Where and How Is It Best To Invest Money?

You may have heard about investing, but you might not have a clear understanding of what the term truly means and encompasses. This article will cover all the essential points and aspects of investing, providing you with a comprehensive overview of what you can expect from it. Through practical examples, we’ll explain what investing means, and why it’s important, and together we’ll dispel the myths that have surrounded investing for years. Our experts will also offer advice on where to invest money currently sitting in regular accounts.

In the article, you will learn about:

- What investing is and the types of investments

- Why investing is important

- The biggest myths about investing

- Where to invest your money

- How and where to invest money most effectively

- Where to invest money in today’s market

- 10 principles for safe and effective investing

- How and where to invest with Fumbi

What Is Investing and What Are the Types of Investing?

From a theoretical perspective, investing is described as an activity where capital or money is placed in financial markets to gain additional income or profit. This means that free funds are used to purchase various financial instruments, such as stocks, bonds, cryptocurrencies, real estate, or shares in mutual funds. However, investing does not solely imply financial investments in certain assets. Investing in oneself is equally essential, encompassing the development of personal skills, education, health, and personal growth. Such investments yield long-term benefits, like better career opportunities, increased productivity, personal satisfaction, and an improved quality of life. In this article, though, we will focus on investing as a form of capital placement in financial markets.

Today, there are two basic types of investing:

Regular Investing – With regular investing, an investor selects a certain amount to invest each month (or at another interval). It’s like setting aside a portion of money each month, but instead of “under the mattress” or in a bank account, it is regularly invested to increase its value. Regular investing allows an investor to average out entry costs, minimizing the impact of market volatility on their investments. It’s also a suitable strategy for investors who don’t wish to time the market or determine the ideal time to invest.

Lump-Sum Investing – In lump-sum investing, the investor has a significant amount of money and invests it all at once. This strategy is particularly beneficial when the market has recently dropped since the investor can buy assets at a lower price, with potential future growth increasing the investment’s value as prices rise again. However, if the investor invests when the market is high and asset prices are elevated, this can carry greater risk. No growth lasts forever, so timing is essential with lump-sum investments.

To illustrate, let’s look at some familiar activities:

Imagine reading a few pages from an educational book daily. It may be just 10-15 minutes of your day, but over several months, you could finish multiple books, gaining valuable knowledge for personal growth. This is like regular investing, where small steps lead to significant gains over time.

As an example of lump-sum investing, think of buying a house. Suppose you plan to save money for your dream home instead of purchasing it with a mortgage. At a certain point, you save enough to make the purchase, buying the house for €60,000. This is lump-sum investing since you used your funds for a single purchase, and as the home’s value rises, you achieve an appreciation on the property.

Why Is Investing Important?

Inflation Affects Everyone

You may have noticed complaints, either from yourself or others, about how things used to be cheaper, allowing for savings even after spending. Yes, there’s some truth to that – but this sentiment has been shared by previous generations and will be echoed by future ones. This perspective is driven by inflation.

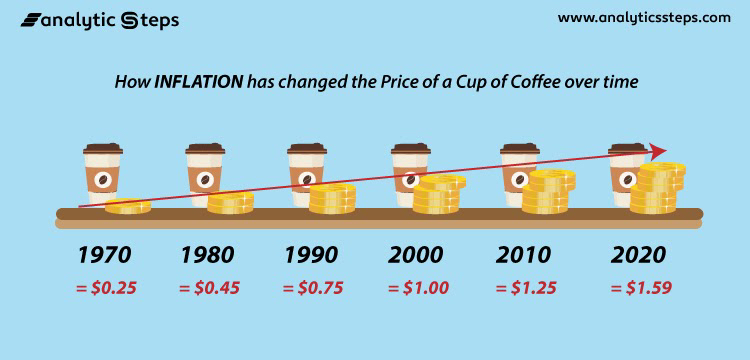

We live in an environment where inflation constantly reduces the purchasing power of money, eating into savings in bank accounts. Consider the price of a cup of coffee: in 1970, people in the U.S. could buy a coffee for around $0.25. Today, buying a coffee for that price is impossible, with current prices exceeding two dollars. Similarly, money stored for a long time in bank accounts loses purchasing power, meaning people can afford fewer goods with the same amount over the years. However, this erosion of purchasing power can be reduced or even eliminated, thanks to investing.

Source: AnalyticSteps

Building Wealth Through Investing

Investing is an excellent way to gradually build wealth and achieve financial freedom. The money you invest won’t just sit idly in an account; it will start “working” for you and generating profit. Whether you choose to invest in stocks, cryptocurrencies, or other assets, your invested funds can grow over time. One of the best aspects of investing is the power of compound interest. Profits earned can be reinvested, yielding additional gains. This way, your investment gradually grows larger. The sooner you start, the more time your wealth has to increase. Even small but regular investments can yield substantial returns over the years.

Preparing for Retirement

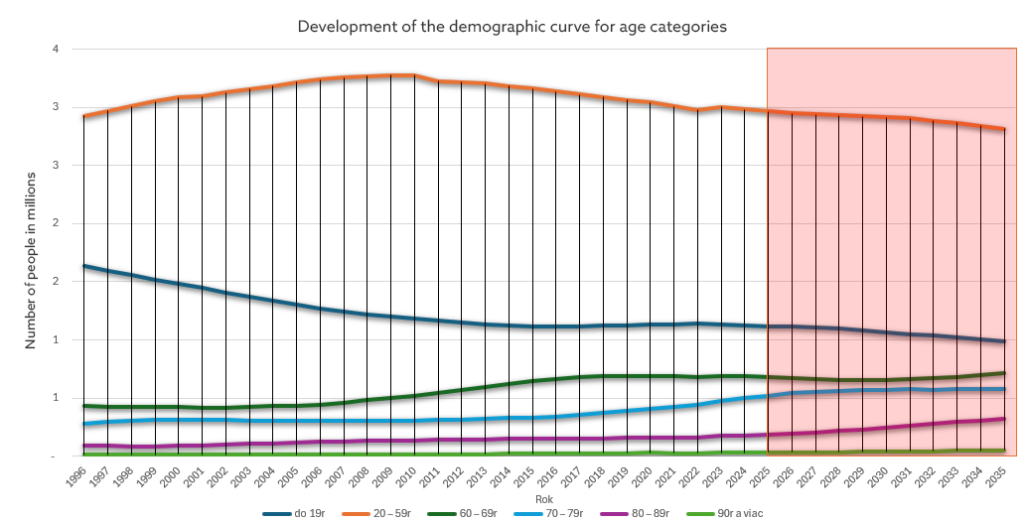

Let’s be honest; demographic trends in Slovakia are not very favorable. According to the Employment Institute, the population aged 20 to 59 is expected to decline, while those over 60 will increase. This means more retirees and a shrinking workforce.

In the future, many of us may face the decision of either extending our work years or relying on state support. For this reason, one of the most critical financial steps you can take for yourself and your family is to prepare for life after active work. The state pension system should be structured to reward you for your years of work through a pension. However, relying solely on it would be highly irresponsible. Slovakia’s pension system is under increasing pressure and may not be able to provide a sufficient pension for today’s young people to maintain their current standard of living. The sooner each of us begins preparing for this and starts investing surplus funds, the better lifestyle we can secure for ourselves in retirement.

Source: Own Analysis Based on the Employment Institute

The Biggest Myths About Investing

Myth #1: It’s Safer to Keep My Money in the Bank

Many people believe that keeping money in the bank is the safest option, which is not entirely true. While bank deposits are protected, for instance, by deposit insurance funds up to €100,000, money sitting in a bank account earns practically no return and is vulnerable to inflation, which steadily reduces its real value. Although a bank account may seem secure as you see the same amount over time, in reality, money left in the bank loses purchasing power over the long term. On the other hand, investments carry some risk but can offer better returns and protect wealth from inflation over the long haul.

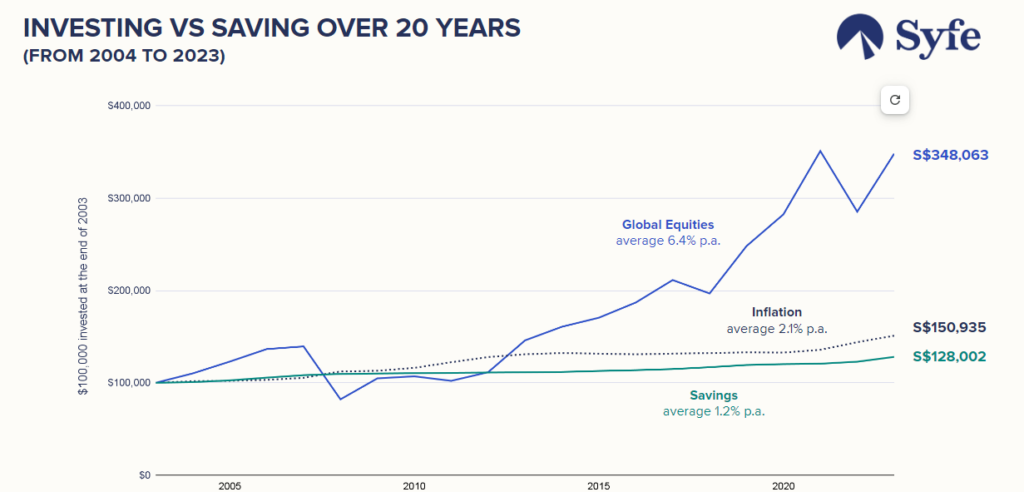

The following chart clearly shows that investing in stocks has historically yielded much higher returns than saving. Over 20 years, a $100,000 investment would grow to approximately $350,000, while the same amount in a savings account would only reach $128,000. Inflation, which reduces the purchasing power of money, would surpass the value of savings, meaning that even saving wouldn’t cover inflation losses. Although investing carries a higher risk than keeping money in a savings account, it also offers significantly higher returns, leading to substantial growth in value over time, unlike savings, which lag in this comparison.

Source: Syfe

Myth #2: There’s No Difference Between Investing and Gambling

A common myth is that investing is the same as gambling. The main difference lies in the approach to risk and expected outcomes. Gambling is based on luck and short-term results, with the player risking everything on an uncertain outcome. In contrast, investing involves strategic and well-thought-out decisions, grounded in analysis, diversification, and a long-term perspective. While gambling can lead to a quick loss of capital, investing offers the possibility of long-term growth where risk is mitigated through smart asset allocation and selecting the right tools.

As an example, consider gambling in a casino, where a player may bet €100 on roulette, hoping for an immediate big win. The chance of winning is slim, and the outcome depends purely on chance, with a high risk of losing the entire bet. On the other hand, if the same €100 is invested in a diversified portfolio of stocks or mutual funds, the likelihood of positive returns is significantly higher, even though results aren’t immediate. Although markets may fluctuate in the short term, investments generally appreciate over the years, distributing risk and offering a much higher potential return than gambling.

Myth #3: Investing Is for the Wealthy

A prevalent myth is that investing is only for the rich, but this is no longer true. Nowadays, almost anyone can start investing, even with small amounts, thanks to various platforms. Some platforms allow you to invest with just a few euros per month in mutual funds, stocks, cryptocurrencies, or ETFs, eliminating entry barriers to the investment world. Even small, regular investments can grow over time due to the power of compound interest. At Fumbi, for example, you can start regular investing with just €20 per month, including products like the Fumbi Index Portfolio. Therefore, you don’t need to be a millionaire to start growing your money and building your financial future.

Myth #4: I Must Be an Expert to Invest

If you’re among those who believe you need to spend countless hours studying and analyzing financial markets and instruments to invest, we’re here to correct that notion. In reality, you don’t need to dedicate much time, nor do you need to be an expert. Today, platforms are designed to be user-friendly, even for beginners, allowing anyone to invest with just a few clicks.

To invest, you need to understand only a few basic concepts, like diversification and risk, to make informed decisions without an expert. Additionally, many investment platforms offer automated solutions that simplify the entire process. So even if you lack a financial background, there’s no need to worry.

Myth #5: Investing Is Too Dangerous, and I Could Lose Everything

It’s true that investing involves certain risks, but a complete loss of investment is unlikely in many cases. There is a straightforward way to invest safely by following some fundamental investment principles. One of these principles is risk minimization, also known as diversification. This involves spreading money across various assets, such as stocks, cryptocurrencies, bonds, or real estate. This way, if one investment fails, it doesn’t result in losing all invested funds.

Where to Invest Money?

If you’re new to investing and unsure where to place your money, today’s options are numerous. Each investment type has its advantages, risks, and specifics. Here’s an overview of the most popular investment instruments:

Gold and Precious Metals

Gold, silver, and other precious metals are traditional forms of investment often used to protect wealth from inflation or during economic uncertainty.

Advantages:

- Protection against inflation.

- Store of value during a crisis.

- Low correlation with the stock market.

- Option to invest in tokenized versions of precious metals.

Disadvantages:

- Does not generate income (unlike stocks or bonds).

- The price of precious metals can fluctuate.

- Storage of these assets can be costly.

Stocks

Stocks represent ownership of a small part of a company. When you buy shares, you become a co-owner of the company, which may pay dividends (a portion of its profits) or bring you profit if the stock price rises.

Advantages:

- Potential for high returns if the company performs well.

- Opportunity for capital growth.

- Diversification – you can invest across various companies and industries.

Disadvantages:

- High volatility – stock prices can rise quickly but also fall.

- Requires monitoring the market and staying informed about the economy and companies.

- Potential losses in unfavorable market conditions.

Cryptocurrencies

Cryptocurrencies like Bitcoin or Ethereum are digital assets based on blockchain technology. As one of the most significant technological innovations since the advent of the internet, cryptocurrency popularity has surged in recent years, with integration into traditional financial systems increasingly common.

Advantages:

- Potential for high returns in the short term.

- New opportunities in the technology and financial sectors.

- Decentralization – not controlled by central banks.

- Ability to invest with just a few euros.

Disadvantages:

- High volatility – cryptocurrency prices can rise quickly but also fall.

- Complex landscape – there are many fraudulent cryptocurrencies, so it’s essential to choose assets carefully.

- Requires deep understanding of technology and market or access to experts familiar with cryptocurrencies – for instance, Fumbi.

TAKE ADVANTAGE OF CRYPTO’S POTENTIAL

Real Estate

Investing in real estate is one of the most popular ways to build wealth. Buying an apartment, house, or land can provide a steady income through rental or capital gains from selling the property at a higher price.

Advantages:

- Stable and long-term value.

- Potential to generate passive income (rental).

- Protection against inflation, as real estate values tend to appreciate.

Disadvantages:

- Requires a large initial investment.

- Property management can be time-consuming.

- Risk of unforeseen expenses (repairs, maintenance).

Mutual Funds

Mutual funds pool money from multiple investors and are managed by a professional manager. These funds are invested in various stocks, bonds, or other assets, ensuring a diversified portfolio.

Advantages:

- Professional management – no need to be an expert in markets.

- Diversification – risk is spread across multiple assets.

- Suitable for beginner investors.

Disadvantages:

- Management fees can reduce overall profit.

- Lower control over individual investments.

- Returns may be lower compared to direct stock investment.

ETFs

ETFs (Exchange Traded Funds) are a type of mutual fund that tracks the performance of a specific index (e.g., S&P 500). Investing in ETFs allows you to own a broad range of stocks without selecting individual ones.

Advantages:

- Low costs and fees.

- Easy diversification.

- Passive management – mirrors the whole market, not individual stocks.

Disadvantages:

- Returns depend on market performance, not individual companies.

- Less flexible compared to active stock trading.

Where and How to Invest Money Most Effectively?

If you decide to start investing, one of the first questions you’ll ask is, “How can I actually purchase these investments?” Today, there are several options, each with unique advantages and drawbacks, suitable for different types of investors.

Investing via the Stock Exchange

One of the most common ways to invest in stocks, bonds, ETFs, or commodities is directly through the stock exchange. However, to buy assets on the exchange, you need a broker who provides access to the market.

How does it work?

- First, open an account with an online or traditional broker.

- Then, select the assets you want to purchase and execute the buy order.

Investing through Online Platforms

In recent years, many online platforms have emerged, making it easy and quick for beginners to invest. These platforms are usually intuitive and often offer automated investment strategies.

How does it work?

- Create an account on the platform, deposit funds, and choose from various investment products like stocks, ETFs, or cryptocurrencies. Popular platforms include Fumbi.

Investing with Fumbi

For those interested in cryptocurrency investments, Fumbi, a Slovak platform, offers an ideal solution for beginners and advanced investors in this field. Fumbi provides a simple, secure way to invest in a portfolio of various cryptocurrencies without needing in-depth technical knowledge or active management.

How does it work?

- Open an account on the Fumbi platform.

- Choose from portfolios curated by Fumbi experts, like the Fumbi Index Portfolio or Advanced Portfolios, or invest in individual cryptocurrencies through the Fumbi Custom option.

- Deposit money into the selected product, into credit, or set up regular investments to start investing.

Advantages:

- No need to be a cryptocurrency expert – Fumbi handles everything for you.

- A diversified portfolio that spreads risk.

- Transparent fees and a secure platform with Slovak roots.

Disadvantages:

- Cryptocurrency investments offer high returns but are riskier due to high market volatility.

- A smaller selection of investment instruments (cryptocurrencies) due to strict criteria – the company offers only verified crypto assets.

Investing Through a Financial Advisor

If you’re not comfortable making investment decisions on your own, you can use the services of a financial intermediary or advisor. This professional will help you create a portfolio based on your financial goals and risk tolerance.

How does it work?

A financial intermediary or advisor will discuss your goals with you and recommend an investment strategy. They will then help you select the right investments, whether mutual funds, bonds, or other instruments.

Where to Invest Money Today?

Whether you have €5,000, €10,000, or €50,000 available, it’s essential to consider your risk tolerance. The investment tools and strategies most beneficial for you may differ depending on whether you are a conservative, balanced, or dynamic investor. Each type of investor has a different goal, from capital preservation to aggressive growth. Here’s how these amounts might be invested based on risk profiles.

Conservative Investor

For a conservative investor, it’s advisable to invest most of the funds in a lump sum, as the portfolio includes low-risk assets. Cash reserves can be held for opportunities or unforeseen situations. Conservative investors may find bond funds, deposit products, real estate funds, or dividend stocks more appealing.

Balanced Investor

A balanced investor, who invests in more volatile assets like stocks and cryptocurrencies, may prefer gradual investing (e.g., monthly). The dollar-cost averaging (DCA) strategy can be useful for investors interested in cryptocurrencies but wary of risks. This approach involves regular purchases of a specific asset at a fixed amount, regardless of its price, helping to avoid poor timing and better handle market fluctuations. For balanced investors, bond and real estate funds are attractive options, supplemented by riskier assets like cryptocurrencies and stocks.

Dynamic Investor

Dynamic investors usually expect higher returns, so they are willing to invest for the long term and accept higher risks to achieve those returns. They are often seen as prudent investors who avoid impulsive decisions, meaning they don’t typically sell assets during short-term declines, viewing such drops as temporary. Dynamic investors primarily invest in equity funds, which offer significantly higher returns compared to bonds. However, the higher the expected return, the greater the risk. Therefore, dynamic investors are increasingly looking at cryptocurrencies as part of their portfolios.

10 Principles for Safe and Effective Investing

Set Clear Goals

Before investing, think about what you want to achieve. Do you want to secure your retirement? Save for a property? Or are you looking for a way to make your money work? Having a specific goal will help determine your time horizon and investment strategy.

Diversify Your Portfolio

One of the most important principles of investing is spreading risk, meaning you should never put everything on one card. Diversification involves investing in various asset types—stocks, bonds, or cryptocurrencies. If one investment fails, another may offset the loss.

Don’t Underestimate the Long-Term Horizon

Investing isn’t about getting rich quickly. The best investors know that markets fluctuate, and achieving solid results requires allowing investments to grow over time. Long-term investing lets you benefit from compound interest, which can significantly increase your returns.

Choose a Stable Investment Partner

It’s essential to select a trusted and reliable partner for investing. Whether it’s a financial advisor, broker, or platform, ensure they are reputable, backed by real people you can see at conferences or in the media, and have a solid reputation.

Educate Yourself and Monitor Markets

Although you don’t need to be an expert on financial markets, it’s wise to keep learning about what you’re investing in. The more you know about each asset, the better you’ll understand the associated risks and opportunities.

Avoid Emotional Decisions

Markets are volatile, and fluctuations can be stressful, especially for new investors. However, making investment decisions based on fear or euphoria can lead to poor outcomes. Success comes from staying calm and sticking to your strategy, even during challenging times.

Invest Regularly

A one-time, large investment can be risky due to market fluctuations. A better way to minimize risk is to invest regularly, such as monthly or quarterly. This approach spreads risk and allows you to buy assets at various prices, averaging entry costs.

Protect Against Inflation

Inflation can reduce the value of your money over time. Leaving funds in a regular account may lower their purchasing power. Therefore, it’s essential to invest in assets with the potential to grow faster than inflation, like stocks, real estate, or cryptocurrencies.

Consider an Emergency Fund

While investing is important, you should always have an emergency fund to cover unexpected expenses for several months. Invested money might not be immediately accessible, so it’s wise to have some cash readily available in emergencies.

Invest Only What You Can Afford to Lose

Remember, every investment tool carries some risk. Therefore, you should only invest money you can afford to lose without negatively impacting your lifestyle. Avoid investing your emergency savings or funds you’ll need shortly.

Where and How to Invest with Fumbi

If you’re interested in cryptocurrencies and want to invest in them, the Slovak company Fumbi might be the right solution for you. Fumbi offers cryptocurrency investment opportunities for virtually anyone, allowing you to start investing with as little as €50, all with just a few clicks.

Fumbi also provides options for investing in portfolio products as well as individual cryptocurrencies. It’s entirely up to you and your preferences—whether you want to invest solely in Bitcoin or balance Bitcoin with other cryptocurrencies.

Overview of Fumbi Products

Our most popular product, the Fumbi Index Portfolio, currently consists of more than 20 top-verified cryptocurrencies. The sophisticated Fumbi Algorithm within it mirrors the growth of the entire cryptocurrency market.

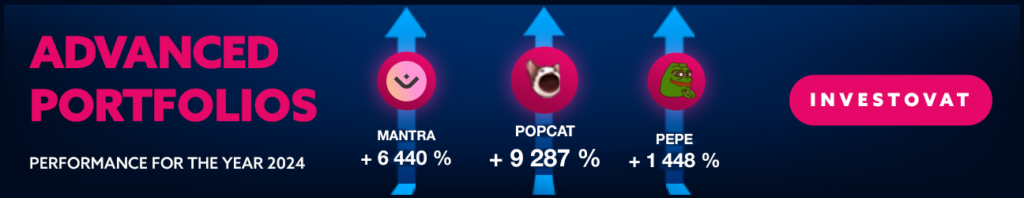

Creating portfolios is now easier than ever. With Advanced Portfolios, you’ll have access to over 80 cryptocurrencies and templates created by our team, focused on various areas within the crypto world. Additionally, you’ll be able to build custom portfolios with different cryptocurrency allocations to suit your investment strategy.

In the Staking Portfolio, you’ll find 10 cryptocurrencies that we will stake on your behalf. These cryptocurrencies have a lower market capitalization than Bitcoin, so they may be more volatile. However, with higher risk comes the potential for higher returns.

With Own Choice, we offer everyone the opportunity to invest in the cryptocurrency of their choice. Select your preferred cryptocurrency and invest in it simply, conveniently, and securely. Currently, you can choose from the five most popular cryptocurrencies on the market.

Bitcoin and Gold

The globally unique product, Bitcoin and Gold, tracks the value of Bitcoin and the cryptocurrency PAX Gold, which is backed by real gold. The algorithm allocates your funds in a 50:50 ratio, intelligently buying the cryptocurrency that has decreased in value and selling the one that has increased. With this combination, you can save for your future easily and stress-free.

With Fumbi Gift Vouchers, you can now surprise and delight your loved ones in a unique way – by gifting cryptocurrencies. Allow them to experience the world of cryptocurrencies and invest in their future.

Invest with Fumbi safely, easily, and with just a few clicks starting from €50.

3 min •

3 min •