrencies simply, securely and efficiently. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in the Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. Meanwhile, if you want to get a weekly reward from investing, choose the Staking Portfolio with an expected annual reward of 5-7% and no entry or annual fees.

START INVESTINGDid you come across a term in the text that you do not understand? Don’t worry, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •