The Arrest of Telegram’s CEO Has Sparked a Strong Reaction – Market Info

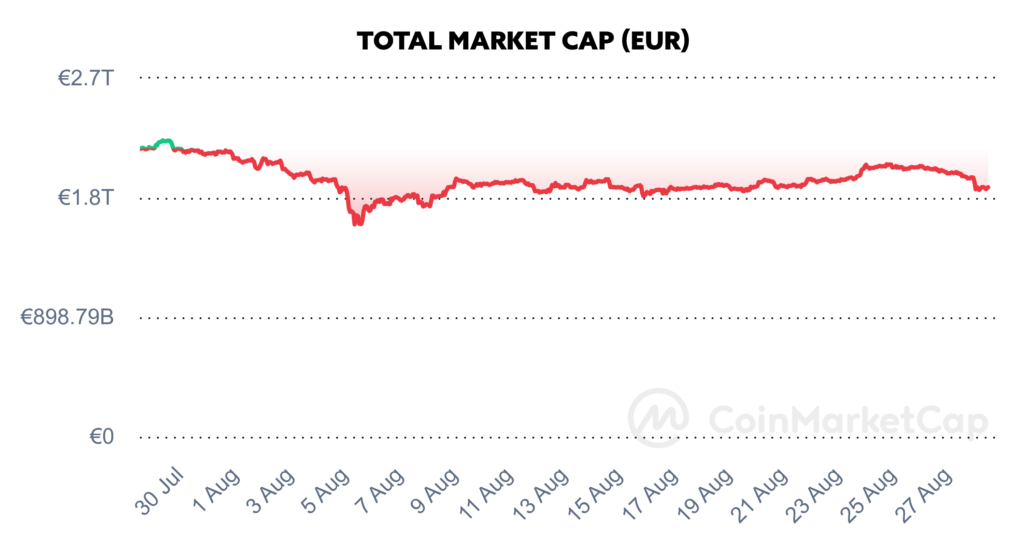

Over the past two weeks, the total market capitalisation exceeded €1.87 trillion. The decrease in market capitalisation over a 14-day period is 3.6%. The price of Bitcoin has fallen by 2.1% over the last 14 days to a current value of over €53,800. Bitcoin’s dominance is currently around 57.3%.

Source: Coinmarketcap

The Arrest of Telegram’s CEO Has Sparked a Strong Reaction

The cryptocurrency Toncoin plummeted dramatically a few days ago following the news of the arrest of Pavel Durov, CEO of Telegram in France. The cryptocurrency has dropped by more than 14.5% and is trading at around €4.90 at the time of writing. The drop reflects the state of uncertainty among investors in the market due to the legal troubles that Telegram’s founder is going through.

Pavel Durov, the CEO and founder of Telegram, has been arrested in France, which has shaken not only the financial market but also the technology world. The French OFIM, the French National Police’s Department for the Prevention of Violence Against Minors, issued an arrest warrant for Pavel Durov on charges of involvement in drug trafficking, distribution of child pornography and also fraud. According to media reports, Durov is not directly involved in these crimes, but OFIM considers him an accomplice due to his lack of moderation of content on the social network Telegram and his refusal to cooperate with law enforcement.

The arrest has not escaped the attention of Elon Musk, who has sided with Durov and publicly called for his release. The arrest sparks a global debate about the responsibility of technology platforms and the rights of individuals.

Source: Coindesk

Durov’s arrest also raises questions for public communication platforms about their responsibility to moderate content and cooperate in criminal investigations. Telegram has been criticized for its lack of censorship and filtering of content, and in recent months in particular, there have been increasing reports that the lack of content moderation is creating a space for organized crime, which has resulted in legal action. Source

RWA Tokens Reach 10 Billion Milestone

The market for tokenized real assets (RWAs) is growing in popularity and, with an increase of $2 billion since the beginning of this year, now has a total value of approximately $10.9 billion.

Currently, the global RWA credit market is worth $8.1 billion, tokenised US Treasuries are worth $1.9 billion, while other asset classes remain below the $1 billion mark. Tokenized U.S. Treasuries emerged as a significant area of RWAs in 2024, as their value nearly tripled from $726.23 million, which may indicate growing demand for traditional digital assets.

Major banks and investment firms are also increasingly engaging in this market. One example is BlackRock and its BUIDL fund, which was launched in March in response to the growing demand for tokenisation of real-world assets. The increased demand for blockchain-based products is evidenced by this fund, which is enjoying huge popularity.

Franklin Templeton and Grayscale, for example, are among the institutions that have joined the RWA sector. Franklin Templeton currently offers a product called Onchain on the Nasdaq exchange and uses blockchains such as Arbitrum or Avalanche to tokenise securities. Grayscale, in turn, covers a wide range of crypto-investment funds targeting different tokens, making both CeFi and DeFi markets more accessible and easier to connect. Other large institutions are reportedly already exploring similar options.

In the area of decentralized finance, Ondo Finance is emerging as one of the leading platforms in the RWA token market. The total locked value on this platform is more than $536 million, making this protocol a major player in the RWA market. Source

Nasdaq Wants Options on Bitcoin Index

The US exchange Nasdaq, one of the largest exchanges in the world, plans to expand its presence in the cryptocurrency market. Nasdaq is seeking approval to start trading options on a bitcoin index that would give institutional investors and traders new tools to manage risk and hedge their exposure to bitcoin. The move could represent a significant milestone in the normalisation of Bitcoin as an investment class.

Options are financial instruments that allow traders to buy or sell an asset such as a stock, index or ETF at a set price on a specific date. This mechanism is particularly useful for institutional investors looking for ways to protect their portfolios from the volatility of the cryptocurrency market. It is also for this reason that Nasdaq has officially announced its intention to launch bitcoin indexing options and has sought approval from the U.S. Securities and Exchange Commission (SEC)

The proposed options will be based on the CME CF Bitcoin Live Index developed by CF Benchmarks. The index would track Bitcoin futures and options contracts traded on CME Group’s platform.

Matt Hougan, chief investment officer at Bitwise, stressed that the existence of Bitcoin options is critical to the full normalization of this investment class. Hogan noted that these options could fill an important “liquidity hole.” This can help provide better accessibility and flexibility for investors in the Bitcoin market. Source

BlackRock and Grayscale Hold Nearly 3% of Bitcoin Supply

In recent weeks, we have seen significant growth in Bitcoin ETF investments. Funds from BlackRock and Grayscale have seen particularly large increases, with their combined Bitcoin holdings recently reaching almost 3% of the total Bitcoin supply, proving that investor interest is growing and has not been deterred by the recent correction in the cryptocurrency market.

Within the available ETF funds, BlackRock’s iShares Bitcoin Trust (IBIT) currently manages 357,736.76 BTC, while Grayscale’s GBTC manages 227,712.33 BTC. This represents 2.97% of the entire Bitcoin stock. The demand for Bitcoin ETFs, represented by these numbers, is helping Bitcoin solidify its position as a digital entity in the market and become an increasingly larger and respected part of the financial markets.

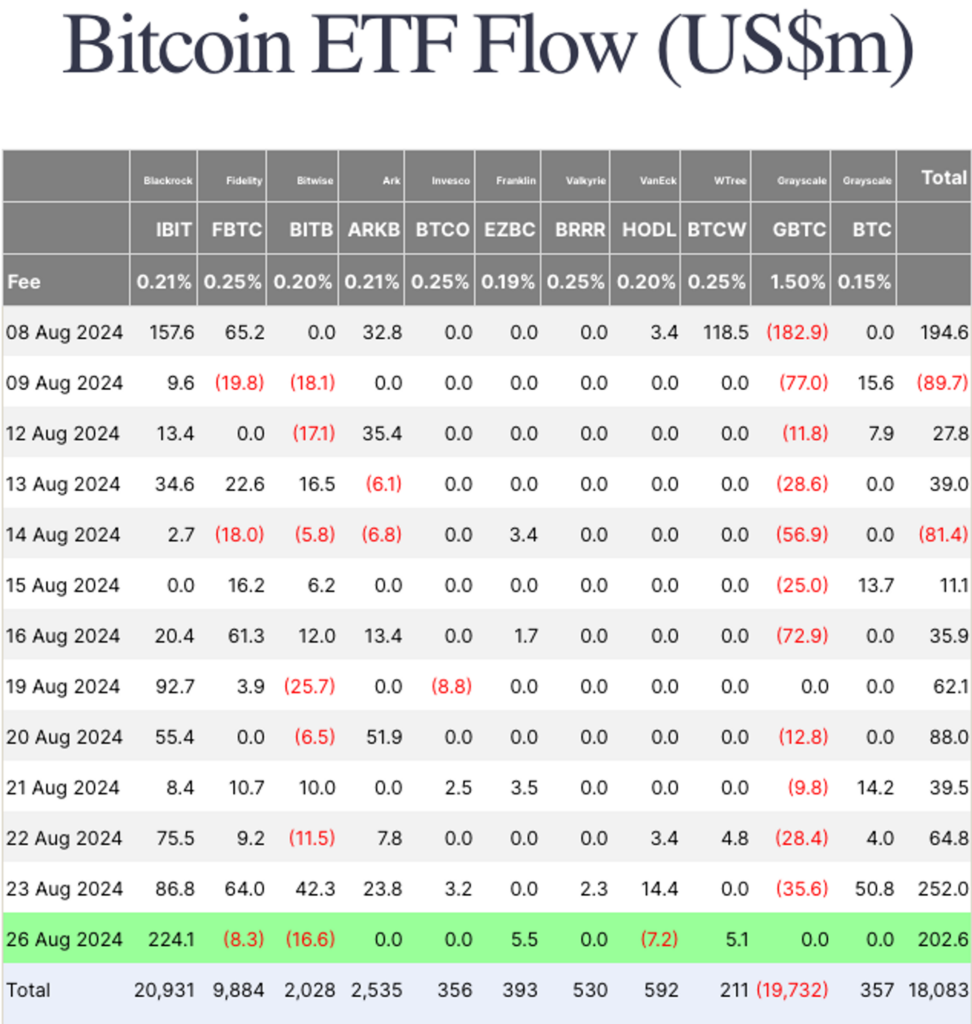

U.S. spot bitcoin ETFs saw net inflows of $202.6 million yesterday, stretching the streak of capital inflows to just eight days. Last week, spot ETF inflows totalled $543 million and was one of the best weeks in months. Source

BlackRock’s Bitcoin ETF Has Seen the Largest Capital Inflows in 35 Days

Last Friday, the fund saw a net inflow of $224.1 million in capital from BlackRock, the largest inflow since July 22, when the fund saw $526.7 million in capital. The capital inflow was in response to Friday’s nearly 2% drop in Bitcoin’s value, as such inflows indicate that investors are taking advantage of declines in Bitcoin’s price to accumulate additional capital.

Inflows into IBIT contributed to 11 spot Bitcoin ETFs in the United States seeing net daily inflows of $202.6 million on Friday. The other two funds that saw inflows were the $5.5 million Franklin Bitcoin ETF (EZBC) and the $5.1 million WisdomTree Bitcoin Fund (BTCW). Bitwise, Fidelity and VanEck saw net outflows totaling $32.1 million.

While most Bitcoin ETFs saw capital inflows, things were not so cheery for funds focused on the cryptocurrency Ethereum. Ethereum ETF funds saw capital outflows of $13.2 million on Friday, which was related to Friday’s drop in Ethereum’s price of over 2%.

Source: Cointelegraph

Other crypto-investment products also saw the largest weekly capital inflows, according to data from CoinShares. The renewed interest in crypto-investment products was very likely driven by expectations that the Fed could cut interest rates as early as September. This possibility was hinted at last Wednesday by Fed Chairman Jerome Powell, who said that inflation is trending as expected and therefore he sees no reason to keep rates at current levels. Source

Invest With Fumbi Today

Harness the potential of cryptocurrencies simply, safely and effectively. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in the Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. If you want to build your own crypto portfolios, choose the Advanced Portfolios product, where you will have access to more than 80 cryptocurrencies and templates created by our team, focusing on various areas within the crypto world.

INVEST WITH FUMBIHave you come across a term in the text that you don’t understand? Never mind, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •