Decentralised Finance and their purpose in the Blockchain Ecosystem

The year 2020 brought with it many challenges for the financial sector, cryptocurrencies included. Despite hardships, the cryptocurrency market is gaining traction, which has been reflected by the ever-growing market capitalisation of cryptocurrencies. Likewise, massive growth is experienced by the DeFi sector, with an excellent performance this year.

One of the main features of crypto is their ability to secure access to transactions and payments for everyone and anywhere, eliminating the participation of centralised organisations upon such transactions. This is not the case for more complicated financial services such as loans and margin trading, however, as these are mostly handled by centralised exchanges. This is one of the reasons behind the creation of decentralised finance.

What is decentralised finance?

Decentralised finance represents a network of financial applications developed on the blockchain system. Though the functioning of these applications may remind us of the financial services and organisations of the legacy world, they are teeming with innovation. These applications function as a piece of open-source code on a transparent blockchain. This is turn means that users do not have to trust a third-party as they would with any classic financial service.

Not only are these applications decentralised, they also offer an unprecedented level of transparency. Source-code is available to all users and all users can confirm, whether the application is indeed functioning as intended. Additionally, since these applications are on the blockchain, all transaction records will be kept and open to the public.

Most applications that belong in DeFi are built on the Ethereum blockchain, but early birds are rising on alternative blockchains such as Cosmos or Polkadot. These cryptocurrencies differ from Bitcoin by offering so-called “smart contracts”. Smart contracts conduct a transaction automatically, as long as pre-determined requirements are met.

It is precisely smart contracts that allow decentralised finance developers create much more sophisticated programs, which have a lot more added value than just simple money transfers.

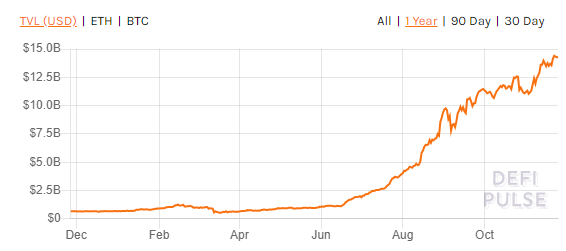

Total value of assets

How does DeFi differ from the traditional financial system?

Basic differences between DeFi and traditional finance:

- Elimination of Human Error – We do not rely on a human to complete any given operation when working with DeFi. Operations are executed according to rules defined in the source code of smart contracts. As soon as a contract is implemented into a network, decentralised applications are empowered to execute operations based on rules without the need for human action.

- Transparency – Open-source smart contracts are the very definition of the decentralised finance idea and can be double-checked by anyone. This allows for a high level of trust between members of a transaction while allowing for anonymity at the same time. Source code of a smart contract is available to anyone, and anyone can read it and check for issues or instabilities while keeping room for improvement.

- Unlimited access, whenever and wherever – DeFi and decentralised applications are designed with global access in mind. The user’s current location is completely irrelevant to the function of the application. The only requirement is access to the internet.

- Elimination of bureaucracy – Anyone can invent and launch a decentralised application without the need for a permission or permit from a bureau or institution, dramatically decreasing costs associated with bureaucracy.

Main functions of decentralised finance

There is a lot of varieties within the current uses of decentralised finance.

Uses of decentralised finance include but are not limited to:

• Guaranteed loans “Compound” – Open loan protocols are currently one of the most popular types of applications in the DeFi ecosystem. Decentralised loans boast many advantages over traditional loans. These include instant advance payment, ability to use digital assets as security and eliminating credit worthiness checks. As these services are built on a blockchain, they significantly decrease the need for trust by employing cryptographic validation of payments. Loans realised on the blockchain decrease the risk for the counterparty and make loans a cheaper and more accessible service.

• Decentralised markets – Decentralised Exchanges (DEX) are among the most important applications. These provide a trading platform to users, eliminating the need to trust entities such as exchanges with your digital assets. In this case, trades happen directly between the client’s wallets via smart contracts. To top it all off, since decentralised exchanges are relatively cheap to run, the also often boast lower trade fees than typical centralised exchanges.

• Stablecoin and MakerDAO – Stablecoins are tokens specifically engineered to match the price of whatever commodity they are tied to as closely as possible. The largest and most widely used Stablecoin at the moment is Tether. Stablecoins such as Tether are wholly based on trust in the company that issues them.

Alternative Stablecoins exist that eliminate this very need for trust in the issuer. The Stablecoin DAI, for example, works via the blockchain loan system, where the user inputs a security deposit of Ethereum, and receives his loan in DAI. DAI is the project of the decentralised organisation MakerDAO, tethered to the US dollar, with cryptocurrencies as collateral.

• Synthetic assets – The programmability of smart contracts as well as their connection to external data sources (oracles) allow for the creation of synthetic assets, or activities on the blockchain that are tethered to physical assets such as stocks, commodities and indexes. Synthetix and UMA are among the most famous of such protocols.

Risks associated with DeFi

• Issue with smart contracts – DeFi is a complicated network interwoven with innumerable smart contracts created by various developers from different parts of the world. The risk of faulty smart contracts is unquestionably one of the most well-known risks, as any given user’s assets are fully dependent on the vulnerability of these contracts. Risks include mistakes and unexpected consequences of running contracts that could possibly lead to financial damage.

Empirically, these risks often turn into scenarios where unsuspecting users end up losing money. The frequency of such scenarios is currently very high, although this can be attributed to the early, buggy stage DeFi finds itself in. Events like professional audits of code by trustworthy companies can eliminate such risks, with a decrease in frequency of such scenarios being very likely in the near future.

• Design flaws – DeFi applications exist in an open environment of thousands of applications, that can freely integrate with each other. Furthermore, these applications manage a massive flow of finances through a wide spectrum of tools such as option contracts, derivatives, instant loans etc. So far, there has never existed a shared environment in which these applications would coexist and influence each other, implemented for the first time in history via DeFi and the Ethereum blockchain.

Although this brings a lot of innovation, many risks are also included such as faulty programs that can be misused further by applications. Some reasons for these risks could be, in part, the unexplored nature of this sector as well as the uneven distribution of knowledge concerning these applications. It is not too bold to assume that these issues will be resolved with time.

• Risk of Protocol Failure – As mentioned before, most DeFi applications are constructed on the Ethereum Blockchain. The Ether blockchain itself is also in early stages however, awaiting many technological innovations, updates and changes such as the migration to Proof-of-Stake, which may prove difficult to implement. These changes have the real potential to benefit the system ten-fold but will fundamentally bring glitches and fatal errors with them, as updates do.

Therefore, it is not unreasonable to expect errors and glitches not only in individual smart contracts, but the chainwide protocol itself. This instability can be expected in the coming months on experimental networks like Ethereum and other smart contract platforms.

• Regulatory risks – Similarly to the crypto sector, the sector of decentralised finance also suffers from regulatory confusion. The confusion arose from the grey-area between the compatibility of DeFi and that of the rules and regulations of the classical financial market. The earliest expected change to this state of confusion is the new regulatory rules from the EU (MiCA), which currently holds a working form of legislature, though it will not be released until about 2022, being put to effect in 2024 at the earliest.

It has to be said, however, that while rules and regulations from the EU aim to protect the security of users, DeFi has the potential to achieve this without any regulations through innovative smart contracts and a transparent blockchain.

Conclusion

Decentralised Finance is set on building a parallel financial world, which works independently from the current global financial and political situation. This allows for the creation of a more open, transparent and effective financial system. For now, the system will be but a shadow of its behemoth predecessor, but could grow to seriously compete or even overshadow the former. If this ever comes to fruition, we can expect the two worlds to converge rather than diverge.

This “fusion” of systems could very seriously lead to the benefit of all.

3 min •

3 min •