Institutions Are Entering Bitcoin – Market Info

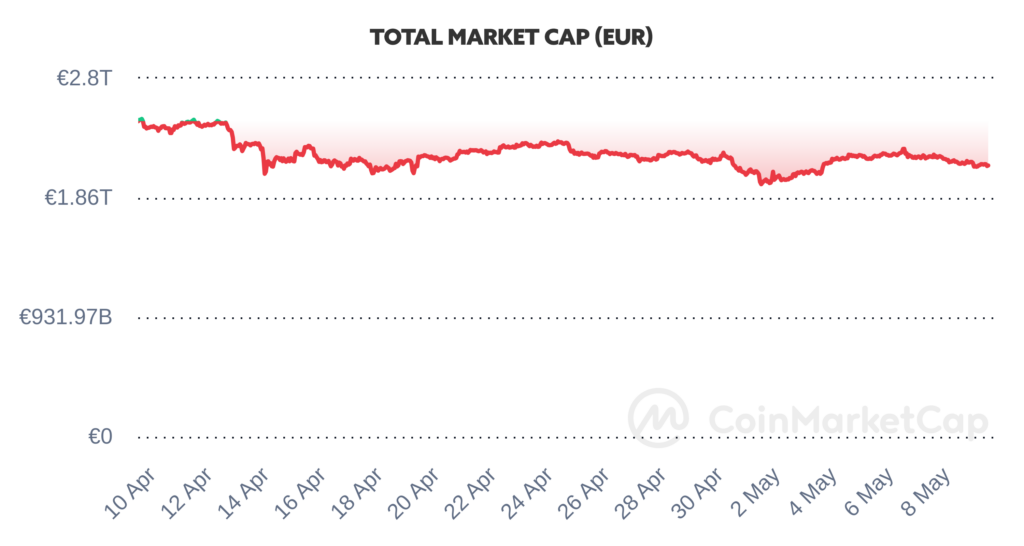

Over the past two weeks, the total market capitalisation exceeded €2.12 trillion. The decrease in market capitalisation over a 14-day period is 4%. The price of Bitcoin has fallen by 5,4 % over the last 14 days to a current value of over €56,800. Bitcoin’s dominance is currently around 54,61 %.

Source: Coinmarketcap

Institutions Are Getting in on Bitcoin

13F filings with the U.S. Securities and Exchange Commission (SEC), which were made public during April and will continue through mid-May, reveal growing institutional interest in bitcoin ETFs. These filings must be made to the SEC by institutions that have assets under management in excess of $100 million.

As the data released so far has shown, holders of U.S. bitcoin ETFs include two major financial institutions – BNP Paribas and BNY Mellon. A filing with the SEC by BNY Mellon showed that the company owns nearly 20,000 shares of a bitcoin ETF from BlackRock called IBIT and approximately 7,000 shares of a bitcoin ETF from Grayscale. BNP Paribas, however, only owns roughly 1,000 shares of IBIT so far.

And although big players are slowly but surely entering the crypto market, their share in bitcoin ETFs is still low. On the other hand, a number of smaller firms have demonstrated in filings with the SEC ownership of bitcoin ETFs that are significantly higher. For example, Pittsburgh-based Quattro Advisors disclosed holdings of as many as 468,200 shares of a spot ETF from BlackRock in its filing. Similarly, another, lesser-known firm, Legacy Wealth, disclosed ownership of 350,000 shares of a bitcoin ETF from Fidelity.

One of BlackRock’s significant holdings of spot ETF shares is Hong Kong-based Yong Rong, which disclosed a few days ago that it holds more than one million shares of the IBIT fund. However, well-known analyst Eric Balchunas pointed out on social network X that Yong Rong is not the only Hong Kong company that owns a U.S. spot ETF. In fact, Hong Kong-based Ovata has admitted to holding as many as four spot bitcoin ETFs worth $74 million, and it turns out that as many as four of its five largest investments were in spot bitcoin ETFs.

Analysts agree, however, that we are still early in the bitcoin ETF investment landscape and shouldn’t expect too much from the first quarter. Moreover, according to analysts, most of the major institutions are only releasing their filings just before the final deadline, which means that it is likely that we will still see a few major names gradually admitting their investments in bitcoin ETFs. Source

Stablecoins Strengthen Their Market Position

Despite last week’s correction in the cryptocurrency market, stablecoins continue to strengthen their position in the market. In the last 30 days alone, more than $4 billion of new stablecoins have been issued, according to data platform Artemis, with the total market capitalization of stablecoins rising 2.5% from $157 billion to $161 billion over the last month.

Stablecoins are a type of cryptocurrency that is pegged to a fiat currency such as the Euro or Dollar at a 1:1 ratio. Because stablecoins retain their value, they are used as a tool to protect against market volatility, but they are also seen as a vehicle through which investors enter their trading positions.

Capital inflows into stablecoins are a commonly used metric by analysts to measure market liquidity. As most cryptocurrencies are traded in currency pairs on both centralised and decentralised exchanges with stablecoins, the growth in the market capitalisation of stablecoins is perceived as positive.

The data also showed that investors referred to as “smart money” realized profits in a big way last week and are currently holding their stablecoins, which may indicate a potential conversion of stablecoins into various cryptocurrencies over the next few days. According to Nansen, a blockchain data analytics company, the share of stablecoins held by this type of investor rose from 5.54% to 8.63% between April 28 and 30. However, after reaching 8.63% on 1 May, the share of stablecoins among these investors began to decline, currently hovering around 6.82%. The decline in stablecoin shares means that traders are converting their stablecoins into other cryptocurrencies. Source

Bitcoin Network Has Already Processed 1 Billion Transactions

The new record is here! The Bitcoin network crossed the 1 billion transactions processed mark earlier this week, marking a huge milestone for the Bitcoin network, demonstrating the growing popularity and adoption of Bitcoin as a means of payment and store of value.

This significant milestone was reached 15 years, four months and four days after Bitcoin’s pseudonymous founder Satoshi Nakamoto mined the first Bitcoin block on January 3, 2009. There is no denying that since its launch in 2009, Bitcoin has seen exponential growth, with the number of transactions on the network steadily rising and averaging up to 178,475 transactions per day. However, this number does not include transactions made on the Lightning Network, a payment protocol built on top of Bitcoin’s second layer that allows for faster and cheaper transactions.

The number of daily transactions on the Bitcoin network saw a spike around the fourth halving, with a record 926,000 transactions processed in a single day on April 23. This high amount of transactions was mainly due to the launch of the Runes protocol with a block utilization of 840,000.

Despite being the oldest and most well-known cryptocurrency network, Bitcoin is not the first network to process a billion transactions. Bitcoin’s biggest rival and the second largest cryptocurrency, Ethereum, has already processed more than two billion transactions since its launch in 2015, according to data from the Etherscan platform. Source

ETF From Grayscale Sees Capital Inflows for the First Time

Currently still the largest bitcoin ETF fund from Grayscale, it has seen its first-ever net inflows since the spot ETFs launched in January. The Grayscale Bitcoin Trust, which has more than $18 billion in assets under management, saw capital inflows of about $63 million on May 3. That’s a broad contrast to recent months, during which the fund has seen outflows of about $17.4 billion since it was converted from a Bitcoin Trust to a spot ETF.

The main reason for the high capital outflows from the GBTC fund was that investors were moving assets from GBTC into new and cheaper funds offered by its competitors, including BlackRock and Fidelity. Indeed, GBTC charges a management fee of 1.5%, while its competitors charge a fee of around 0.3% in most cases in their funds.

However, Grayscale’s position as the largest bitcoin ETF in terms of assets under management is under threat from BlackRock and its iShares Bitcoin Trust (IBIT), which has $16.91 billion under management as of January 2024.

Grayscale CEO Michael Sonnenshein was asked in a Bloomberg Television interview in April about when management fees in the GBTC fund might drop. Sonnenshein responded by saying that his company plans to create a new “mini” version of the Bitcoin ETF. A few days after that, Grayscale made public that it would ask the Securities and Exchange Commission (SEC) for approval to allocate a portion of GBTC’s assets to a new Bitcoin Mini Trust with a lower management fee, which initial information suggested would be around the 0.15% level. Should the fund become a reality, the Bitcoin Mini Trust would have the lowest fees of any Bitcoin ETF launched in January. Source

SEC Continues Its Aggressive Policy

Every crypto fan knows that the U.S. Securities and Exchange Commission (SEC) under the leadership of Gary Gensler has been actively fighting against cryptocurrencies and companies operating in this area for a long time. The most recent victim is the popular trading platform Robinhood.

On Monday, May 4, Robinhood officials said that the company received a law enforcement notice from the SEC regarding cryptocurrencies traded on its platform. The company said it received what is known as a “Wells notice,” which the SEC sends to companies when it plans to take action against them. It should be added, however, that such a notice does not necessarily mean that the company has committed wrongdoing.

Dan Gallagher, Robinhood’s Senior Director of Legal, Compliance and Corporate Affairs, commented on the Wells Notice that Robinhood firmly believes that the assets traded on its platform are not securities. He also added that they look forward to working with the SEC in clarifying this case.

The SEC has long enforced a tough stance on the digital currency industry, arguing that most tokens in the cryptocurrency sector are securities and subject to its registration rules, while crypto firms accuse the SEC of overreaching into the cryptocurrency market.

“If necessary we will use our resources to contest this matter in the courts,” Robinhood CEO Vlad Tenev said in a post on social network X. The SEC has served similar notices to Coinbase and Binance in the past, with Coinbase being the company that has long argued and pushed the view that crypto assets, unlike stocks and bonds, do not meet the definition of securities. It is because of this that the SEC is currently engaged in a legal battle against Coinbase. Source

US Interest Rates Remain Unchanged

The Federal Open Market Committee (FOMC) left its benchmark interest rate range unchanged at 5.25%-5.50% during last week’s meeting.

This decision was in line with investor expectations that the Fed would leave interest rates at a higher level for a little longer. This was later confirmed during a press conference by Fed Chairman Jerome Powell, who acknowledged that progress in reducing inflation has stalled this year, saying it would not be appropriate to cut rates until the central bank was sufficiently confident that inflation was moving towards 2%.

In addition to the rate news, the FOMC announced that it was slowing the pace of reducing the securities held on its balance sheet – so-called quantitative tightening (QT) – from $60 billion per month to just $25 billion per month. The lower pace of portfolio reduction allows the Fed to better manage liquidity in the market and is one more way to ease monetary policy.

Markets entered 2024 with expectations of an early rate cut by the U.S. central bank, but those expectations have diminished considerably in recent weeks as the economy continues to show strength and inflation rose modestly in the first four months of this year. According to CME’s FedWatch tool, investors currently forecast at 91.3% that the Fed will not change its interest rates in June, with an 8.7% probability of a 25 basis point cut to the 5-5.25% range. Source

Invest with Fumbi today

Harness the potential of cryptocurrencies simply, safely and effectively. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. And if you want to earn a weekly reward from investing, choose the Staking Portfolio with an expected annual reward of 5-7% and no entry or annual fees.

INVEST WITH FUMBIHave you come across a term in the text that you don’t understand? Never mind, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •