BlackRock and Asset Tokenization – Market Info

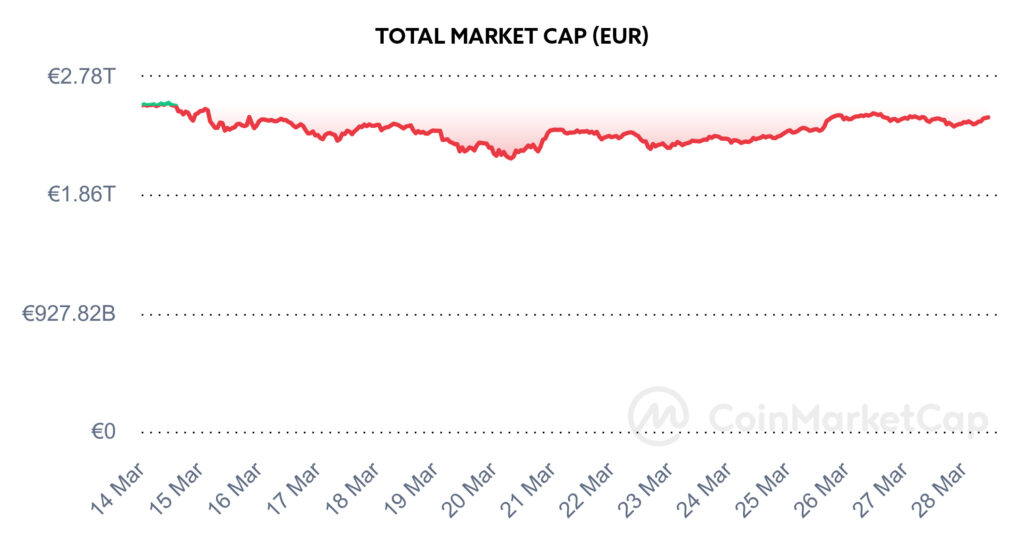

Over the past two weeks, the total market capitalisation exceeded €2.47 trillion. The decrease in market capitalisation over a 14-day period is 1.98%. The price of Bitcoin has fallen by 1.5% over the last 14 days to a current value of over €65,500. Bitcoin’s dominance is currently around 54%.

Source: Coinmarketcap

BlackRock and Asset Tokenization

Asset management giant BlackRock, the world’s largest asset manager, which also launched its own spot Bitcoin ETF in January, continues its expansion in the world of cryptocurrencies. According to the latest information, the company plans an expansion in the tokenization of so-called Real-World Assets (RWAs).

BlackRock officially unveiled its Ethereum network asset tokenization fund last Wednesday. According to the information available, the BlackRock USD institutional tokenization fund would be represented by the BUIDL token, which will be fully backed by cash, U.S. Treasury bills and repurchase agreements. The token will also provide its holders with returns paid daily.

Real-world asset tokenization (RWA) is a process that converts ownership of tangible assets into digital tokens on the blockchain. This innovation democratizes investment opportunities by fragmenting assets such as real estate and commodities into tradable tokens. This process also increases liquidity and expands global reach, directly removing geographic restrictions for investors.

BlackRock will work with Securitize and BNY Mellon as part of the filing with the U.S. Securities and Exchange Commission (SEC). Securitize will act as a transfer agent and tokenization platform while banking giant BNY Mellon will act as the fund’s asset manager. Major companies from the cryptocurrency world such as BitGo, Coinbase, Fireblocks and Anchorage Digital Bank NA are also reportedly involved in the creation and management of the fund.

The BlackRock USD Institutional Digital Liquidity Fund will be registered in the British Virgin Islands. The fund will be a pooled investment and investors who wish to be a part of it will be required to deposit a minimum amount of $100 thousand. However, BlackRock has not yet disclosed the total size of the fund in its filing with the SEC, but estimates are that it will range from $1 million to $100 million.

In addition, BlackRock is currently awaiting comment on its application to launch a spot ETF on Ethereum. Source

London Stock Exchange Launches Crypto ETN

The London Stock Exchange, one of the oldest exchanges in Europe and one of the world’s best-known securities markets, has announced the launch of Cryptocurrency Exchange-Traded Notes (ETNs) to track the performance of cryptocurrencies Bitcoin and Ethereum.

According to the March 25 announcement, applications for crypto ETNs can be made as early as April 8, and successful funds will be listed the following month, subject to approval by the Financial Conduct Authority (FCA) in the UK. Additionally, issuers must submit a draft prospectus and a letter explaining why they meet the ETN requirements by April 15.

The difference between ETFs and ETNs is that ETNs are unsecured debt securities that are backed by the issuer’s credit, whereas ETFs are investment funds that directly hold the assets they track and provide direct exposure to the assets. As a result, ETNs carry credit risk that ETFs do not, given that the value of ETNs also depends on the solvency of the issuer, whereas the values of ETFs are directly linked to their underlying assets.

Despite significant investor interest, ETNs will only be available to professional investors in line with the UK FCA’s ban on the sale of cryptocurrencies and ETNs, which was enacted in January 2021. To be approved, crypto ETNs must be physically backed, unleveraged and have a reliable underlying market price, whereby they can only be denominated in the cryptocurrencies Bitcoin or Ethereum. The underlying assets must be held in cold storage by the issuer with a custodian that is licensed for AML purposes in the United Kingdom, the European Union or the United States. Source

Cryptocurrency Kucoin Allegedly Violated AML Rules

US Justice Department officials have indicted one of the largest cryptocurrency exchanges, Kucoin, and two of its founders for “conspiring to operate an unlicensed money-transmitting business” and violating the Bank Secrecy Act.

In a March 26 announcement, the U.S. Department of Justice said that Kucoin founders Chun Gan and Ke Tang willfully failed and violated rules in complying with the exchange’s anti-money laundering program, which led to the platform being used for money laundering and terrorist financing. The company itself was charged with operating an unlicensed money-transmitting business and violating banking secrecy.

According to the indictment, KuCoin and its founders deliberately tried to conceal the fact that a significant number of users in the US traded on the KuCoin platform. “Indeed, KuCoin allegedly took advantage of its sizeable U.S. customer base to become one of the world’s largest cryptocurrency derivatives and spot exchanges, with billions of dollars of daily trades and trillions of dollars of annual trade volume,” U.S. Attorney Damian Williams said in response to the indictment. Williams also added that the exchange operators failed to implement even basic anti-money laundering rules, which led many entities to use it as a haven for illegal money laundering.

This allegation was made in parallel with the initiation of proceedings against Kucoin by the U.S. Commodity Futures Trading Commission (CFTC), which charged the crypto exchange with multiple violations of the Commodity Exchange Act (CEA) and CFTC regulations. According to the CFTC, Kucoin received more than $5 billion and was sent more than $4 billion originating from suspicious sources.

Representatives of the Kucoin crypto exchange, as well as the exchange itself, have objected to these allegations. According to posts on the social network X, the crypto exchange continues to operate under standard conditions and has no problems with the withdrawal of funds. We will actively monitor the situation surrounding the Kucoin crypto exchange. Source

The Fed Left Interest Rates Unchanged

The U.S. central bank left interest rates at 5.25%-5.5% last Wednesday as expected and maintained its projection of three rate cuts this year, easing investor concerns that it could again take a hawkish stance.

Officials from the Federal Open Market Committee (FOMC) forecast that they will cut interest rates to 4.6% by the end of 2024, according to the economic projection from their March meeting, the same forecast they presented back in their December outlook. However, the dot plot of the forecast showed that only one Fed committee member expected more than three interest rate cuts this year, while as many as five committee members expected more than three cuts in December.

The Fed’s decision followed higher-than-expected news on the Consumer Price Index (CPI) and Producer Price Index (PPI), which sparked concerns that inflation could accelerate and forced the U.S. central bank to maintain tight financial conditions and delay rate cuts, which could have a negative impact on asset prices. Tighter monetary policy dampens investors’ risk appetite in financial markets, while lower rates increase the appeal of riskier asset classes such as cryptocurrencies. Source

Grayscale Believes in Ethereum ETF Approval

The U.S. central bank left interest rates at 5.25%-5.5% last Wednesday as expected and maintained its projection of three rate cuts this year, easing investor concerns that it could again take a hawkish stance.

Officials from the Federal Open Market Committee (FOMC) forecast that they will cut interest rates to 4.6% by the end of 2024, according to the economic projection from their March meeting, the same forecast they presented back in their December outlook. However, the dot plot of the forecast showed that only one Fed committee member expected more than three interest rate cuts this year, while as many as five committee members expected more than three cuts in December.

The Fed’s decision followed higher-than-expected news on the Consumer Price Index (CPI) and Producer Price Index (PPI), which sparked concerns that inflation could accelerate and forced the U.S. central bank to maintain tight financial conditions and delay rate cuts, which could have a negative impact on asset prices. Tighter monetary policy dampens investors’ risk appetite in financial markets, while lower rates increase the appeal of riskier asset classes such as cryptocurrencies. Source

El Salvador Continues to Accumulate Bitcoin

El Salvador, where Bitcoin became legal tender in 2021, is continuing its Bitcoin policy and increasing its Bitcoin reserves. The country’s president, Nayib Bukele, said on Monday that the country currently owns 5,700 bitcoins with a market value of $400 million.

Bukele also said in his speech that most of the country’s bitcoin reserves have been moved to so-called cold storage, while also disclosing the address of the bitcoin wallet. The country, which defines itself as a pro-bitcoin nation, this month removed income tax for money coming into the country from abroad, making the country an attractive destination for foreign investment as well as for bitcoin fans. Source

Invest With Fumbi Today

Capitalise on the potential of cryptocurrencies simply, securely and efficiently. Start investing with Fumbi with amounts starting from €50. The Fumbi Algorithm in the Fumbi Index Portfolio tracks price movements in the cryptocurrency market for you. Meanwhile, if you want to get a weekly reward from investing, choose the Staking Portfolio with an expected annual reward of 5-7% and no entry or annual fees.

START INVESTINGDid you come across a term in the text that you do not understand? Don’t worry, you can find all the important terms related to cryptocurrencies in one place in our new Fumbi Dictionary.

3 min •

3 min •