When and Why Is It Worth Investing in Cryptocurrencies?

Even though cryptocurrencies bring a revolutionary technology that can significantly change the financial world and bring greater equality, many people (while acknowledging their potential) believe that the opportunity to profitably invest in this asset has already passed. So is it still worth investing in cryptocurrencies?

In this article, we’ll review a few basic reasons why cryptocurrencies are still a very attractive investment opportunity.

1. Cryptocurrencies Are Just at the Beginning of Their Journey

You may have come across the statement that cryptocurrencies are somewhere where the internet was in the 1990s. One can largely agree with this opinion. Cryptocurrencies are bringing about a technological revolution, but they are still in the early stages of development. By investing in cryptocurrencies, you are investing in their future, as cryptocurrencies are currently still in development, but their global adoption and acceptance are steadily increasing.

Bitcoin is a great example. It brings to the world a new form of store of value that is decentralised, deflationary, secure and virtually uninfluenced by central powers. However, is Bitcoin already a finished product ready to be a common currency? Far from it. Bitcoin today can only handle about 7 transactions per second, while Mastercard or VISA cards handle thousands of transactions in the same amount of time. If the same number of people used Bitcoin today as VISA, Mastercard or PayPal, the payment process would take an extremely long time.

But were payment cards the standard 30 years ago that they are today? Has the internet always been this fast? When people first heard about it in emails or listened to the visionaries of the time about how the internet would one day be used to communicate and sell goods and services, most people shook their heads and thought they were crazy. Today, however, those who have stuffed their wallets full of coins and still haven’t got to grips with their smartphones are considered fools.

As such, cryptocurrencies are here to stay because their technology is revolutionary. However, we cannot say for certain which cryptocurrencies will survive and find their niche, and which will disappear over time and be replaced by more technologically advanced projects. It will certainly not always be the case that Bitcoin transactions will be slow and complicated. Just as the internet has become user-friendly over the years and many of us cannot imagine our lives without it, so will virtual currencies in the future be a common standard with a user-friendly environment.

2. Few People Are Familiar With Them

Most people first became aware of Bitcoin and cryptocurrencies in 2017, when the media reported on the huge rise in their prices. Today in 2024, when we have lived through a huge merry-go-round of price rises and falls, we can say with certainty that cryptocurrencies and Bitcoin already have such a strong user base that breaking them and shutting them down completely would be very difficult and virtually impossible. However, it should be added that although cryptocurrencies have grown significantly in popularity in recent years, it is still the case that only a narrow percentage of the population understands how cryptocurrencies actually work. If you choose to invest in cryptocurrencies today, you will still be among the group of early adopters of the world’s total population. That sounds like an interesting investment opportunity.

3. Market Capitalisation of Cryptocurrencies Versus Other Assets

When people heard about Bitcoin surpassing a price of $69,000,000 in November 2021, to many this amount seemed extremely exaggerated. In reality, however, Bitcoin reached a capitalisation of “only” $1.2 trillion at the time, which is about 8% of the market capitalisation of gold… To an individual, this may be a staggering figure, but in the general population? Let’s look at it in the form of a few examples.

Almost the same value as Bitcoin’s highest capitalisation to date, according to this year’s ranking, is the value of Meta. Only slightly higher is silver, which has a market capitalisation of around $1.25 trillion.

The market capitalisation of gold, to which Bitcoin is most often compared, is over $13.75 trillion. So if Bitcoin was to match it, where many believe it is headed, it would have to surpass its record capitalisation approximately 11-fold.

How about comparing Bitcoin to the largest publicly traded companies? Microsoft alone is estimated to be worth $3 trillion, Apple is estimated to be worth $2.92 trillion, Amazon is estimated to be worth $1.75 trillion, Alphabet (Google) is estimated to be worth $1.8 trillion, and NVIDIA is estimated to be worth approximately $1.68 trillion. These figures show that if Bitcoin is to become mainstream, its value has yet to grow considerably.

4. Institutions Are Coming

Bitcoin is only in its first decade of existence, and other well-known cryptocurrencies have been on the market for much shorter. Until 2017, when it first began to attract significant media attention, few people had heard of it. At the same time, the general consensus is that it was pushed to a price of $20,000 in December 2017 by the frenzy among small retail investors, who jumped on the bandwagon, often unwisely, in droves during the forming of a bubble, lest they miss out on an investment opportunity.

At the same time, however, this means that the market capitalisation of cryptocurrencies has so far been made up primarily of retail money, and only in recent months has there been loud talk that cryptocurrencies, led by Bitcoin, are gradually catching the eye of large financial corporations.

Institutional investors, unlike ordinary people, need to have a regulated safe environment before entering this sector. Right now, we are in a period where the first such opportunities are coming to market. Trading in the first spot BTC ETF in the US (approved in January 2024) is reaching new records and a huge amount of new and fresh capital is flowing into Bitcoin. Companies that have launched their own bitcoin ETFs include BlackRock, the world’s largest asset manager with more than $9 trillion in assets under management. The fact that Bitcoin is only at the beginning of a period where institutional capital is being poured into it sounds very exciting in terms of its prospective growth.

When to Invest in Cryptocurrencies?

Speculating on the price of Bitcoin falling so that we can buy it cheaper may not always pay off. Many have predicted that Bitcoin will fall below the price of 15,000 in early 2023. However, that didn’t happen and those who were waiting for the “perfect opportunity” to enter the market are probably banging their heads against the wall as Bitcoin has since risen from $15,000 to $48,000. Unless you are an active trader, the best and most commonly recommended way to invest in cryptocurrencies is to purchase them on a regular basis. This is because statistics show that through buying Bitcoin at regular intervals you eliminate the impact of volatility on your investment and average your entry points, which can be very profitable and effective in the long run.

At the time of writing, if you had invested in Bitcoin for the last 5 years, at $10 each week, you would have invested a total of $2,610 in Bitcoin and the current value of your investment would be $4,070 (+55.96%).

If you chose to invest on a monthly basis, an investment of $100 per month for the last 5 years would cost you a total of $6000, and the current value of your investment at the time of writing would be $9438 with an appreciation of 57.31%.

Start safely investing in cryptocurrencies now.

TAKE ADVANTAGE OF CRYPTO’S POTENTIALWhat to Invest In?

Fumbi Index Portfolio – Buy a whole bundle of proven cryptocurrencies as soon as possible through our Fumbi Index Portfolio product and take advantage of the current growth. With the Fumbi Index Portfolio, you will buy more than 20 cryptocurrencies with one deposit and your investment will be managed by our Fumbi Algorithm, which tracks the growth of the entire market. The portfolio has achieved a total appreciation of up to 122.75% in 2023.

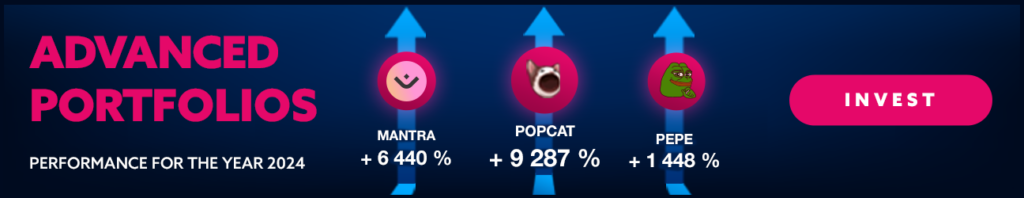

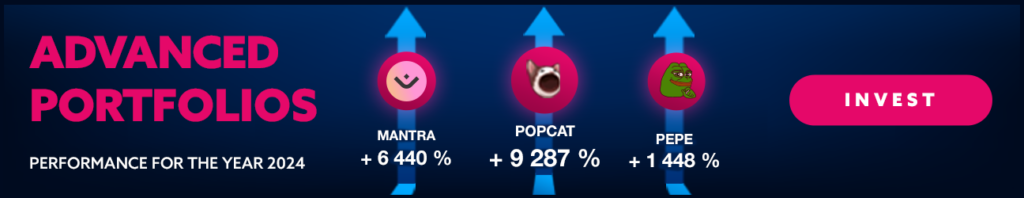

Advanced Portfolios – In this product, you will find a wide range (over 60 top) of new and exotic cryptocurrencies and new portfolios that you can either build yourself or use templates pre-made by our specialists.

At Fumbi you can buy and invest from as little as €50.

TAKE ADVANTAGE OF CRYPTO’S POTENTIAL

3 min •

3 min •