Ripple Achieved an Important Victory – Market Info

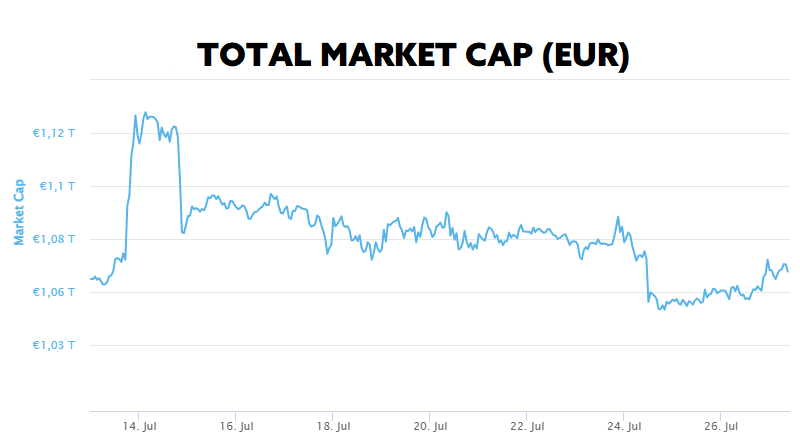

Over the past two weeks, the total market capitalisation exceeded €1.07 trillion. The increase in market capitalisation over a 14-day period is 0.93%. The price of Bitcoin has fallen by 2.75% over the last 14 days to a current value of over €26,450. Bitcoin’s dominance is currently around 48.2 %.

Source: Coinmarketcap

Ripple Achieved an Important Victory

In 2020, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs Inc. and some of its executives. The SEC said at the time that the sale of the cryptocurrency XRP, of which Ripple Labs was the issuer, was illegal because XRP was an unregistered security, according to the Commission.

Ripple Labs, however, was undeterred by the allegations and decided to fight for its right. Ripple officials argued that XRP is a cryptocurrency and its distribution and use were not under the company’s control and therefore should not be considered a security. The dispute between Ripple and the SEC has dragged on for more than 2.5 years.

Around the middle of this calendar month, significant progress was made in that litigation. Judge Analisa Torres, who was in charge of the dispute between Ripple and the SEC, issued a partial ruling that XRP cryptocurrency sold to retail investors on exchanges and through algorithms is not a security. However, the judge also ruled that the offering of XRP to institutional investors was a sale of unregistered securities.

In response to the ruling, the cryptocurrency XRP rose as much as 75% in a matter of hours. Other altcoins, such as Polygon (MATIC) and Cardano (ADA), which were designated as securities by the SEC a few months ago, rose as well.

The judge’s decision was viewed very positively by the wider crypto community. Indeed, the recognition that XRP is not a security when sold to retail investors sets an important precedent for other lawsuits, as the SEC has recently accused countless cryptocurrencies of offering to sell unregistered securities. Although the decision is specific to this particular case, it is likely to provide a fresh charge for other institutions battling with the SEC over whether their products fall under the regulator’s jurisdiction.

An SEC spokesman said the agency was pleased with the part of the ruling in which the judge ruled that Ripple violated federal securities law by directly selling XRP to institutional investors. However, the agency was not satisfied with the ruling regarding sales to retail investors. It will now be very interesting to see if the SEC appeals the court’s decision. Source

SEC Accepts Applications for Spot ETFs

The U.S. Securities and Exchange Commission (SEC) has accepted applications to create bitcoin spot exchange-traded funds (ETFs) from six firms, including BlackRock, the world’s largest institutional asset manager. This is the first step in the agency’s process of deciding whether or not to approve the applications filed.

The SEC’s acknowledgement of receipt of the applications marks the start of the formal review process for each proposal. And while this is the first step in a long regulatory journey, it signals the SEC’s readiness to explore the idea of a spot bitcoin ETF and assess its potential impacts and risks.

In addition to Blackrock’s application, the SEC has formally accepted applications from Bitwise, VanEck, WisdomTree Fidelity, and Invesco seeking to create a spot ETF, and those proposals are now available in the Federal Register.

The competition between companies vying to be the first to launch a spot ETF in the United States is seen by many as a positive development for the crypto industry as a whole. As more companies seek to launch these types of funds, analysts believe that as the number of applications increases, so do the chances of the first spot Bitcoin ETF being approved, as the SEC can review and compare multiple options and approaches. Source

Tesla Continues to Hold Its BTC

For the fourth quarter in a row, Tesla did not sell and did not purchase any more cryptocurrencies. The electric vehicle maker continues to hold approximately $184 million worth of remaining bitcoins, as the quarterly earnings results from companies in the United States showed.

Tesla hasn’t bought or sold any bitcoins since the second quarter of last year when it last sold more than 30,000 bitcoins – representing roughly 75% of its total holdings – for $936 million. Tesla first bought $1.5 billion worth of bitcoins back in March 2021, with CEO Elon Musk promising at the time that Tesla would accept bitcoin as a payment method for its products in the future. However, Musk suspended Bitcoin payments after a short period of time, citing environmental concerns due to Bitcoin’s high energy consumption.

Tesla beat analysts’ expectations in the second quarter, with the company reporting adjusted earnings per share of $0.91, beating analysts’ forecasts, who were expecting adjusted earnings per share of $0.81. The company’s revenue came in at $24.93 billion, with analysts expecting revenue of $24.56 billion. Source

Bitcoin Surpasses 800,000 Blocks Milestone

This Monday, a block with the sequential number of 800 thousand was mined on the Bitcoin network, which is seen by supporters and crypto-addicts as another significant milestone in the history of the world’s most popular and largest cryptocurrency.

The block was 1.64 megabytes in size, contained 3,721 transactions, and was mined at a price of $29,815 per Bitcoin. The miner who managed to mine this block received a reward of 0.137 BTC in transaction fees in addition to the block reward of 6.25 BTC. In total, the successful miner of this block thus collected 6,387 BTC worth $189,907.

The average time to mine one block in the Bitcoin network is roughly 10 minutes. This means that, on average, 6 blocks are mined per hour 144 blocks are mined in any one day. The block number labelled 800,000 refers to the location of that block in the blockchain and also reflects how many blocks have been mined from the launch of Bitcoin until today. In practice, the more blocks that are added to the blockchain, the more resilient the blockchain becomes to potential attacks.

At the same time, mining a block with an 800,000 sequence number means that the event of halving the block reward, known as bitcoin halving, will take place after another 40,000 blocks have been mined. At a mining rate averaging 10 minutes per block, this means that the next halving will take place with a high probability as early as the end of April 2024.

Historically, all three halvings so far have seen the Bitcoin price rise significantly. However, no one can predict with certainty whether history will repeat itself for a fourth time or whether we will see a completely different scenario from what we have been used to in the past. Source

Long-Term Holders Continue Not to Sell

According to estimates by analyst firm Glassnode, Long-Time Holders (LTH) currently own as much as 14.52 million BTC, representing up to 75% of the circulating BTC stock. Roughly 25% of the circulating stock is held by short-term holders and speculators.

Investors who hold their BTC without movement for more than 155 days are considered long-term BTC holders based on this metric. These investors have been gradually increasing their exposure to Bitcoin over the past month, despite Bitcoin experiencing much lower volatility during the summer months and consolidating in the region of around $30,000. Statistically, the longer an investor holds their coins, the less likely they are to sell off their BTC in the near future. Long-term holders are generally considered to be more decisive investors than short-term holders.

Sustained accumulation by long-term holders bodes well for the future of Bitcoin. Their accumulation and conviction signal a belief in the potential of cryptocurrencies and resilience to short-term market fluctuations. Sometimes, however, it can take longer to see the results of long-term investing. Therefore, it is necessary to be patient, invest regularly and wisely. Source

Interesting Fact: Twitter Is Rebranding

The boss of Tesla, SpaceX and Twitter, Elon Musk, took significant steps this week to fulfil his plan to turn the social network Twitter into a new “X” brand. According to tweets, Musk plans to bring new features to the platform and add new apps, such as the ability to search for jobs or adding a dating app.

The changed logo from the legendary blue bird to the new “X” logo can already be seen on the site. Elon Musk made a similar move on Twitter’s headquarters building.

However, Elon Musk hasn’t forgotten about his favourite cryptocurrency Dogecoin once again. Dogecoin has risen as much as 13% over the past 7 days after Elon Musk added the Dogecoin symbol to the location box in his Twitter profile description (?Ð).

Rumours have been circulating for some time that Dogecoin could be integrated into the platform as a form of payment in the future. Back in January, there were reports that Musk and his team were working on a product that would support crypto payments directly on Twitter. Source

TAKE ADVANTAGE OF CRYPTO’S POTENTIAL

3 min •

3 min •