CRYPTO CLOSER TO YOU

Simple and safe

You don't have to be a cryptocurrency expert to invest. Fumbi takes care of everything so you can invest without worry.

INVEST IN CRYPTO

Simple and safe

Open an account and find out why tens of thousands of people trust Fumbi when investing in cryptocurrencies. Start investing today.

CREATE BUSINESS ACCOUNT

Simple and safe

Investing in cryptocurrencies isn't difficult when you have a reliable partner. With Fumbi, you can tap the full potential of cryptocurrencies.

Download the Fumbi app:

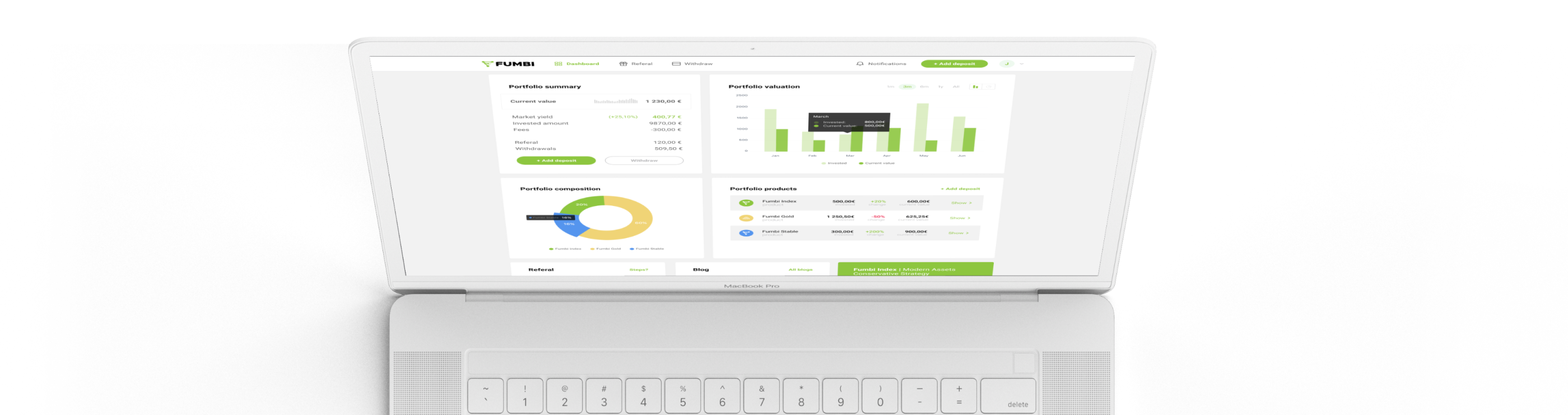

Investing in cryptocurrencies can be simple, transparent and safe

Fumbi brings the opportunity to harness the potential of the fast-growing cryptocurrency industry to absolutely everyone. Join our users who invest in proven top cryptocurrencies with a deposit of as little as €50.

Start investing0  cryptocurrencies

cryptocurrencies

Proven top cryptocurrencies meeting high standards.

0  registrations

registrations

Join our users who benefit from the potential of cryptocurrencies.

0  average investment

average investment

We are trusted by small, medium and large investors.

How it works

1.Easy Registration

Create your Fumbi account quickly and easily.2.Choose a Crypto Product

Choose a crypto product for beginners or advanced users based on your experience.3.Invest in

Make your first deposit using secure and verified payment methods.

Fumbi Benefits

Easy to Invest

With just a few clicks, you can invest in a dynamic index portfolio of top performing cryptocurrencies.

Crypto With Minimised Risk

By using sophisticated algorithms and regular portfolio updates, we reduce the risk of investing in cryptocurrencies to a minimum.

Direct Ownership

Fumbi only works as an administrator, all cryptocurrencies are directly owned by users.

Independent Audit

We are the first platform for investing in cryptocurrencies with an independent wallet audit.

Small Initial Investment

You can invest with us starting from €50.

Maximum Security

We use Fireblocks to store cryptocurrencies, one of the world’s best and most secure cryptocurrency storage options.

Fumbi Products

Business Staking Portfolio

Make the most of your investment. Investite in crypt free entry fees and receive regular rewards. Invest without nuovo Business Staking Portfolio with an expected annual reward of 5-7% in cryptocurrencies.

Business Advanced Portfolios

With this product, you can create your own personalised crypto portfolios that align with your investment goals and preferences. Our product is designed to provide you with greater flexibility and freedom to select and purchase crypto assets that meet your requirements.

Fumbi Business Custom

Do you want to compile your investment portfolio at your own discretion? In this product you can choose from individual cryptocurrencies, while still using a simple profile and secure storage in Fumbi.

Employee Program

Through Fumbi, you can bring a unique benefit to your company's employees - they can automatically receive a portion of their paycheck in the form of a crypto to their own secure Fumbi account.

Fumbi Products

Fumbi

Index Portfolio

Invest with one deposit in the entire portfolio of well-chosen and proven top cryptocurrencies. The uniquely designed Fumbi Algorithm tracks the growth of the entire market and does not rely on individual cryptoassets.

Advanced Portfolios

With this product, you can create your own personalised crypto portfolios that align with your investment goals and preferences. Our product is designed to provide you with greater flexibility and freedom to select and purchase crypto assets that meet your requirements.

Staking Portfolio

Get the most out of your investment. Invest in crypto with no entry fees and receive a regular reward. Invest in the new Staking Portfolio with an expected annual reward of 5-7% in cryptocurrencies.

Bitcoin and Gold

A unique product in which the algorithm rebalances your investment between bitcoin with huge growth potential and cryptocurrency PAX Gold, which is covered with real gold. Gold in this product stabilizes your investment and makes it an ideal product for long-term savings.

Fumbi Custom

Do you want to compile your investment portfolio at your own discretion? In this product you can choose from individual cryptocurrencies, while still using a simple profile and secure storage in Fumbi.

Gift vouchers

With Fumbi Gift Vouchers, you can now surprise and delight your loved ones in a unique way - by gifting cryptocurrencies. Allow them to experience the world of cryptocurrencies and invest in their future.

Custody

Have you purchased crypto and wondering how to store them as safely as possible? Take advantage of a first-class cryptocurrency safekeeping option with Fumbi. We work with market leaders to keep your crypto safe at all times.

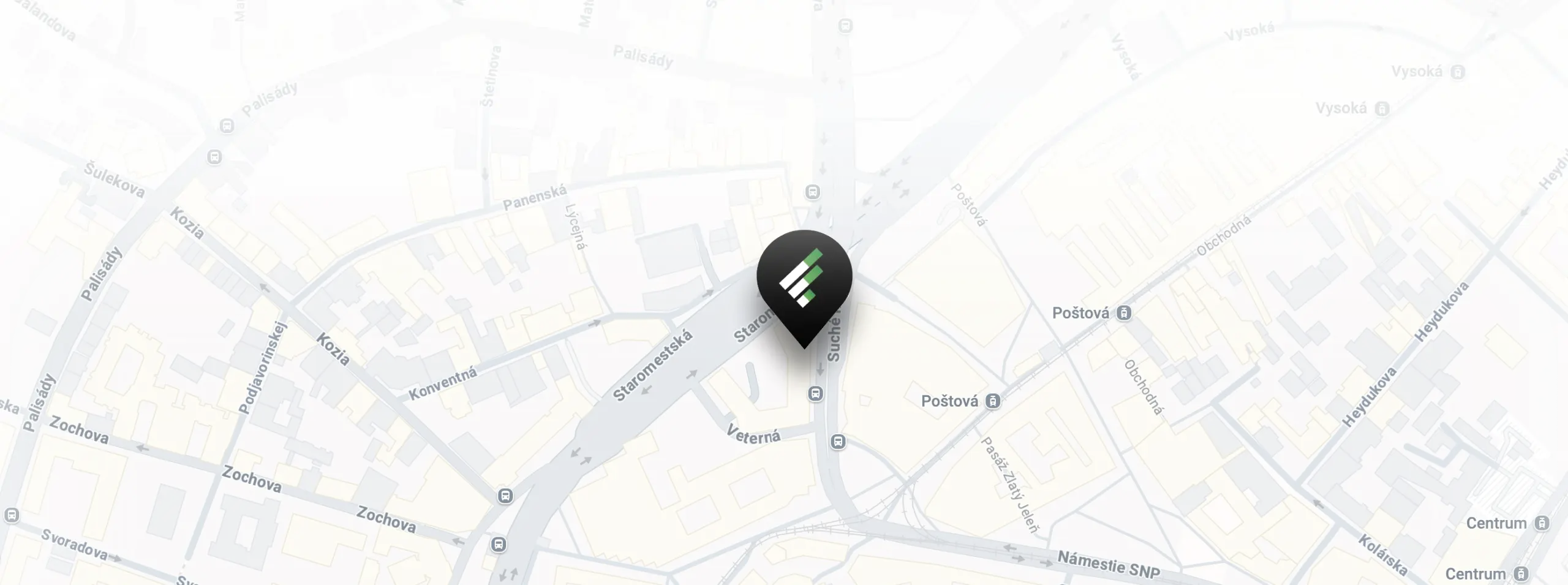

You can find us at

Suché mýto 6

811 03 Bratislava

Slovakia

Do you have questions?

Answers to frequently asked questions can be found in the section support

News from the world of Fumbi and cryptocurrencies

Join our satisfied users

Fumbi in the media