What is a Bear or Bull Market?

Most people have come across the terms bear market or bull market at some point in their adult life – whether on TV, the radio, online, or in everyday conversation. These are basic terms in the world of finance and investing. In this article, we’ll explain what a bear and bull market are, what they mean, how they manifest, and most importantly, how to invest under these very different market conditions.

There are many definitions of what constitutes a bear or bull market. In short, a bear market occurs when the prices of stocks, bonds, ETFs, cryptocurrencies, or other assets decline over a prolonged period. Conversely, a bull market is characterized by long-term price increases. Price developments are influenced by many factors – from market sentiment, inflation, and global political situations to environmental and other macroeconomic conditions. It’s not always easy to determine whether a bull or bear market is dominant. In the crypto context, we also often encounter the term volatility – sharp price movements up or down. However, this only refers to short-term changes and does not indicate a shift in market trend. Bull or bear markets typically last for several months, and in some cases, even years.

New investors often fear the arrival of a bear market. But further in this article, we’ll show why you shouldn’t fear it and what opportunities it offers compared to a bull market.

In this article, you will learn:

- How bear and bull markets originated

- What is a bear market

- Bear market vs. correction

- What characterizes a bear market

- Why does a bear market occur

- What is a bull market

- What characterizes a bull market

- How does a bull market form

- How to invest in a bull or bear market

How bear markets and bull markets originated

Many people ask themselves why, out of the entire animal kingdom, bears were chosen to symbolize a declining trend and falling prices in the markets. On the other hand, bulls represent a positive mood and rising prices in the stock market.

There are many historical theories behind the choice of bears and bulls, but the most popular explanation is based on the way these animals attack. Bears, who strike their prey from above and swipe their paws down to the ground, symbolize a downward trend and falling prices, i.e., a bear market. On the other hand, bulls attack upwards with their horns, which is reflected in the market as rising value of the asset over the long term, i.e., a bull market.

Another theory about the bear and bull market says: The bear hibernates and slows down during winter, which reflects the slowdown of the economy when prices fall. The bull, on the other hand, is a symbol of growth and fertility in many cultures, naturally associated with market growth and the desire to invest. That’s why bull and bear markets are named after these animals.

On Wall Street, there is even a large bronze statue of a bull – the Charging Bull. This massive sculpture was illegally installed in 1989 by artist Arturo Di Modica in front of the New York Stock Exchange as a symbol of strength, resilience, and market growth after the financial crisis and the rebirth of a bull market after difficult times. The statue weighs over 3 tons and quickly became a Wall Street icon. Later, the Fearless Girl statue was added, sparking a wave of controversy.

What is a bear market

A bear market (bear market) can be defined as a long-term decline in the prices of assets, primarily stocks and cryptocurrencies, or ETFs lasting several months, and in extreme cases, it can last for years. In some cases, especially at the beginning of a bear market, it is not easy to determine whether it is the start of a bear market or just a correction. However, in general, we can start talking about a bear market when prices fall by 20% or more compared to the previous high. In the case of cryptocurrencies, this percentage may be higher because cryptocurrencies tend to have higher volatility.

Bear market vs correction

Stock markets or cryptocurrency prices do not rise or fall in a straight line, but their prices move in so-called waves. This means that the price of an asset reaches a certain peak value and then drops, only to break that peak in the following days/weeks/months. For example, the price of Bitcoin was $73,550 on October 29, 2024, and a few days later (November 4), the price dropped to $66,800. Then, on November 6, the previous peak was surpassed, and a new all-time high was set. Even though this drop over a few days may seem alarming, we cannot say that it marks the beginning of a bear market, but rather it is just a market correction, which is a natural occurrence. Therefore, when investing in cryptocurrencies, it’s essential to distinguish between a correction and the natural volatility in the market, and when a bear market actually begins. According to an article from Morningstar, a market correction can be defined as a 10-20% drop in the price of an asset. We can start talking about a bear market when the price of an asset falls by more than 20%.

What is characteristic of a bear market

Negative sentiment in a bear market – During a bear market, negative sentiment prevails, and most traders expect the price of an asset, such as Bitcoin, Ethereum, or Cardano, to decline in the long term. Traders and investors can monitor this sentiment through the fear and greed index.

Lack of trust in a specific asset – The long-term and sometimes aggressive decline in the price of specific assets in a bear market can affect investors’ confidence. They subsequently sell their assets at a significant loss. This behavior is especially common among novice investors who lack experience with bear markets and, under emotional pressure, lose their money. A typical example is the end of the bull market in November 2021, when Bitcoin reached its peak around $68,000 and then fell by more than 77% to around $15,000. During this time, many traders lost their money due to emotional pressure and the sale of their assets below the purchase price.

Allocating money to more conservative investments – Many traders and investors move their investment resources into more conservative products, such as government bonds, gold, or keep their money in cash during a bear market. This is, however, the wrong approach because a bear market is an ideal environment for accumulating investments, as you can purchase assets at low prices. This way, you achieve a lower entry price, and when the bear market (medvedí trh) ends and the bull market (býčí trh) arrives, you’ll enjoy a higher return percentage. If you’re thinking about investing in cryptocurrencies, check out our articles – Buying and Selling Cryptocurrencies: Where and How to Buy or How to Buy Bitcoin.

Why does a bear market occur?

In economics and finance, things aren’t always clear, so there’s no exact answer for why bear markets happen. It’s usually a combination of economic, financial, and psychological factors that lead to prolonged asset price declines and negative market sentiment, ultimately resulting in a bear market.

The most common reasons for the onset of a bear market include:

Global Crisis – A common reason for a bear market is the onset of an economic crisis, which negatively impacts stock or cryptocurrency markets. Some of the most well-known global crises according to WorldFinance include the Wall Street Crash, the Dot-com Bubble, the Oil Crisis, and Black Friday.

Geopolitical Events – Political and, especially, geopolitical situations and sentiment directly impact the price of individual assets or currencies. For example, the start of the war in Ukraine and the subsequent sanctions against Russia caused the Russian ruble’s value to drop by more than 50% in just a few months.

Economic Factors – A decline in GDP, high unemployment, lower consumer activity, rising interest rates, and other economic indicators directly affect the prices of specific assets. In general, when the economy is struggling, people invest less or withdraw money from their investment assets.

Natural Disasters – Just like geopolitical events, natural disasters that occur in one part of the world can have a huge impact on the entire sector. This negative event also reflects in asset prices on the stock market. For example, the climate crisis that caused drought in West Africa led to an 11% decrease in cocoa production during the 2023/2024 season, which consequently pushed the price to a historical high of nearly $10,000 per metric ton.

What is a bull market

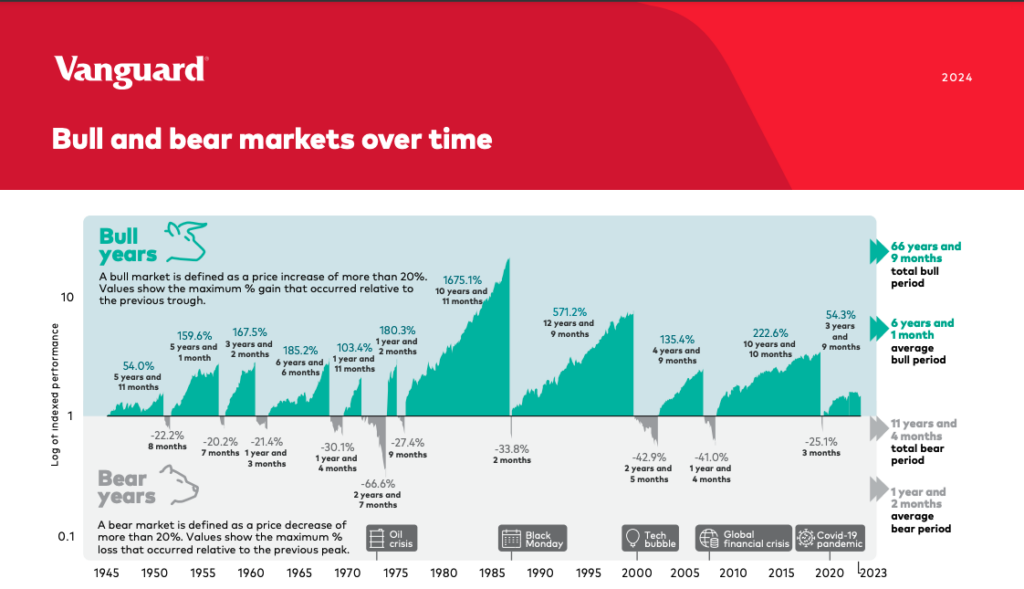

A bull market (bull market) can generally be defined as a long-term increase in the price of a specific asset, which lasts for several months, sometimes even years. We can talk about a bull market when the price of the asset has increased by at least 20% from the previous low. In the world of finance and investing, historical data shows that bull markets are generally stronger and longer than their counterparts, bear markets. According to statistics from 2024 by the investment company Vanguard, the average duration of a bear market is approximately 1 year and 2 months. On the other hand, the average duration of a bull market is 6 years and 1 month. From this statistic, we can also deduce that every bull market has been at least twice as strong as a bear market. So if you’re new to investing and experiencing your first bear market (medvedí trh) and your investments show red, don’t worry – you’re not in a loss until you withdraw your money.

Statistics of Bull and Bear Markets

What is characteristic of a bull market

Economic stability and growth – Bull markets are often associated with a positive economic situation, low unemployment, and favorable macroeconomic factors. Essentially, in most cases, when the global economy is doing well, so are the stock or cryptocurrency markets.

Positive market sentiment and investor confidence – During a bull market, we can observe positive forecasts from experts, analysts, and overall confidence from investors in their investment assets. We can also identify positive numbers in market sentiment. Additionally, demand for riskier forms of investment and speculation on price movements increases.

High trading activity – During a bull market, more trades are conducted daily on exchanges than during a bear market. Investors and traders allocate a larger portion of their money into assets with the expectation of making profits.

Influx of new investors – During a bull market, a large number of new, novice investors enter the market. News of assets breaking historical highs spreads through the media, magazines, social networks, and among people. This phenomenon attracts many new investors who believe they can make “easy money” on the market. A typical example can be seen at the end of 2020 and the beginning of 2021, when Bitcoin was in a strong bull market, and news of its rise were featured in every media outlet. At that time, a huge number of new, inexperienced investors poured into the market, putting a large portion of their wealth into Bitcoin with the expectation of big profits. However, if you’re thinking about investing in Bitcoin, feel free to check out our article – How to Buy Bitcoin. Note that even in a strong bull market (býčí trh), it’s essential to stay grounded and not invest all the money you currently have in your account.

How a bull market occurs

Just like the creation of a bear market, the emergence of a bull market is not due to a single factor, but rather a combination of various economic, financial, psychological, and market factors.

The most common reasons for the start of a bull market include:

Recovery after a crisis – A bull market often arises after a period of recession or a bear market, when the economy begins to recover. Stocks, ETFs, and cryptocurrencies have hit their bottom and minimums, and investors come back to the market with new investments.

Discovery of new technologies or trends – Technologies that have a global impact on society drive a bull market. Companies or cryptocurrencies based on these new innovations achieve the best results on the market. An example is the current boom around AI, where according to statistics from the IMF, AI-powered ETFs outperform those that do not use AI by a factor of 11.62.

Improvement in the business environment – Businesses are the driving force behind the entire economy. Reforms, lower interest rates, taxes, and optimizations that lead to improvements in the business environment have a positive impact on companies’ operations. They can then invest more in development, innovations, employees, and other factors that help them achieve desired results. This positive chain reaction revives the economy and starts a bull market (býčí trh) period.

Positive expectations – Positive news and market forecasts from reputable experts, media, or institutions increase traders’ and investors’ confidence in specific investment assets. They are then more willing to enter the market and invest their money in selected stocks, ETFs, mutual funds or cryptocurrencies, which increases capitalization and, in turn, the overall price.

How to invest in a bull or bear market (bull/bear market)

Investing in a bear market

- Don’t Sell at a Loss – You should follow the golden rule of investing: Only invest money you don’t need. If you follow this rule, a bear market is the perfect opportunity to buy stocks or cryptocurrencies at lower prices. For example, if you had bought Bitcoin during the bear market for approximately $20,000 in January 2023, your investment would have increased by 370% in November 2024. For a better understanding, if you had purchased Bitcoin for 1,000 € at that time, your investment would now be worth around 4,700 €.

- Use the DCA Strategy (Dollar Cost Average) – This is a passive investment style where, at the beginning of your investment plan, you define the amount you will invest weekly/monthly/quarterly into selected assets. This strategy is popular among both new and experienced investors because you buy selected stocks, ETFs, or cryptocurrencies when prices rise and fall. Over a long-term horizon of 5 years or more, this is one of the most profitable investment strategies. For example, at the start of your investment plan, you decide to send 100 € every month from your paycheck to an indexed cryptocurrency portfolio. You will repeat this step every month, regardless of whether the selected cryptocurrencies are declining or rising in value.

- Invest Unnecessary Money – A bear market is a great opportunity to invest unnecessary money that is just sitting in your regular bank account. In a bear market, many stocks, ETFs, and cryptocurrencies are undervalued and are considered “sales.” However, you should be careful to invest only in assets that have a future, so you don’t lose your hard-earned money. If you’re unsure where to invest your money, we are happy to help you at Fumbi. Alternatively, check out our articles – How to Start Investing in Cryptocurrencies or Buying and Selling Cryptocurrencies: Where and How to Buy.

Investing in a bull market

- Invest with a Cool Head – When investing, you should keep in mind that markets do not move only upward and a bull market does not last forever. Many inexperienced investors enter the market during a bull market and have the illusion of “quick and easy” profits, often investing money they need for everyday expenses. In worse cases, they borrow money under unfavorable conditions. Such behavior is very irresponsible, and every investor should remember that they must invest only money they do not need, and that if a loss occurs, it will not ruin them. Otherwise, you may end up buying at the peak of the bull market and selling your investments in panic at a loss.

- Use the DCA Strategy (Dollar Cost Average) – Just like in a bear market, you should also use the DCA strategy in a bull market and buy regularly throughout the duration of the bull market.

- Beware of Scammers – During a bull market, many unreliable projects or “experts” emerge, promising guaranteed (often unrealistic and exaggerated) profits. Therefore, you should verify your business partner before investing, to ensure they are legitimate and trustworthy. Our FUMBI team consists of verified and reliable cryptocurrency experts, and your money is safe with us. You can see us at various professional conferences, in the media, or at lectures. Our vision is to bring cryptocurrencies to people and help them invest their money in verified projects that have a future.

- Diversify Your Investment Portfolio – If you want to start investing in cryptocurrencies, you should think about diversifying your portfolio when making purchases. Diversification is the process of selecting several cryptocurrencies in addition to one, into which you will invest your money in percentage shares. This ensures that if one cryptocurrency underperforms, others will drive the portfolio upwards. In our Fumbi Index Portfolio product, we have methodically selected several cryptocurrencies that have a future, so you will be investing in a wide range of projects, not just one.

What and how to invest in with Fumbi during a bull or bear market (bull/bear market)

Fumbi offers the opportunity to invest in portfolio products as well as individual cryptocurrencies. It all depends on you and your preferences, whether you want to invest only in Bitcoin or balance it with other cryptocurrencies.

If you’re interested in cryptocurrencies and would like to invest in them, Fumbi could be the right solution for you. Investing is accessible to practically anyone, and you can start investing in cryptocurrencies through Fumbi with as little as €50, all with just a few clicks. If you liked the article about the bear and bull market (bear and býčí trh) and want to learn more about investing in cryptocurrencies, check out our articles – Buying and Selling Cryptocurrencies: Where and How to Buy, How to Buy Bitcoin or How to Start Investing in Cryptocurrencies?

Overview of Fumbi Products

Fumbi Index Portfolio currently consists of more than 20 top verified cryptocurrencies. The sophisticated Fumbi Algorithm mirrors the growth of the entire cryptocurrency market.

Creating portfolios is now easier. With Advanced Portfolios, you will have access to more than 90 cryptocurrencies and templates created by our team, focusing on various areas within the crypto world. In addition, you can build your own portfolios with different cryptocurrency ratios that match your investment strategy.

In the Staking Portfolio, you will find 10 cryptocurrencies that we will stake on your behalf. These cryptocurrencies have a lower market capitalization than Bitcoin, which makes them more volatile. However, higher risk also brings the potential for higher returns.

With Custom Choice, we offer everyone the opportunity to invest in the cryptocurrency of their choice. Select your preferred cryptocurrency and invest in it easily, conveniently, and securely. Currently, you can choose from fifteen of the most popular cryptocurrencies on the market.

With Custom Choice, we offer everyone the opportunity to invest in the cryptocurrency of their choice. Select your preferred cryptocurrency and invest in it easily, conveniently, and securely. Currently, you can choose from fifteen of the most popular cryptocurrencies on the market.

With Fumbi Gift Vouchers, you can now surprise and delight your loved ones in a unique way – by gifting cryptocurrencies. Allow them to experience the world of cryptocurrencies and invest in their future.

Invest with Fumbi safely, easily, and in just a few clicks, starting from €50.

TAKE ADVANTAGE OF CRYPTO’S POTENTIAL

3 min •

3 min •